Energy Market Update

Weekly Energy Industry Summary

Commodity Fundamentals

Week of August 11, 2025

Commodity Fundamentals

Week of August 11, 2025

By The Numbers:

NG '25 prompt-month NYMEX natural gas settled at $2.96/MMbtu, down $.04 on Monday August 11.

One week ago, NG '25 prompt-month NYMEX natural gas settled at $2.95 per MMbtu.

Prompt-month NYMEX crude oil settled at $63.96 per barrel, up $.08 on Monday, August 11.

One week ago, NYMEX crude oil settled at $66.29 per barrel.

Natural Gas Fundamentals - Neutral/Bearish

Natural gas production is surging.

Month-to-date, production averaged 108.1 Bcf/d, up 2.8 Bcf/d from July 1.

Power-generation demand in August averaged 44.5 Bcf per day, down 5.3 Bcf per day from the same period last year.

LNG exports, month-to-date averaged 16.2 Bcf per day, up 2 Bcf/d from July 1.

The supply side has gained 3 Bcf per day in August while the demand side has dropped 3 Bcf per day. The net result is an advantaged supply-side to the supply/demand balance. This supply-side advantage is working to depress near-dated natural gas futures.

It is well worth noting that over the past several weeks, as the prompt-month has lost nearly $.75 per MMbtu, the 2026-2030 strip is barely changed. On June 16, the 2026-2030 five-year strip was $3.86 -- this morning it is $3.75.

The heat that is building in the midcontinent and moving east will peak this weekend.

The tropical season is off to a start with Hurricane Erin possibly threatening the North Carolina coast, but Erin is currently expected to take a turn east into the Atlantic Ocean.

Crude Oil - Neutral/Bearish

NYMEX (WTI) prompt-month-crude settled at $63.96 per barrel, up $.08.

The market is well supplied.

President Trump is going to meet with Vladimir Putin in Alaska on Friday.

If no progress is made pursuant to these talks, some Russian oil supplies may be indirectly affected as Trump has threatened the purchasers of Russian oil with large tariffs.

Economy - Neutral

The Consumer Price Index (CPI) increased a seasonally-adjusted 0.2% for the month of July and 2.7% on a 12-month basis, The Bureau of Labor Statistics reported today.

Excluding food and energy, the core CPI increased 0.3% for the month and 3.1% from a year ago, compared with forecasts of 0.3% and 3%.

Following the report, Wall Street ramped up bets that the Federal Reserve would begin to reduce interest rates in September.

Tariff impacts did appear in some categories, but other areas that would normally be hit by import duties showed little effect.

Weather - Neutral/Bearish

Heat from the West expands into the Midwest and east this week.

The heat wave will peak this weekend.

The remainder of the month appears to be variable, but not as hot as last year on a population-weighted cooling-degree day basis.

The tropics are ramping up -- Hurricane Erin is the first major hurricane of the season -- Erin is expected to turn eastward and head out to sea -- but there is a chance Erin could threaten the North Carolina coast.

An active tropical season would be generally bearish of natural gas as rain drives down the heat.

Weekly Natural Gas Report:

Inventories of natural gas in underground storage for the week ending August 1 are 3,130 Bcf; an injection of 7 Bcf was reported for the week ending August 1.

Gas inventories are 173 Bcf above the five-year average and 137 Bcf less than the same time last year.

Values reflect week ending August 8, 2025.

Prices reflect week ending August 8, 2025.

Weekly Power Report:

