UEC Energy Market Update

Weekly Energy Industry Summary

Commodity Fundamentals

Week of October 20, 2025

By The Numbers:

Prompt-month NYMEX natural gas settled at $3.40/MMbtu, up $.38 on Monday, October 20.

Prompt-month NYMEX natural gas settled at $3.36/MMbtu, on Monday, October 6.

Prompt-month crude oil settled at $57.82/bbl., down $.02 on Monday, October 20.

Prompt-month crude oil settled at $61.69/bbl., on Monday, October 6.

Natural Gas Fundamentals - Neutral/Bullish

After a sell off last week, natural gas has regained all of the lost ground over the past few days.

Two weeks ago, on October 6, prompt-month gas settled at $3.36/MMbtu.

It proceeded to trade downward for several days briefly breaching $2.99/MMbtu with very mild weather, ample storage, and strong production as a backdrop. This afternoon, prompt-month gas was trading at $3.47/MMbtu.

Cooler temperatures in the northern tier this week are driving some heating demand gains.

Additionally, winter forecasts are now gelling with some calling for a repeat of last winter.

The runway to the start of the winter season is shortening along with the appetite to be short of natural gas before the snow flies (if it does).

2026 looms large as a major wave of LNG is set to deliver 7.5 Bcf per day of new exports.

A normal winter coupled with additional LNG would be supportive of and provide upward price action to natural gas over the next year.

Production remains at an all-time high. Month-to-date production averaged 106.3 Bcf per day versus 101.2 Bcf per day for the same period last year.

Storage will be full at the end of October

Power generation demand month-to-date averaged 34.2 Bcf per day versus 34.7 Bcf per day for the same period last year.

Residential/Commercial demand month-to-date averaged 12.5 Bcf per day versus 12.9 Bcf per day for the same period last year.

Industrial demand month-to date averaged 22 Bcf per day versus 22.4 Bcf per day; same period last year.

LNG exports averaged 16.4 Bcf per day month-to-date versus 13 Bcf per day; same period last year.

Exports to Mexico averaged 5.6 Bcf per day month-to-date versus 6.3 Bcf per day; same period last year.

Crude Oil - Neutral/Bearish

NYMEX (WTI) prompt-month crude settled at $57.82/bbl., down $.02 on Monday, October 20.

Two weeks ago, NYMEX (WTI) prompt-month-crude settled at $61.69/bbl., up $.81, on Monday, October 6.

A faltering in tariff talks with China is causing bearish sentiment in the market.

President Trump is scheduled to meet with China's President Xi in South Korea at the end of October at the Asia Pacific Economic Cooperation meeting regarding a new trade deal.

If a new trade deal with China cannot be struck, Trump is threatening a new 157% tariff on China.

Such an outcome would be bearish of crude oil pricing.

There is a lot of trade tension in the air between the U.S. and China.

President Trump also said that India would not import Russian crude oil, although it is not clear that India's Prime Minister is on board with this.

Crude is bearish until the trade issue gets resolved.

Economy - Neutral

The U.S. Government shut down is now exiting week four.

Fed Governor Miran advocates a half-point cut to rates pursuant to the upcoming meeting.

The U.S. budget deficit edged lower in 2025 as tariffs and debt payments saw new records.

The CPI inflation report will be released by the Labor Department as staff have been called back. The report will be issued on October 24.

Government reports on employment and other key economic indicators are mostly at a standstill pursuant to the shutdown.

Weather - Neutral

Temperatures are geting cooler in the eastern half of the country.

Seasonal fall-like weather is the norm for the coming week with some overnight lows in the northern tier, the Midwest and Mid-Atlantic going below normal.

The west maintains a largely above normal condition with the exception being Washington state and Oregon.

Weekly Natural Gas Report:

Inventories of natural gas in underground storage for the week ending October 10 are 3,721 Bcf; an injection of 80 Bcf was reported for the week ending October 10.

Gas inventories are 154 Bcf above the five-year average and 26 Bcf more than the same time last year.

