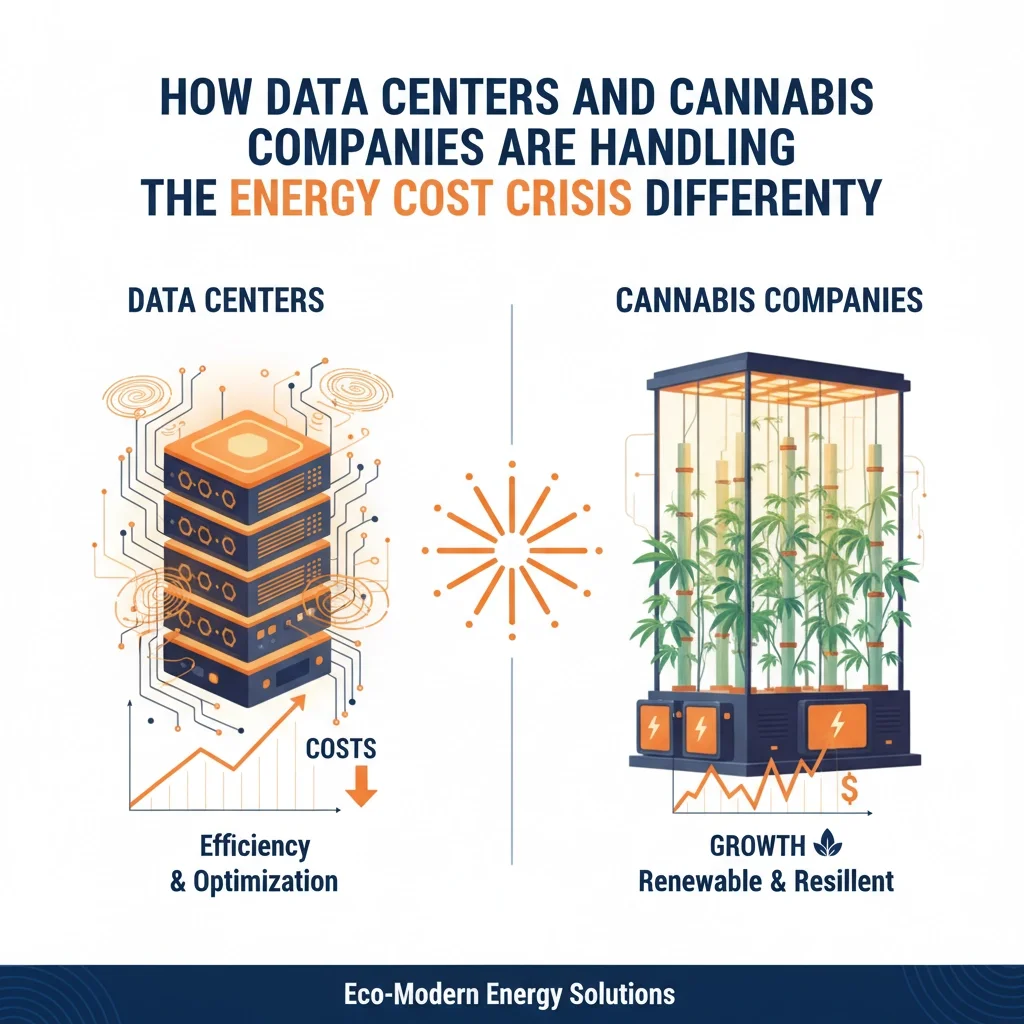

How Data Centers and Cannabis Companies Are Handling the Energy Cost Crisis Differently

Energy costs are crushing businesses across every industry, but two sectors are handling the crisis in completely different ways: data centers and cannabis companies. While both face massive electricity bills, their approaches to managing wholesale energy rates and reducing business energy costs couldn't be more different.

Understanding how these energy-intensive industries tackle their utility expenses offers valuable insights for any commercial energy buyer looking to optimize their energy strategy.

The Scale of the Problem

Before diving into solutions, let's look at the numbers. Data centers now consume about 4% of all US electricity: more than double their 2018 consumption. That's expected to grow another 160% by 2030, according to Goldman Sachs Research.

Cannabis cultivation, while smaller in total impact at just 0.1% of US electricity consumption, is incredibly energy-intensive. Indoor marijuana growers use about 10 times more energy per square foot than typical office buildings. A single grow facility can consume as much power as hundreds of homes.

Both industries are feeling the squeeze from rising electricity rates, but their responses reveal two fundamentally different approaches to energy management.

Data Centers: The Enterprise Approach

Data centers have the capital and technical expertise to deploy sophisticated energy solutions at massive scale. For them, energy efficiency isn't just about cost savings: it's a competitive necessity.

Technology-Driven Solutions

The biggest data center operators are investing heavily in cutting-edge efficiency technologies:

Server Virtualization: Traditional data centers ran servers at just 10-15% utilization. Companies like Citigroup have pushed utilization rates to around 50%, delivering immediate energy savings without new hardware.

