Energy Market Update

Weekly Energy Industry Summary

Commodity Fundamentals

Week of April 28, 2025

By The Numbers:

NG '25 prompt-month NYMEX settled at $3.17 per MMbtu, up $.23/MMbtu, on Monday, April 28.

WTI '25 prompt-month crude oil settled at $61.87 per barrel, down $.97 per barrel on Monday, April 28.

Natural Gas Fundamentals - Bearish

Prompt NYMEX natural gas settled at $3.17 per MMbtu, up $.23/MMbtu on Monday, April 28.

The May prompt-month contract settled up sharply yesterday as traders took profit on lots of selling action over the past couple of weeks.

Last week's storage injection of 88 Bcf was above expectations and well above the five-year-average of 58 Bcf.

Production of natural gas, month-to-date is 105.0 Bcf per day, versus 99.9 Bcf per day for the same period last year.

Electric power generation demand for gas, month-to-date, averaged 28.5 bcf per day versus 29.5 Bcf per day for the same period last year.

Residential/commercial demand for gas month-to-date averaged 20.8 Bcf per day versus 19.7 Bcf per day for the same period last year.

LNG exports month-to-date averaged 16.0 Bcf per day versus 11.8 Bcf per day for the same period last year.

Natural gas strip pricing for 2026 through 2030 is: $4.13, $3.80, $3.61, $3.51, $3.42 per MMbtu respectively.

Crude Oil - Neutral/Bearish

NYMEX (WTI) prompt-month crude settled at $61.87/bbl, down $.97 per barrel.

Demand outlooks are bearish.

Several members of OPEC will suggest an acceleration of production for a second consecutive month, Reuters reports.

There is some discussion that the Saudi's are cooperating with the Trump Administration in boosting output and pressuring prices downward. This makes geopolitical sense as the Saudi's are looking to improve relations with the U.S. and buttress their defensive posture toward Iran.

Additionally, The Saudi's are reportedly sending a message to several OPEC members who have been over-producing, most notably Kazakhstan, to get in line with targets and if they fail to do so, the spigots will be opened and the price will move downward.

Moreover, lower oil prices will hamper Russia's war efforts in Ukraine at a time when the Administration is applying pressure for a cease fire and the commencement of a peace settlement.

Economy - Neutral

The World Bank said it expects commodity prices to fall sharply this year and

The U.S. broadened its trade dispute with China by imposing steep tariffs on solar imports .

Treasury Secretary Scott Bessent declined to say whether the U.S. and China are in direct communication on tariffs.

U.S. initial jobless claims rose to 220,000 last the week.

Jobless-claims data remain in a narrow range, suggesting no big uptick in layoffs, The Wall Street Journal reports.

The home building season is off to a rocky start.

Housing starts for March fell 11.4 percent.

Orders for big ticket items surged 9.2% in March as consumers looked to get ahead of tariffs.

Weather - Neutral

May is here.

The weather is generally seasonal in the eastern two-thirds of the country.

After a brief warm up east of the Mississippi, things get a bit cooler next week.

No major anomalies from the 30-year normal temperature averages.

Weekly Natural Gas Report:

Inventories of natural gas in underground storage for the week ending April 18, 2025 are 1,934 Bcf; an injection of 88 Bcf was reported for the week ending April 18, 2025.

Gas inventories are 44 Bcf below the five-year average and 478 Bcf less than the same time last year.

Values reflect week ending May 2, 2025.

Prices

reflect week ending April 25, 2025.

Weekly Power Report:

Prices reflect week ending April 25, 2025.

Prices reflect week ending April 25, 2025.

Mid-Atlantic Electric Summary

The Mid-Atlantic Region’s forward power prices were supported this past week, despite natural gas prices continuing their decline ahead of the May contract expiry on Monday of this week. Strong natural gas production, weak demand, lower LNG feedgas and talk of a recession continues to weigh on natural gas prices, but forward power prices were higher due to big power procurements this time of year. Natural gas prices moved-up considerably early this week, as most traders got out of their oversold positions before expiry. The warmth from this week fades over the weekend in the wake of a cold front, which introduces some below normal temperatures into the forecasts, followed by a slower and weaker warm-up next week. Power price futures for the 2026-2030 terms were 1% higher over the past week, but -3% lower over the past month. The month-to-date, day-ahead settlement price in West Hub is averaging $46.25/MWh, which is 3% higher than March’s average final settlement price.