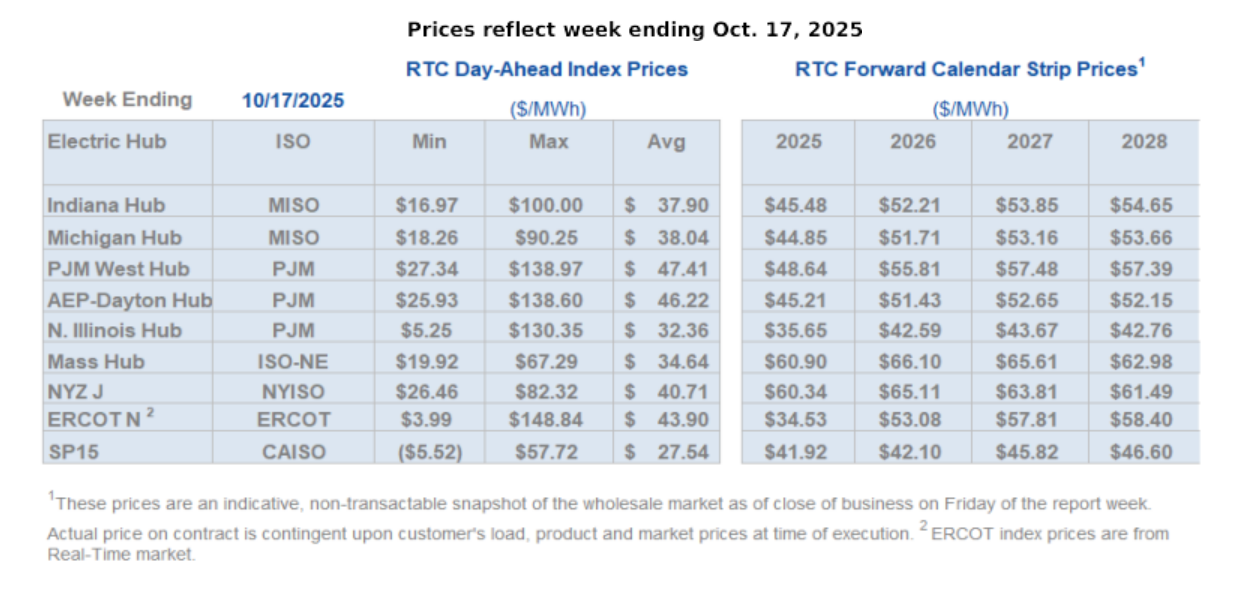

Weekly Power Report:

Mid-Atlantic Electric Summary

The Mid-Atlantic Region’s forward power prices were back up again last week after falling the prior week with the tumble in natural gas prices. An over-sold gas market amid bearish market drivers weighed on forward power prices earlier in the month, but colder temperature forecasts along with some short-covering by traders, seemed to provide some uplift to the market of late. A cold front crossing the region will bring below-normal temperatures from the Midwest into the East and South for the second half of this week. The pattern will turn warmer, with above-normal temperatures early next week ahead of a cold front that brings another round of below-normal temperatures eastward. Last week, forward power prices were unchanged for the 2026-2027 terms while the 2028-2030 terms saw a 1% increase. The month-to-date, day-ahead settlement price in West Hub for October is $48.47/MWh, which is 17% higher than last month and 37% higher than a year ago.

