Energy Market Update

Weekly Energy Industry Summary

Commodity Fundamentals

Week of July 7, 2025

By The Numbers:

NG '25 prompt-month NYMEX natural gas settled at $3.41 per MMbtu, unchanged on Monday, July 7.

NG '25 prompt-month NYMEX natural gas settled at $3.46 per MMbtu, down $.29/MMbtu, one week ago.

WTI '25 prompt-month crude oil settled at $67.57 per barrel, up $.57 per barrel on Monday, July 7.

WTI '25 prompt-month crude oil settled at $65.11 per barrel, down $.41 per barrel on Monday, one week ago.

Natural Gas Fundamentals - Neutral

Prompt NYMEX natural gas settled at $3.41 per MMbtu, flat and unchanged, on Monday, July 7.

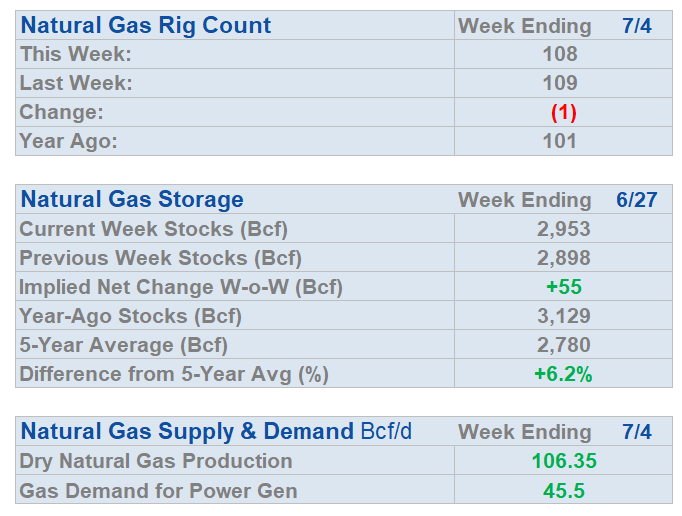

Natural gas production is rising modestly and has added 1 Bcf per day so far this month over the prior three-month average.

Month to date production averaged 105.9 Bcf per day vs. 101.9 Bcf per day for the same period last year.

Month-to-date power generation demand averaged 45.7 Bcf per day vs. 48.4 Bcf per day for the same period last year.

Month-to-date res/com demand averaged 7.0 Bcf per day vs. 7.4 Bcf per day for the same period last year.

Month-to-date LNG exports averaged 15.5 Bcf per day vs. 12.1 Bcf per day for the same period last year.

Year-to-date exports to Mexico averaged 6.4 Bcf per day vs. 6.2 Bcf per day for the same period last year.

The weather pattern is more moderate in the midcontinent.

Production is increasing modestly.

LNG exports are up year-over-year.

Crude Oil - Neutral

NYMEX (WTI) prompt-month-crude settled at $67.57 per barrel, up $.57/bbl on Monday, July 7.

NYMEX (WTI) prompt-month crude settled at $65.11, down $.41 per barrel a week ago.

Thus far, the ceasefire between Iran and Israel continues to hold.

OPEC is boosting production, 548,000 barrels per day for August.

OPEC's production announcement exceeded the 411,000 barrel per day increases the previous three months.

Some oil analysts are signaling bearishness in the nearer term as production increases continue.

A level of uncertainty remains relative to tariffs in the near term.

Economy - Neutral

The Big Beautiful Bill (BBB) is now law.

Japan will keep trying to strike a trade deal with the U.S. that benefits both sides, Prime Minister Shigeru Ishiba and his ministers said.

The European Union is scrambling to secure a trade deal with the U.S., The Wall Street Journal reports.

A trade deal was struck last week with Vietnam -- seeking to stop Chinese-made goods from transiting through the Southeast Asian country to avoid higher duties.

Fed officials have cited a solid labor market in justifying a wait-and-see stance on interest rates.

Inflation expectations drift back to "pre-tariff" levels, a survey by the New York Fed shows.

Trump announces steep tariffs on 14 countries by August 1 included Japan and South Korea.

U.S. payrolls increased by 147,000 in June, more than expected.

Amazon deploys its 1 millionth robot in a sign of more job automation.

Weather - Neutral

The 16-30 day outlook features the main heat source in the west with occasional ridging in the east. This results in a milder temperature pattern over the mid-continent.

It's still going to be summer, but July will not be as hot as the past several years.

The tropics are expected to be very active this season. This could act to tamp temperatures down in the Gulf Coast and Southeast as rain tends to drive temperatures to the downside.

Weekly Natural Gas Report

Inventories of natural gas in underground storage for the week ending June 27 are 2,953 Bcf; an injection of 55 Bcf was reported for the week ending June 27.

Gas inventories are 173 Bcf above the five-year average and 176 Bcf less than the same time last year.

Values reflect week ending July 4, 2025.