FERC Approves PJM’s Capacity Market Price Collar Filing - On 4/21, FERC issued an order accepting PJM’s proposal to temporarily “collar” capacity market prices. The proposal sets an approximate $325/MW-day price cap and $175/MW-day floor on capacity market clearing prices for the 2026/27 and 2027/28 delivery years and grew out of settlement discussions between PJM and Pennsylvania’s Governor Shapiro, who filed a complaint at FERC in December seeking to reduce the auction’s price cap. FERC reasoned that for the next two delivery years “the combination of the price cap and price floor will establish a price collar that protects consumers from price volatility outside the bounds of the price collar while also enabling capacity prices to reflect the system’s need for capacity.” This order provides further clarity as to the rules that will apply to PJM’s upcoming capacity market auction this summer.

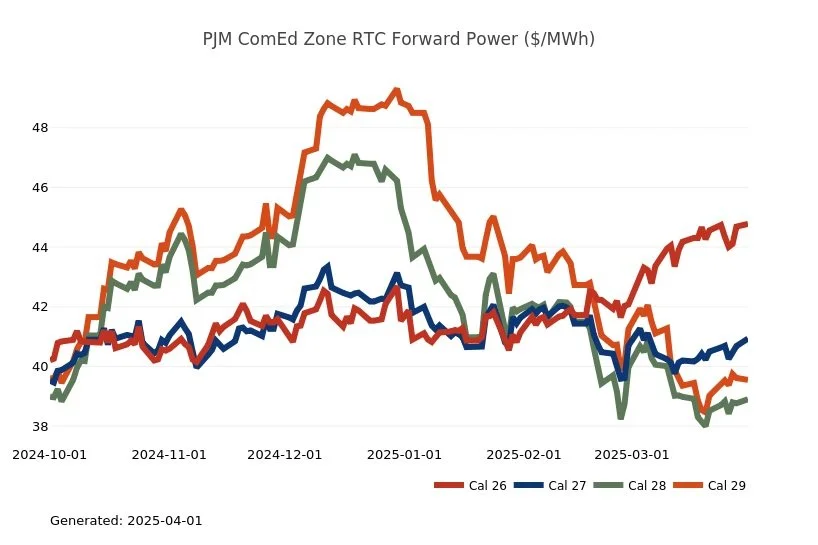

Great Lakes Electric Summary

The Great Lakes Region’s forward power prices were supported this past week, despite natural gas prices continuing their decline ahead of the May contract expiry on Monday of this week. Strong natural gas production, weak demand, lower LNG feedgas and talk of a recession continues to weigh on natural gas prices, but forward power prices were higher due to big power procurements this time of year. Natural gas prices moved-up considerably early this week, as most traders got out of their oversold positions before expiry. The warmth from this week fades over the weekend in the wake of a cold front, which introduces some below normal temperatures into the forecasts, followed by a slower and weaker warm-up next week. Power price futures for the 2026-2030 terms were 1% higher over the past week, but -2% lower over the past month. The month-to-date, day-ahead settlement price in COMED is averaging $23.20/MWh, which is -9% lower than March’s average, while those index averages in AdHub are priced at $45.65/MWh or 13% higher than last month. In Michigan, the month-to-date, day ahead average settlement price is $36.91/MWh or is -1% lower than March’s average, while that price in Ameren is currently averaging $29.33/MWh or is -5% lower, month-over-month.

FERC Approves PJM’s Capacity Market Price Collar Filing - On 4/21, FERC issued an order accepting PJM’s proposal to temporarily “collar” capacity market prices. The proposal sets an approximate $325/MW-day price cap and $175/MW-day floor on capacity market clearing prices for the 2026/27 and 2027/28 delivery years and grew out of settlement discussions between PJM and Pennsylvania’s Governor Shapiro, who filed a complaint at FERC in December seeking to reduce the auction’s price cap. FERC reasoned that for the next two delivery years “the combination of the price cap and price floor will establish a price collar that protects consumers from price volatility outside the bounds of the price collar while also enabling capacity prices to reflect the system’s need for capacity.” This order provides further clarity as to the rules that will apply to PJM’s upcoming capacity market auction this summer.