PJM Completes Stage 2 of Critical Issue Fast Path – On 10/14, PJM held the second and final “Stage 2” meeting for the Critical Issue Fast Path – Large Load Additions (CIFP-LLA), during which 11 stakeholders presented proposed options to address resource adequacy concerns associated with integrating large loads quickly and reliably. Eolian Energy and The Brattle Group brought forward a joint option for a Bilateral Integration of Generation Portfolio and Load (BIGPAL) seeking to accelerate the contracting process between load and supply and interconnection and get supply online quickly in cases where generators and loads are adjacent. While focused on battery energy storage resources, the BIGPAL proposal would apply to other resource types as well. Jacob Finkel, Deputy Secretary of Policy for the Office of the Governor of Pennsylvania urged PJM to address cost to consumers, barriers to entry, flexibility of large load, and broader regional challenges. Additional presentations were made by the IMM focusing heavily on bring your own generation (BYOG) and Vistra proposing that load serving entities be subject to resource adequacy requirements with financial penalties for shortfalls. Prior to the meeting, PJM posted a letter from U.S. Senator John Fetterman to the PJM Board of Managers expressing strong concern over the impact of data centers and other large load additions on electricity prices in Pennsylvania and across the PJM region. Fetterman asked PJM to reconsider voluntary, and potentially mandatory, Non-Capacity Backed Load (NCBL) status for new large loads, as well as BYOG incentives to encourage large loads to develop or co-locate with new generation. He also highlighted his “Clean Cloud Act,” which would require annual reporting of data center electricity use, and urged PJM to prioritize consumer protection over corporate interests.

Great Lakes Electric Summary

The Great Lakes Region’s forward power prices were back up again last week after falling the prior week with the tumble in natural gas prices. An over-sold gas market amid bearish market drivers weighed on forward power prices earlier in the month, but colder temperature forecasts along with some short-covering, seemed to provide some uplift to the market of late. A cold front crossing the region will bring below-normal temperatures from the Midwest into the East and South for the second half of this week. The pattern will turn warmer, with above-normal temperatures early next week ahead of a cold front that brings another round of below-normal temperatures eastward. Last week, forward power prices were unchanged for the 2026 term, while the 2027-2030 terms saw a 1% increase. The month-to-date, day-ahead settlement price in COMED for October is $33.67/MWh which is -9% lower than last month while in AdHub that price is $47.09/MWh or 18% higher than last month. In Michigan the October month-to-date settlement price average is currently $40.06/MWh which is 1% higher than September, while Ameren’s settlement price average is $35.28/MWh or -9% lower than last month.

PJM Completes Stage 2 of Critical Issue Fast Path – On 10/14, PJM held the second and final “Stage 2” meeting for the Critical Issue Fast Path – Large Load Additions (CIFP-LLA), during which 11 stakeholders presented proposed options to address resource adequacy concerns associated with integrating large loads quickly and reliably. Eolian Energy and The Brattle Group brought forward a joint option for a Bilateral Integration of Generation Portfolio and Load (BIGPAL) seeking to accelerate the contracting process between load and supply and interconnection and get supply online quickly in cases where generators and loads are adjacent. While focused on battery energy storage resources, the BIGPAL proposal would apply to other resource types as well. Jacob Finkel, Deputy Secretary of Policy for the Office of the Governor of Pennsylvania urged PJM to address cost to consumers, barriers to entry, flexibility of large load, and broader regional challenges. Additional presentations were made by the IMM focusing heavily on bring your own generation (BYOG) and Vistra proposing that load serving entities be subject to resource adequacy requirements with financial penalties for shortfalls. Prior to the meeting, PJM posted a letter from U.S. Senator John Fetterman to the PJM Board of Managers expressing strong concern over the impact of data centers and other large load additions on electricity prices in Pennsylvania and across the PJM region. Fetterman asked PJM to reconsider voluntary, and potentially mandatory, Non-Capacity Backed Load (NCBL) status for new large loads, as well as BYOG incentives to encourage large loads to develop or co-locate with new generation. He also highlighted his “Clean Cloud Act,” which would require annual reporting of data center electricity use, and urged PJM to prioritize consumer protection over corporate interests.