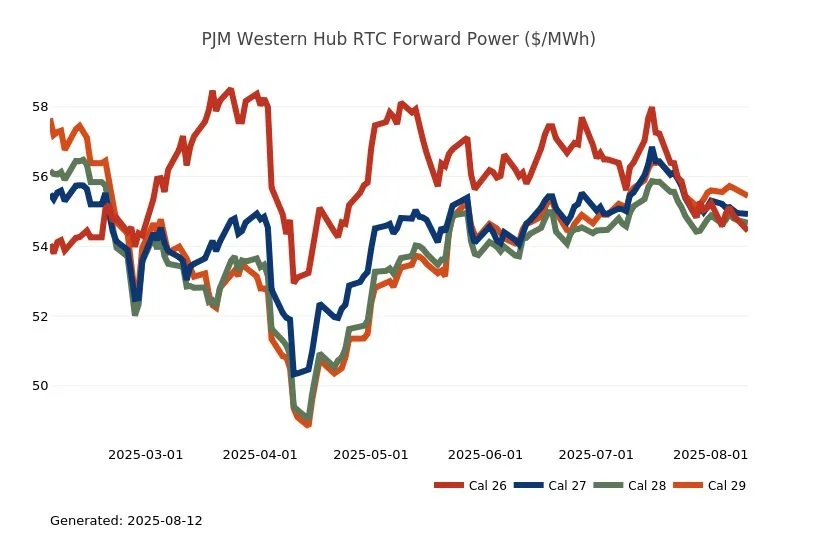

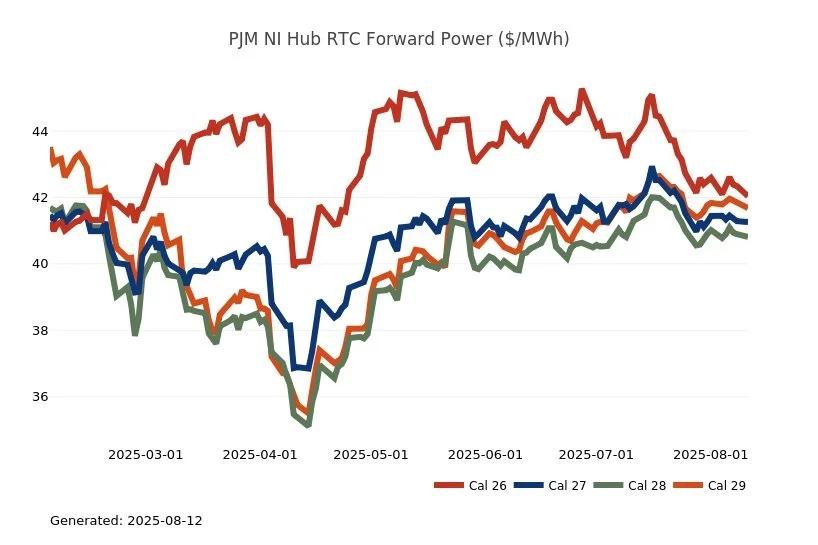

Mid-Atlantic Electric Summary

The Mid-Atlantic Region’s forward power prices were lower on the week as bearish fundamentals continue to dominate the market as we head to the finish line for summer. Near record high natural gas production, expanding surpluses in storage inventories and moderate weather continue to dominate the market. The recent weather model run is calling for a generally hotter-than-normal pattern across the eastern two-thirds of the nation. However, normal temperatures are now beginning to drop, and the heat is not expected to reach the same intensity as what we saw in July. Power futures were -1% lower for the 2026-2030 term over the past week on average. The 2026-2028 terms were -1% lower, while the 2029-2030 terms were unchanged for that time. The final day-ahead settlement price average in West Hub for July was $62.95/MWh or was 36% higher than June’s final average price as well as being 40% higher than last year for the month.

PJM Board Initiates Critical Issue Fast Path (CIFP) to Address Integration of Large Loads - On 8/8, the PJM Board of Manager initiated a Critical Issue Fast Path (CIFP) process to address resource adequacy concerns associated with integrating large loads quickly and reliably. The Board explained that PJM will use the CIFP expedited stakeholder process to evaluate for potential implementation concepts introduced at the large load addition workshop on 5/9 and examine competitive, market-based solutions whether transitional, permanent, or hybrid. Solutions could include adjusting the load utilized and/or cleared through capacity auctions if load is not backed by capacity, leveraging existing tools such as demand response, and voluntarily bringing new generation to directly meet large load needs. The Board also calls for establishing clear reliability triggers, considering updates to interconnection rules, and improving coordination among PJM, states, utilities, and large-load customers. A pre-CIFP workshop will be held on 8/18 for PJM to present its initial proposal and solicit feedback from stakeholders on the proposed scope of the stakeholder process. The Board stated that PJM is targeting a FERC filing in December 2025 for implementation in the 2028/29 Base Residual Auction scheduled for June 2026.