Northeast Energy Summary

On April 24, the New Hampshire Department of Energy (DOE) held its first stakeholder meeting to discuss the start of the review of the Renewable Portfolio Standards (RPS) as required by law. This initial meeting focused on the status of the RPS in New Hampshire and compared New Hampshire’s RPS to other states in New England. DOE outlined next steps, including two more stakeholder sessions on May 29 and June 26, to dig deeper into New Hampshire’s RPS including adequacy of current sources to meet requirements, potential for thermal energy in the RPS, increasing the requirements beyond 2025, introduction or consolidation of classes, timeframe for treating new resources as existing resources, evaluation of using Power Purchase Agreements for meeting goals, alternatives to the RPS, and the distribution of the renewable energy fund. DOE noted that stakeholders will have an opportunity to provide comments or a presentation at future meetings.

NYISO recently published its 2025 summer assessment as well as its summer operating report. The summer assessment projects sufficient capacity margins this summer in all weather conditions with utilization of up to 3,159 MW of emergency operating actions. Without emergency operating actions, capacity margins for baseline conditions are sufficient (997 MW) but capacity margin shortfalls of -1,082 MW and -2,768 MW would exist in extreme weather conditions (90-10 and 99-1 respectively). NYISO included a chart in the summer assessment showing changes in summer capacity margins and details between this summer and last summer. Summer generation capacity decreased by 185 MW this summer due to the retirement of some gas turbines. Peak load forecast also decreased by 70 MW this summer due to economic changes as well as additions of behind the meter solar. On balance there is a 245 MW increase in the capacity margin in the baseline forecast for 2025 compared to 2024. Fuel surveys indicate both oil and duel fuel units have sufficient inventories ahead of the season, and scheduled generation and transmission maintenance should mitigate the risk of such outages occurring during the peak season.

ERCOT Energy Summary

Spring weather continued last week with Dallas averaged in the mid 70’s while Houston saw average temperatures in the mid 70’s and daytime highs in the upper 80’s along with Austin and San Antonio daily high temperatures mid 80’s. Wind output was strong last week in the mid-teens and solar average above 6.5 GW of flat average load.

For the coming week of April 28th, in the near term, north-central Texas is on the tail end of a stormy pattern that stretches from the Great Lakes back toward the southern Plains. This brings chances for storms in Dallas, while Houston is drier and more consistently warmer this week. A cool front will bring temperatures down toward normal this weekend, followed by a slower warming pattern next week. The models are split in the 11-15 day forecast, with the American model showing warmer than normal temperatures, while the European model predicts normal to below normal temperatures. The truth may lie between the two—warm, but not significantly hot.

ERCOT Forward Prices:

The forward calendar strips week over week and month over month basis were the following:

Forward Calendar Price Review Last Week

Source: ERCOT

ERCOT Real Time Prices

Real time prices were under $100/MWh through April 25th and prices averaged $121/MWh in HE 21 and prices were subdued the rest of the week as solar and wind output was strong.

Source: ERCOT

Wind and Solar Output:

No new solar, wind for battery records last week. Wind started the week off strong at 12-15 GW most of the week. April 25th saw the lowest wind output at 7.5 GW in the midday. Solar started the week off at 21 GW and dropped to 15 GW on April 24th before rebounding back to 18 GW to finish the week out strong.

Two weeks ago, ERCOT achieved a two combined solar and wind renewable output records. The first was for 41,675MW on April 13th at 4:40 PM CT and the second was for 41,916 MW at 2:45 PM CT on April 17th. See below. Prices were stable most of last week.

Battery capacity saw a Maximum storage record of 5,970 MW on 4/10 at 7:30 pm CT and the 5th new record in 2025, up from 4,587 MW on February 20th.

Source: https://www.gridstatus.io/live

Generator Outages:

https://www.gridstatus.io/graph/ercot-outages?iso=ercot&outageType=thermal

Source: ERCOT & Grid Status

Thermal outage season of maintenance ahead of summer demand continues as outages are holding steady at around 25 GW.

ERCOT/TX News

Several updates this week from the PUCT & legislative actions in Austin as the Texas legislature is in session.

Progressing Nuclear Legislation - On 4/23, the bill establishing funding mechanisms for new nuclear reactors (HB 14) was passed by the Texas House with a vote of 134 to 9. As previously reported, the bill would establish the Texas Advanced Nuclear Energy Office to promote nuclear development in the state including the coordination of permitting activities. The bill also would establish a nuclear energy fund to provide up to $12.5M in state funding (with a 50/50 cost-match) for early project development activities and reimburse up to $200 in costs associated with construction, permitting, and procurement of long-lead equipment (also with a 50/50 cost-match). The PUCT also would be directed to establish a $/MWh bonus grant using available money in the fund for the completion and operation of a new reactor capable of interconnecting to the ERCOT grid.