Northeast Energy Summary

At the October 9 ISO New England (ISO-NE) Participant’s Committee (PC) Meeting, ISO-NE reviewed its 2026 workplan, most of which will focus on the Capacity Auction Reforms (CAR) prompt-seasonal market design and capacity accreditation changes, the dynamic operating reserves project, and various interconnection and transmission planning initiatives and compliance matters. The first phase of the CAR effort, the prompt auction design and deactivation process (CAR-PD), is nearing its conclusion, with votes scheduled at the November technical committee meetings and the December 4 PC meeting followed by a FERC filing by year-end. The second phase of CAR, addressing the seasonal auction design and resource capacity accreditation reforms (CAR-SA), is now underway with discussions continuing through 2026 and a FERC filing in December 2026. ISO-NE is continuing to evaluate market design and operational tool changes to enhance its ability to address greater operational uncertainties stemming from an increasingly weather-dependent resource mix (see memo reviewed at March 2025 MC meeting). ISO-NE is assessing a combination of new probabilistic forecasts and improvements to the co-optimized energy and reserve markets, including a longer response time (60- or 90-minute) real-time reserve product also with dynamically determined demand quantities. ISO-NE agreed to requests from the New England states and transmission owners (TOs) to take on the role of Asset Condition Reviewer subject to certain conditions, chief among which that ISO-NE’s role is purely advisory and will not include prudence reviews or otherwise perform a regulatory function over these transmission projects.

The Assembly Energy Committee will hold a hearing this week (10/23) about interconnection of large loads in New York and consumer protections for residential ratepayers from increased energy costs associated with the integration of new large energy users. The hearing notice acknowledges the EIA’s “Annual Energy Outlook” and the NYISO’s “Power Trends” reports regarding rising electricity consumption, leading to higher utility bills in the coming years.

New York Governor Kathy Hochul (D) recently announced the next phase of funding allocations from the state’s $1 billion Sustainable Future Program. The Sustainable Future Program was first announced during the January 2025 State of the State address. This next phase allocates funding to the following:

EmPower+ program ($50 million) – Providing low- and moderate-income residents free home energy audits;

School decarbonization ($50 million) – Assisting under-resourced public schools in decarbonizing building footprints;

Thermal Energy Networks ($200 million) – Supporting municipal and state-owned buildings pursuing thermal network projects, with specific funding allocated to the State University of New York (SUNY) at Purchase ($50 million); SUNY Buffalo ($68 million); and SUNY Stony Brook ($22 million);

Green Small Buildings Program ($150 million) – Funding the launch of the new program to provide assistance to eligible homeowners for energy upgrades (such as heat pumps) administered by New York State Homes and Community Renewal;

Zero-emission school bus purchases and supporting infrastructure ($100 million) – Providing funds for the purchase zero-emission school buses and supporting infrastructure (e.g., electric chargers);

Medium- and heavy-duty vehicle charging infrastructure ($50 million) – Providing funds to depot fleets, distribution centers and ports, for electric charging infrastructure for medium- and heavy-duty vehicles;

EV charging station rebates ($50 million) – Providing rebates to workplaces, multifamily buildings, and large public sector organizations, for installation of EV charging infrastructure; and

Accelerating Renewable Energy Projects ($200 million) – Providing the New York Power Authority with funds to finance renewable energy generation projects.

ERCOT Energy Summary

While cooling load was still present in Texas last week, temperatures came off a few degrees during the week before a cold front arrived over the weekend. We saw Austin get to 92F on October 15th before dropping to 87F on the 16th but rebounding to 96 on the 18th. Dallas didn’t get above 88F through October 17th before dropping to 72F by the 19th. Houston and San Antonio were in the upper 80’s. 15-16 GW by 10/16. Wind generation, on a flat average, started off the week strong at 11 GW and rose to 18 GW by 10/18. Last week, solar on a flat capacity was weaker due to clouds and storm front. It ranged from a high of 9.7 GW on 10/16 before dropping to 6.9 on Saturday (18th).

After weeks and weeks of unseasonal warmth, dare I say it, the upcoming pattern features some below normal temperatures. A cold front will cross the state over the next 24 hours, bringing milder conditions to Dallas, while Houston and San Antonio will reach the low 90s today ahead of the front. Temperatures will remain above normal into early next week, but it looks like highs in the 90s will become more difficult to achieve. Another cold front next week will bring normal or even below-normal temperatures for the second half of the week. The 11–15 day outlook features a cooler East and a warmer West, with Texas positioned near normal along the pivot point.