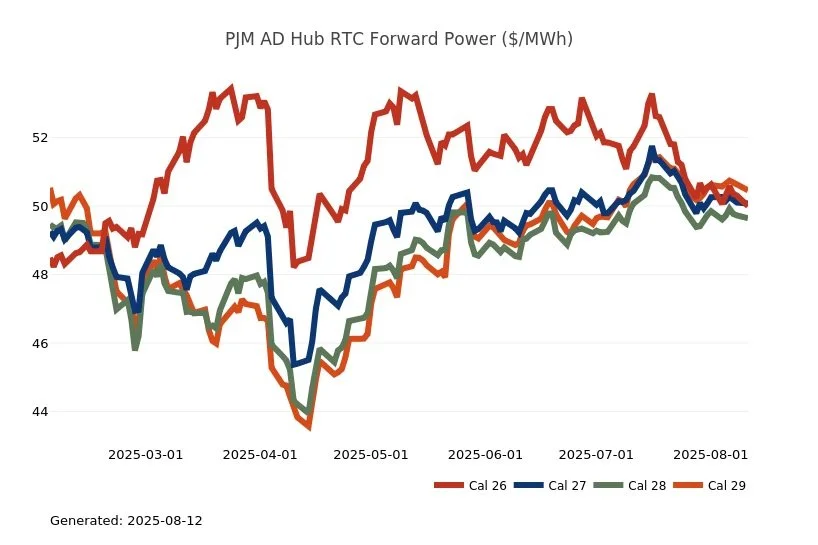

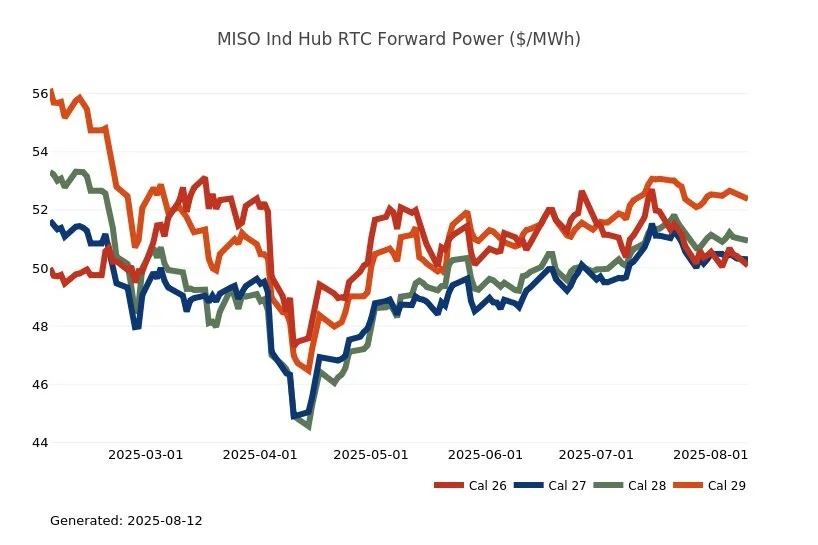

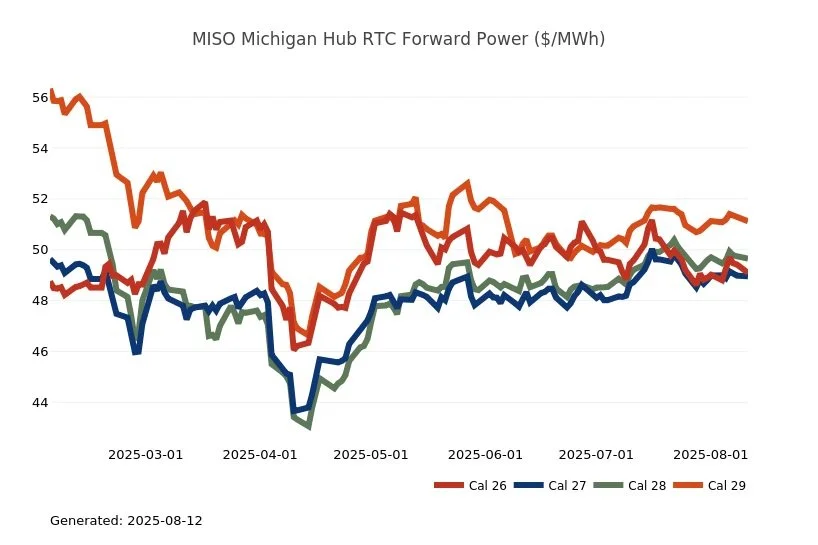

Great Lakes Electric Summary

The Great Lakes Region’s forward power prices were lower on the week as bearish fundamentals continue to dominate the market as we head to the finish line for summer. Near record high natural gas production, expanding surpluses in storage inventories and moderate weather continue to dominate the market. The recent weather model run is calling for a generally hotter-than-normal pattern across the eastern two-thirds of the nation. However, normal temperatures are now beginning to drop, and the heat is not expected to reach the same intensity as what we saw in July. Power futures were -1% lower for the 2026-2030 term over the past week on average. The 2026-2028 terms were -1% lower, while the 2029-2030 terms were unchanged for that time. The final day-ahead settlement price average for COMED in July was $54.23/MWh or was 35% higher than June’s final average price while that final price in AdHub was $54.38 or was 24% lower than June. In Michigan, those final settlement prices, averaged $60.64/MWh or was 31% higher than last month, while Ameren’s average was $56.94/MWh and was 32% higher than the previous month of June.

PJM Board Initiates Critical Issue Fast Path (CIFP) to Address Integration of Large Loads - On 8/8, the PJM Board of Manager initiated a Critical Issue Fast Path (CIFP) process to address resource adequacy concerns associated with integrating large loads quickly and reliably. The Board explained that PJM will use the CIFP expedited stakeholder process to evaluate for potential implementation concepts introduced at the large load addition workshop on 5/9 and examine competitive, market-based solutions whether transitional, permanent, or hybrid. Solutions could include adjusting the load utilized and/or cleared through capacity auctions if load is not backed by capacity, leveraging existing tools such as demand response, and voluntarily bringing new generation to directly meet large load needs. The Board also calls for establishing clear reliability triggers, considering updates to interconnection rules, and improving coordination among PJM, states, utilities, and large-load customers. A pre-CIFP workshop will be held on 8/18 for PJM to present its initial proposal and solicit feedback from stakeholders on the proposed scope of the stakeholder process. The Board stated that PJM is targeting a FERC filing in December 2025 for implementation in the 2028/29 Base Residual Auction scheduled for June 2026.