Battery Energy Storage Systems (BESS): These systems store renewable energy when it's cheap and abundant, then discharge during peak pricing periods. They also provide grid stability services that can generate additional revenue.

AI-Powered Workload Management: Advanced systems automatically shift computing tasks to times when renewable energy is plentiful or wholesale energy rates are lowest.

Infrastructure Investments

Forward-thinking data center operators are moving beyond traditional grid dependency:

On-Site Renewable Generation: Major hyperscalers are building "energy campuses" that integrate solar and wind generation directly into their infrastructure planning.

Heat Recovery Systems: Especially popular in Europe, these systems capture waste heat and convert it into a valuable resource for heating nearby buildings or industrial processes.

Demand Response Programs: Data centers enroll in utility programs that pay them to reduce consumption during peak demand periods.

The Challenge of Scale

Despite these innovations, data centers face a fundamental problem: their energy demand is growing faster than their efficiency improvements. A single hyperscale data center consumes as much electricity as 80,000 homes, and AI applications are driving demand through the roof.

Cannabis Companies: The Survival Strategy

Cannabis growers face a completely different set of constraints. Unlike data centers with deep pockets, cannabis companies are driven to efficiency primarily by economic survival.

Economics-First Approach

The cannabis industry's approach to energy management is simple: reduce costs or go out of business. As marijuana prices have collapsed in mature markets, operators have been forced to slash operating expenses wherever possible.

Industry stakeholders consistently identify cost reduction as the primary driver for efficiency improvements. This creates a different dynamic than data centers, where efficiency is driven by growth demands and competitive positioning.

Emerging Solutions

The cannabis sector is still developing its efficiency toolkit:

Benchmarking and Metrics: The industry is developing key performance indicators like "grams produced per kilowatt-hour" to measure and improve efficiency.

LED and HVAC Upgrades: Most efficiency gains come from proven technologies like LED lighting and improved climate control systems.

Greenhouse Conversions: Some growers are moving from energy-intensive indoor facilities to more efficient greenhouse operations that use natural light.

Creative Financing: Smaller growers are organizing collectively to access renewable energy tax incentives and efficiency financing programs.

Localized Grid Impact

While cannabis represents a tiny fraction of national electricity consumption, it creates significant localized challenges. In Colorado's Xcel Energy territory, about 500 grow facilities consume 35,000-45,000 MWh annually: close to 2% of regional demand.

Early legalization created infrastructure headaches. Utility transformers designed for different industrial uses required replacement to handle 24-hour grow operations. However, energy consumption has largely stabilized in mature markets like Colorado.

Key Differences in Energy Strategy

The contrast between these industries reveals different approaches to commercial energy management:

Capital Availability: Data centers can invest millions in efficiency infrastructure. Cannabis companies work with limited budgets and emerging financing options.

Technology Sophistication: Data centers deploy cutting-edge solutions like AI optimization and battery storage. Cannabis companies focus on proven, cost-effective upgrades.

Regulatory Support: Data centers benefit from utility demand response programs and renewable energy incentives. Cannabis companies face limited program access due to federal restrictions.

Strategic Focus: For data centers, efficiency is a competitive advantage. For cannabis companies, it's economic survival.

Lessons for Commercial Energy Buyers

Both industries offer valuable insights for businesses looking to reduce their energy costs:

From Data Centers: Think Long-Term

Invest in Infrastructure: While the upfront costs are significant, investments in energy storage, renewable generation, and advanced controls pay dividends over time.

Leverage Demand Response: Most utilities offer programs that pay businesses to reduce consumption during peak periods. These programs can significantly offset utility expenses.

Monitor and Optimize: Continuous monitoring and optimization can identify efficiency opportunities without major capital investments.

From Cannabis: Focus on Fundamentals

Start with Low-Hanging Fruit: LED lighting, HVAC optimization, and basic controls deliver immediate savings with reasonable payback periods.

Develop Internal Metrics: Tracking energy use per unit of production helps identify improvement opportunities and benchmark against industry standards.

Explore Group Purchasing: Smaller businesses can band together to access better electricity rates and financing options.

The Bottom Line for Your Business

Whether you're running a small manufacturing operation or a large industrial facility, these industries demonstrate that successful energy management requires matching your strategy to your resources and constraints.

If you have significant capital and technical expertise, consider the data center approach: invest in sophisticated systems that deliver long-term competitive advantages. If you're working with tighter budgets, follow the cannabis industry's lead: focus on proven, cost-effective improvements that deliver immediate savings.

Most importantly, both industries show that doing nothing isn't an option. Rising electricity rates and increasing grid instability make energy strategy a business-critical issue, not just an operational detail.

The companies that proactively address their energy challenges: whether through high-tech solutions or practical efficiency improvements: will be the ones that survive and thrive as energy costs continue to climb.

For businesses looking to navigate these complex energy markets, working with experienced energy consultants can help identify the right mix of strategies for your specific situation and budget. The key is getting started before rising costs force your hand.