ERCOT Forward Prices:

The forward calendar strips week over week and month over month basis were the following:

Source: ERCOT

ERCOT Real Time Prices

Wind and Solar Output

Source: ERCOT

Real time prices stayed under ~$100/MWh again last week as load was moderate, but temperatures in the upper 80’s to low 90’s is generating cooling load.

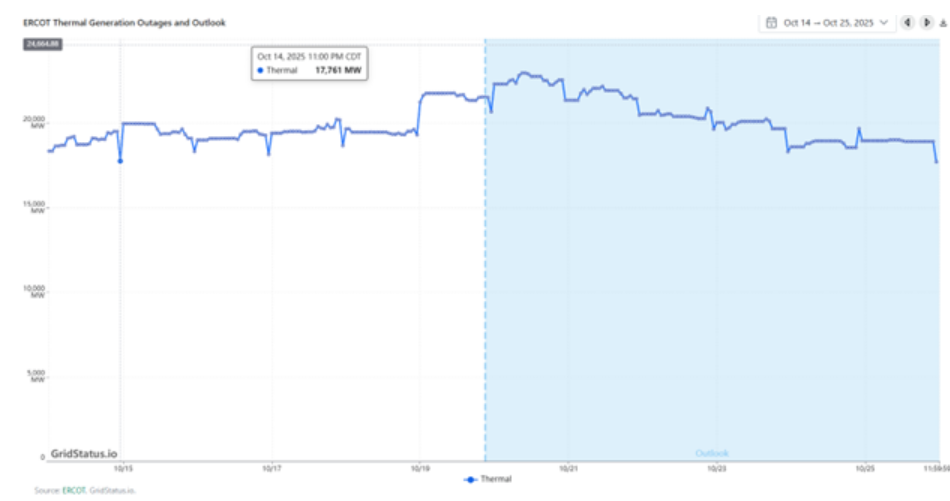

Generation outages are less than 20 GW.

Recent Solar, Wind and Battery Milestones:

Batteries reached a new maximum storage discharge of 8,628 MW on October 10th at 6:35 pm and up from 7,676 MW September 11th. This is the 4th new battery storage record in September. Solar hit a new output record of 29,833 MW on September 9th and its first new since July 29th.

Wind peaked at 28,470 MW on March 3rd. The combined renewables record was set last week on June 21st at 12:55 CT with 47,040 MW vs load of 73,320 MW or 64% of ERCOT load.

Generator Outages:

Outage season is in full swing in ERCOT with thermal (gas, coal, nuclear & hydro) units holding steady around 20 GW. Outage season will likely continue into late November as ERCOT units need to be inspected by ERCOT officials for winter readiness.

Source: ERCOT & Grid Status

TX Legislature, PUCT & ERCOT News:

Texas Energy Fund (TEF) Update

On 10/14, Governor Greg Abbott announced the fourth Texas Energy Fund (TEF) loan agreement for a 460 MW power plant in Fairfield, Texas. Calpine estimates the Pine Oak Creek Energy Center in Freestone County to begin generating power before summer 2026. Under the loan agreement, total project costs are estimated to be $464 million. The Public Utility Commission is providing a 20-year TEF loan of $278.3 million, or 60% of the total project cost, at a 3% interest rate. The loan term runs from 10/27/26 through 12/31/45. The facility is under construction adjacent to Calpine's Freestone Energy Center in Freestone County. The project will interconnect in the ERCOT North Load Zone, which includes the Dallas-Fort Worth metroplex.

Per Calpine:

The Freestone Energy Center is a natural gas-fired combined-cycle facility located on approximately 506 acres near Fairfield, Texas. The facility was Calpine’s first to be built in the northern part of the Texas Regional Entity market area. The Freestone Energy Center consists of four combustion turbines, four heat recovery steam generators and two steam turbine generators, configured in two largely independent power blocks.

In February 2023, Calpine commenced development efforts for Pin Oak Creek Energy Center, a new ~425 MW peaking facility adjacent to Freestone Energy Center in Freestone County, Texas. These development efforts are warranted in light of the Public Utility Commission’s recent adoption of a framework for implementing a Performance Credit Mechanism (PCM) designed to incentivize new generation.