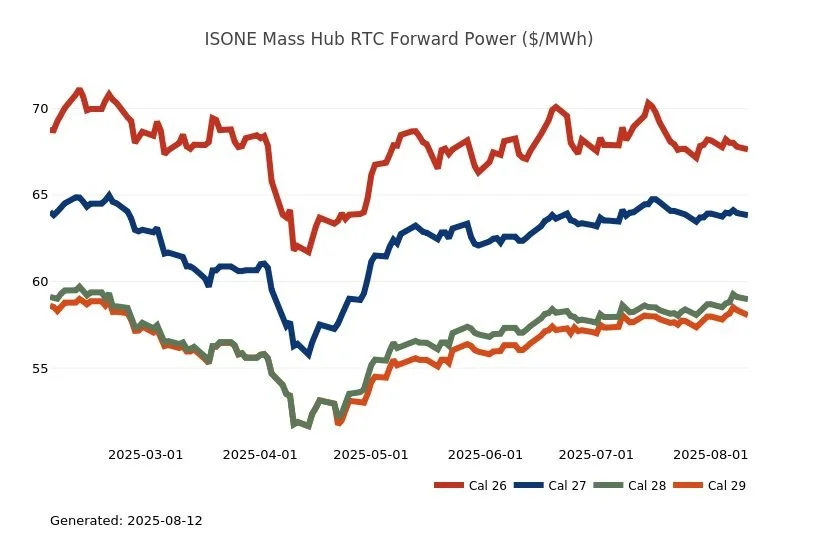

Northeast Energy Summary

The Chief Operating Officer's report from the August 7 NEPOOL Participant's Committee meeting revealed the annual peak load for Forward Capacity Market purposes remains at 26,184 MW on June 24 Hour Ending 19 (6-7pm). Also covered was the fact that higher natural gas prices in July pushed index prices higher. As compared to June averages, July gas prices jumped to $4.27/MMBtu, 48% above June, and real-time hub LMPs went up by 27% ($60.22/MWh; average day-ahead hub LMP was $70.56/MWh). July 2025 average real-time and day-ahead hub LMPs were higher by 25% and 54% from July 2024. A Day-Ahead Ancillary Services update was also given showing elevated reserve pricing during high temperature/elevated load periods. The July Market Performance report revealed a straight monthly average unitized cost for the ancillary component for June to be $5.42/MWh, up over $3/MWh from May's $2.36. March's settled average came in at $4.05 while April's settled about 50 cents lower to $3.53/MWh. Actual Load-Serving Entity costs will vary because the billing is on an hourly-load weighted basis.

New York’s State Fire Prevention and Building Code Council has approved new rules requiring most new buildings to be all-electric starting next year, with broader requirements set for 2029. These rules target buildings—responsible for 40% of the state’s emissions—as a major step toward environmental goals. The policy, modeled after New York City’s own electrification mandate, will apply initially to new single-family homes, small commercial buildings, and residential buildings up to seven stories, with exemptions in cases where electrification is deemed unreasonable. While environmental groups support the move, citing alignment with the state’s emissions reduction plans, homebuilders and related industries have expressed concerns about increased costs and project delays. A recent federal court ruling upheld the state’s authority to impose these requirements, though ongoing legal challenges remain. The Department of Public Service is finalizing exemption criteria, balancing the mandate’s intent with practical grid limitations. The changes are expected to significantly shape New York’s approach to building emissions and clean energy adoption in the coming years.

ERCOT Energy Summary

It was another week of warm summer temperatures but fortunately not quite warm enough to spur volatility as temperatures were in the upper 90’s and more importantly wind generation was strong. The only day temperatures reached 100F but did not exceed were on August 8th but only in San Antonio and Austin while Houston was 99 F and Dallas was at 97 F. Wind generation ranged on a flat basis between 10 GW on Monday and increased over the course of the week to 18.5 GW on Saturday 8/9. Solar output was on a flat load basis but solar generation was strong at 9.5-12.5 GW last week.

For the current week of August 11th, temperatures are trending higher, as the models are a bit stronger with the heat. Daytime highs have moved into the upper 90s in the forecast, with some low 100s possible for Dallas, Austin, San Antonio and Houston is at 98 F through next Monday. The peak of the heat is expected later this week, but the American and Canadian models suggest the potential for low 100s will continue into early next week. After that, the models show temperatures beginning to trend back down toward normal as we move into the 11- to 15-day period.

Turning to the wind forecast, wind output is going to be dropping through Wednesday (8/13) with flat average wind at only 4.9 GW and this will be increasing the net load (grid load – combined renewable output) in the late evening hours that will require more generation.

ERCOT Forward Prices:

The forward calendar strips week over week and month over month basis were the following:

Source: ERCOT

ERCOT Real Time Prices

Wind and Solar Output

Source: ERCOT

Wind was strong last week, not getting below 10 GW until Sunday 8/10 and was its lowest yesterday 8/11. Solar output helped push combined renewable generation up over 35 GW for most of last week’s mid-day hours which accounted for +40% of ERCOT generation in mid generation.

Recent Solar, Wind and Battery Milestones:

Two new records for solar and batteries last week. Solar reached a new record of 29,318 MW on July 29th and its second this month. Wind peaked at 28,470 MW on March 3rd. Batteries reached a new maximum discharge of 7,124 MW on July 30th at 7:55 PM. The combined renewables record was set last week on June 21st at 12:55 CT with 47,040 MW vs load of 73,320 MW or 64% of ERCOT load.