PUCT Approves 765-kV Permian Basin Import Passes - At its open meeting on 4/24, the Public Utility Commission of Texas (PUCT) approved the three 765-kV import paths to the Permian Basin. The purpose of the import paths in the Permian Basin Reliability Plan is to transfer power from generation resources outside the region to meet the forecasted 2038 net demand for power inside the region. Although the 765-kV passes have higher initial costs compared to the 345-kV proposal, the PUCT concluded that they will provide higher transfer capability, fewer line losses, reduced congestion, which will overall make the 765-kV option more cost-effective and justify the additional 22% estimated capital cost premium. The Transmission Service Providers (TSPs) also confirmed they are working with AEP to review the 765-kV standards and guidance to leverage AEP’s experience, which mitigated the PUCT’s concerns about the TSP's lack of experience with developing 765-kV infrastructure.

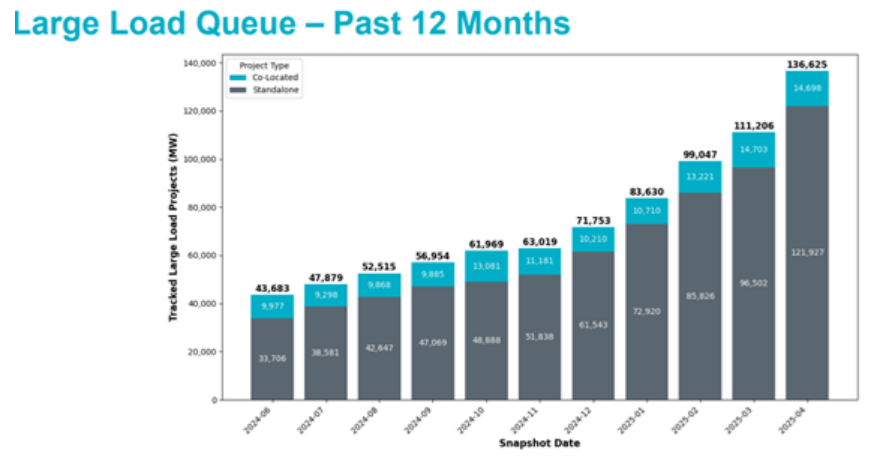

ERCOT provided an updated on large loads at its Technical Advisory Committee meeting on 4/23, and gave an update on changes to the queue. It was noted there are 50 projects that are over 1,000 MW, 40 projects are greater than 500 but less than 1,000 MW and 57 projects of between 250-500 MW.

Large Load Queue – Past 12 Months: The April update reported a growth of 25,419 MW net increase in the queue since March. This was due to a combination of new standalone and co-located projects. In the current queue, there is 51 GW of new loads under review between 2025 thru 2030 while 66 GW has no studies submitted. There are 12 GW with planning studies approved. There are currently 4.6 GW of current data load that is commercially operational in ERCOT.

Source: ERCOT

CAISO, Desert Southwest and Pacific Northwest Energy Summary

Changes over the weekend to the near-term forecast were mostly to the cooler side, as an active Pacific flow continues to keep a marine layer in the picture thus keeping temperatures in check for the West region. We are still expecting a seasonal warming trend later this week, seeing Sacramento looking at highs in the mid-80’s by Weds while Burbank is ten degrees cooler with highs in the mid-70s. A more significant cooler than normal period is expected next week throughout much of the West. The forecast suggests increased heating demand in the Northwest and Rockies early next week while greatly reducing cooling demand in the DSW cities. A deep upper-level trough that looks to progress into the West will bring unseasonably cool conditions; highs are expected to retreat to the mid to upper 70s in Phoenix and upper 60s to low 70s in Las Vegas on Sun-Mon. The forecasted high of 67° in Las Vegas on May 4th would tie the daily record cool high, while the forecast of 76° in Phoenix on May 5th is not near records but well below the normal high of 91°. Highs in California will mostly be in the 60s and 70s with lows in the 50s. Snow melt will only gradually increase heading into May as temperatures are looking slow to warm, keeping the water on the mountains for now.