Other TEF Projects:

There are currently 13 applications undergoing due diligence in the TEF In-ERCOT Loan Program, representing a potential 7,211 MW of proposed dispatchable generation capacity.

ERCOT Explores New Options for its Reliability Must-Run Process

On October 17th ERCOT held a workshop to consider changes to its Reliability Must-Run (RMR) Process. What has prompted this review was the extensive and at times challenging process of procuring RMR for the CPS Braunig units, which began in March of 2024 (Brauning retirement).

Source: ERCOT

ERCOT has proposed changing the minimum notification requirement from 150 days to either of two options. For the first option, there would be two deadlines per year (e.g., January and July of each year) with an NSO notice of at least 15-21 months in advance. In the second option, the NSO could be submitted anytime throughout the year but at least 18 months (i.e. 547 calendar days) in advance. In addition, ERCOT also suggested it might seek from plant owners potential retirement plans annually for units over a certain age by issuing a set of RFI questions.

CAISO, Desert Southwest and Pacific Northwest Energy Summary

Forecast changes to start the week were mixed - cooler later this weekend into early next week across the interior West and Rockies while California and the Southwest trended warmer towards the middle of next week. An active storm track will begin to take shape into NorCal and the Pacific Northwest later this week with notable rain and mountain snow for higher elevations. Temperatures look mostly seasonable to start the week before a brief surge in warmth will be seen across the PNW and interior West for the balance of the week before cooler than normal temperatures arrive later this weekend into early next week. Looking out about 10 days, it appears that summer will return for a brief period across parts of SoCal with highs across the LA Basin in the upper 80s. The recent solar generation conditions look to continue as output should remain high across SoCal until clouds drift into the region late this week and into the weekend. Since July 1, Los Angeles has seen more rain than normal, bolstered by 1.38 inches of precipitation last Tuesday, according to the National Weather Service (NWS). The area around Lake Tahoe and the Truckee River in the Sierra Nevada mountains got nearly 3 inches of snow in some places.

Shifting gears to the CAISO power market and day-ahead index price settlements, the steady stream of solar generation midday and the low load profiles meant NP15 prices fell from the recent comfort zone of $40ish per MWh for the peak periods to the upper-$20s during the weekend peak hours. Prices in SP15 settled in the $15 - $20 MWh range dragged lower by negatively priced hours in the height of the solar window (HE10-17). As soon as the weekdays rolled around again, prices were into the $40s in the north while buyers in the south are seeing about a $10 discount to those numbers. Notably, the weekend package gas strip at the SoCal border crashed down to $1.28 MMBtu while the city gate only managed to print a $2.24 number reflecting the weak demand on the grid. For the next few weeks the grid will remain highly sensitive to the sudden arrival of any cooler temperatures as two nuclear plants are offline for refueling maintenance (the Diablo Canyon Unit 2 and Palo Verde Unit 3).

The NOAA’s latest seasonal precipitation outlook for the months of November, December, and January can be found here. As of the October 16 version, it presents a reality that is challenging for the West’s hydro year which is now all of three weeks old. The current weak La Niña weather pattern looks to persist for the better part of winter 2025-26 and the precipitation outlook is typical for the conditions. It is mainly a signpost for risk to the California water outlook and more bad news for the Colorado River basin which could see a continuation of historic drought conditions. For California, it could break poorly since water flows in the Southwest are a key component of California’s water supply; or it could break well if the Sierra mountains see a strong snowpack develop. The forecast gives an equal to above average outlook for the state of California itself in the months pictured. For the Pacific Northwest, however, it could be a sign of good news and a break from the run of recent dry years.

Get Started with UEC Today

Ready to take control of your energy costs? Contact us at info@uecnow.com or (201) 820-8565 for a free consultation. Visit our website at uecnow.com to learn more about how we can tailor our services to your needs.

Thank you for reading! Stay tuned for more tips and updates in our next edition.

United Energy Consultants LLC

190 Great Hills Drive, South Orange, NJ 07079

Website: uecnow.com

Email: info@uecnow.com

Phone: (201) 820-8565