Generator Outages:

Over the past 45 days, thermal outages ranged from 8.5 GW to +12GW with average outages ~9.8 GW. They continued this past week ranging between 9 GW and 10 GW. 9 GW of thermal outages in summer months appears to be the new normal and could likely stay that way unless demand was to move significantly higher above 85 GW.

Source: ERCOT & Grid Status

TX Legislature, PUCT & ERCOT News:

Last week we highlighted AEP Texas utility region growth of 13 GW of new load in its Texas utility areas between 2025 – 2030, up from current load includes 5 GW of cryptocurrency operations and 2 GW in data centers, according to AEP’s President and CEO William Fehrman.

This week Oncor, Sempra’s utility in Texas, was highlighted on the company’s earnings call last Thursday. It was noted that Oncor has ~200 GW of interconnection requests sitting in its queue of which 186 GW were data centers, 7 GW of traditional C&I load, 5 GW of crypto currency and 4 GW of oil and gas development. Sempra & Oncor executives highlighted that currently 20% of the new demand has signed contracts or is categorized as “high-confidence load.” Oncor is looking to increase its capital spend by $12 billion to $36 billion next year.

Texas Energy Update:

Last Monday, (8/4) Governor Abbott announced the execution of a loan agreement between the Public Utility Commission and NRG for the development of a 456 MW natural gas power plant in Houston. The loan will provide up to $216 million over a 20-year period at an interest rate of 3%, covering approximately 60% of anticipated project costs, which is expected to remain below $360 million. NRG will construct the facility at its existing TH Wharton Generating Station in Houston. The project is currently underway and is scheduled to commence operations by Summer 2026. Once operational, the facility will interconnect within the ERCOT Houston Load Zone, serving major electricity demand centers including Houston, Pasadena, and The Woodlands. Following this announcement, the total capacity approved through the TEF In-ERCOT Loan Program has reached 578 MW. There are currently 15 active applications, representing 8,392 MW, that continue to progress through the program’s due diligence process.

The successful completion of issuing the loan to NRG follows the June decision by LS Power to withdraw its 527-MW project out of due diligence “due to numerous factors” and cease pursuing funds from the TEF program.

Real Time Co-optimization Trials Progressing:

ERCOT reported at its July 30th meeting of the Technical Advisory Committee (TAC) that the early market trials were successful for its Real-time Co-optimization plus Batteries (RTC+B) and that it is on track for a December 5th launch date. ERCOT reported for testing done in May & June, every generation, battery and demand response resource was able to establish connectivity with ERCOT systems and submit at least one bid. The next phase of testing being currently conducted in August is for initial real-time market execution and verifying QSEs’ ability to follow ERCOT frequency signals. Following those trials, in September, the optional day-ahead market begins along with a required live-production test to ensure effective frequency dispatch and control.