The annual low load period means SoCalGas continues to see a surplus of molecules on their system and pipeline maintenance along with maintenance at the Aliso Canyon storage is limiting their ability to move them around. High operational flow orders (OFOs) alerts have become a nearly daily part of the natural gas landscape in the region … we think we’re up to 10 consecutive days but admit to having lost count at this point. Today through May 15th, maintenance outages will limit total SoCal injection capacity to 0.224 Bcf/d meaning chances are the OFO streak continues given the mild weather outlook. PG&E storage is trending ahead of last year showing 139.8 Bcf as of Monday’s report, while SoCal is at 81.3 Bcf which is roughly 19 Bcf behind where they were at the end of April last year. Maintenance at the T-South compressor in British Columbia produced some remarkable index settlements last week, bringing West Texas style prices to the Pacific Northwest. A $9 gap opened between Westcoast Station 2 and the Sumas hub as the former settled at -$8.04 while the latter shifted up to +$1.10. This is one of the lowest prices seen at this Canadian trading hub but exemplifies what happens when pipeline capacity gets pinched.

Low demand on the CAISO system and high renewables from the trifecta of solar production flying out of the state’s deserts, the seasonal pickup in wind output and the building hydro gen megawatts is aggravating the S to N congestion on display in the day-ahead index market and worsens in the real-time where NP15 prices settle in positive territory but SP15 prices clear well into negative territory posting numbers routinely in the teens and $20 per MWh below zero. This has been a great environment for batteries as the prices quickly move back above zero when the sun fades. Max discharges on the system have been growing as operators try to capture these economics, the largest to date has been 9.7 GW during the 20th hour on April 21st, a number that in all likelihood would have broken 10 GW if Moss Landing did not have its thermal issue back in January.

We heard California’s governor last week boast that the state overtook Japan in 2024 to become the world’s fourth-largest economy. The hold on that rank is fragile as the state is losing jobs – 54,800 during the first three months of this year – and potentially more to come as Valero notified the California Energy Commission (CEC) of their intention to “to idle, restructure, or cease refining operations at the Benicia Refinery by the end of April 2026”, citing the state’s challenging regulatory environment as a driving factor. The refinery is the sixth largest in California and has been under Valero’s names since 2000, processing 149,000 barrels per day and accounting for roughly 9% of the state’s crude oil capacity. Valero is also evaluating options for its Wilmington facility in Los Angeles County, which produces 93,500 barrels per day. The announcement comes six months after Phillips 66 announced its decision to close its Los Angeles refinery at the end of 2025, and two weeks after Chevron announced plans to lay off 600 employees as it relocates its HQ from San Ramon to Texas. Chevron’s move was seen as a response to California’s stringent regulatory and environmental policies, which, combined with the state's reliance on imports and lack of pipelines, have contributed to volatile gas prices in the state. Chevron urged the state legislature and the governor to reconsider various regulations, including the ban on new gas-powered cars by 2035, a recent law limiting oil refiners’ profit margins, and new regulations regarding oil supply and maintenance. Valero’s potential refinery closure could exacerbate that volatility. The state has stricter environmental standards for its gasoline, requiring a squeaky-clean blend known as California Reformulated Gasoline, which reduces pollutant emissions but is more expensive to refine, driving the state’s higher gas prices. California relies on nine refineries to produce its special gasoline blend, with production barely meeting current fuel consumption. The potential closure of Valero’s Benicia facility, along with Phillips 66’s planned closure, would reduce California's refining capacity by 18% within a year. The closure would also impact carbon dioxide supply in a state that is already at risk of a potential CO2 shortage. The Phillips 66 refinery supplies around 500 tons per day and with the potential Valero closure, California could lose one-fifth of its carbon dioxide production by mid-2026. According to the CEC’s website, only 10 refineries currently produce diesel or gasoline for the state.

Marathon Petroleum, Los Angeles Refinery 365,000 barrels per day (bpd)

Chevron, El Segundo Refinery 269,000

Chevron, Richmond Refinery 245,271

PBF Energy, Torrance 160,000

PBF Energy, Martinez 156,400

Valero Energy (Benicia), Wilmington 145,000

Phillips 66, Los Angeles 139,000

Valero Energy, Wilmington 85,000

Kern Energy, Bakersfield 26,000

San Joaquin Refining, Bakersfield 15,000