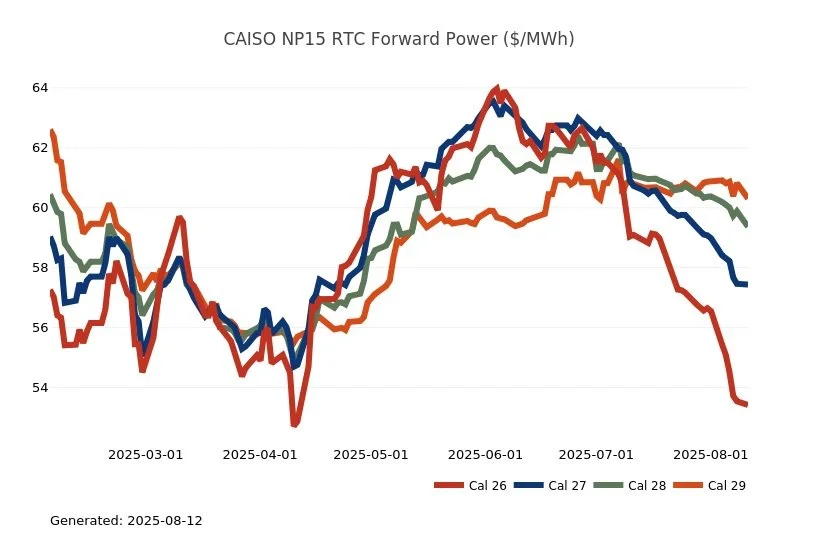

CAISO, Desert Southwest and Pacific Northwest Energy Summary

The first full week of August is projected to deliver anomalous heat across California and the Desert Southwest with the former hitting triple digits by this weekend in the northern part of the state while the latter is already under extreme heat advisories. Phoenix is likely to see record challenging highs of 113° on Wednesday (record: 114°), 115° on Thursday (record: 112°) and 113° on Friday (record: 116°)! The uptick will shift the peak demand higher with an inflection point showing up tomorrow and lasting through Friday. Heat also looks to increase in California with highs forecast to reach the mid to upper 90s in Burbank later this week and upper 90s in Sacramento this weekend. This looks to be some of the hottest weather thus far of what has been a relatively cool summer-to-date in California. Burbank’s hottest weather thus far this year was in early May, reaching 101° on May 10th, but the station has only reached as high as the low 90s since the start of meteorological summer. Cool sea surface temperatures extending well offshore have been a limiting factor for heat this summer, and risks to the forecast will depend on how much the strong upper-level ridge can overcome the cooler onshore flow influence. Monsoon moisture still looks to be limited over the next 10 days and mostly confined to thunderstorms near the Four Corners and the higher elevations of the Rockies. Even though it will be on the edge of any moisture, the heat indices in California will still be the highest seen all summer, but they can only muster a peak demand of around 39 GW in the CAISO, a far cry from any type of scarcity event that would shake up the markets.

The West gas situation is as healthy as we have seen it in the past decade with PG&E storage still carrying more than 18 Bcf than this time last year and the facilities are basically near full capacity, if you take into consideration the level seen this past November (current is 175.5 Bcf while Nov 2024 topped out around 178 Bcf). SoCalGas has benefited from the mild weather up to this point, abundant solar volume and the battery fleet providing flex ramping resources outside of the state’s reservoirs and natural gas generators. Aliso Canyon’s refill does not seem to have been hindered by the long-term capacity reduction tied to the North Zone which began in July. Currently, the storage facility is 1.5 Bcf below its level at this time last year, but given the predominantly cooler weather influence this summer and the robust renewable/battery availability, there is plenty of time to top things off before the end of October.

FERC is moving to rescind the West-wide wholesale electricity price cap mechanism it instituted in 2002 in response to widespread price manipulation during the Western energy crisis of 2000/2001, which resulted in rolling blackouts in California and famously led to prison sentences for the smartest guys in the room at Enron. Under the policy, any electricity sales exceeding the cap — currently set at $1,000/MWh — are subject to cost justification and refund upon review by FERC. The commission on July 14 opened a Section 206 proceeding to examine discontinuing its policy of maintaining a “soft” price cap for short-term electricity sales in the West to prevent the exercise of market power in areas outside CAISO. The proceeding comes a year after the D.C. Circuit Court of Appeals ruled the commission must apply the Mobile-Sierra doctrine when reconsidering a series of 2022 orders requiring electricity sellers to refund a portion of the high prices they earned during an August 2020 heat wave. That case dealt with the surging prices associated with tight electricity supplies stemming from soaring temperatures over August 18-19, 2020, as CAISO scrambled to prevent a repeat of the rolling blackouts it was forced to order August 14-15 — the first such blackouts in California in 20 years. During the heat wave, wholesale prices at Arizona’s Palo Verde hub on Intercontinental Exchange (ICE) hit records of $1,515/MWh on August 18 and $1,750 on August 19, compared with average prices that summer of $52/MWh. While FERC has over time revised the soft offer cap to reflect increases in CAISO’s caps, it has never reassessed whether the framework is necessary to ensure just and reasonable rates in the West. The commission wrote that the region’s wholesale market landscape in 2025 is “substantially different than in 2002,” when it created the soft cap.