Prices reflect week ending July 4, 2025.

Weekly Power Report:

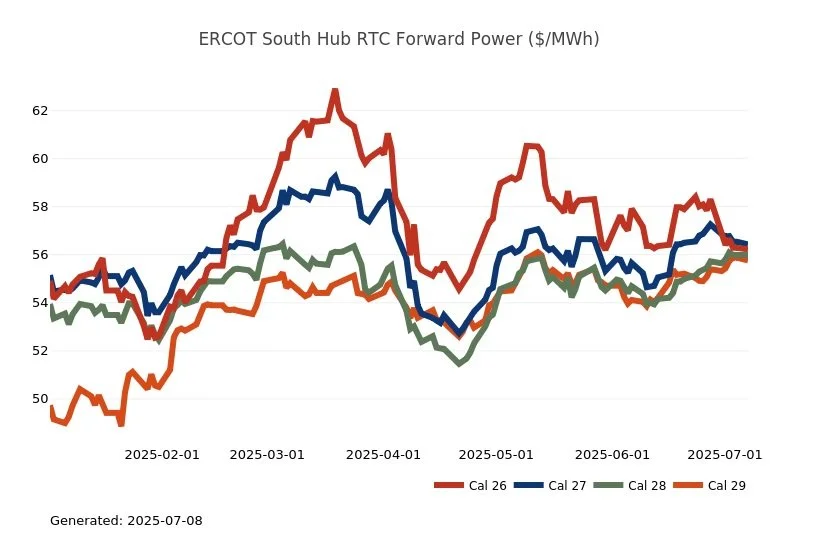

Mid-Atlantic Electric Summary

The Mid-Atlantic Region’s forward power prices were slightly lower on the front of the price curve and unchanged on the back, over the past week. US natural gas futures extended their downside move, Monday, gapping lower below last week’s low of $3.293/MMBtu before finding temporary support at 3.275/MMBtu. The early weakness reflects weekend weather models that shifted away from the high-heat projections bulls needed to sustain momentum, extending bearish sentiment after last week’s 8.8% drop on cooling forecasts. Market expectations for consistent East Coast temperatures in the 80s-100s have turned toward a mix of showers and 70s-80s, undercutting peak summer demand in key urban corridors that typically drive July natural gas consumption. Power futures were 1-2% lower last week for the 2026-2027 terms, while the 2028-2030 strips were unchanged. The final, day-ahead settlement price in West Hub for June averaged $46.29/MWh which is 32% higher than May’s final average and 49% higher than June’s average last year in 2024.

PJM Responds to Governor’s Letter on FERC Order 1920 - PJM responded to a joint letter sent in May by five Governors (IL, MD, NJ, DE, MI) regarding FERC Order 1920, which sought to improve long-term regional transmission planning and cost allocation by, among other things, requiring transmission providers to include 20-year time frames in planning processes. The governors expressed concern that PJM’s proposed compliance proposal does not adequately address reliability, affordability, and state energy policies. In its response, PJM defends is proposal to divide transmission needs into “Core” and “Additional” to distinguish the minimum set of system needs for maintaining grid reliability. PJM explained that the proposal reflects that several states have objected to being charged for transmission that is designed to exclusively support another state’s policy choices. However, PJM explained that 'Core Needs' and their associated projects ultimately would form part of a broader final plan that also includes state-prioritized initiatives.

Great Lakes Electric Summary

The Great Lakes Region’s forward power prices were slightly lower on the front of the price curve and unchanged on the back, over the past week. US natural gas futures extended their downside move, Monday, gapping lower below last week’s low of $3.293/MMBtu before finding temporary support at 3.275/MMBtu. The early weakness reflects weekend weather models that shifted away from the high-heat projections bulls needed to sustain momentum, extending bearish sentiment after last week’s 8.8% drop on cooling forecasts. The current models show the main heat ridge over the western United States with a secondary ridge near the East Coast. This keeps the strongest heat in the West and occasionally along the East Coast, with a wetter and closer to normal pattern over the Mid-continent. Power futures were -3% lower for the 2026 term, -1% lower for 2027 and unchanged for the 2028-2030 strips last week. The final, day-ahead settlement price in COMED for June averaged $40.19/MWh or was 36% higher than May’s final average, while in AdHub that average was $43.83/MWh which was 34% higher than the previous month. In Michigan, the final day-ahead settlement average price was 46.35/MWh or was 34% higher than last month, while Ameren averaged $43.11/MWh and was also 34% higher than the previous month of May.

ComEd Files Large Load Tariffs - On 6/23, ComEd filed with the Illinois Commerce Commission (ICC) revisions to its General Terms and Conditions and Rider DE (distribution system extensions) to add new interconnection and service requirements for large load customers, defined as those requesting extension of service or new service of 50 MW or more. The revisions include requiring larger deposits, including a new requirement for deposits for long lead equipment in some cases, formalizing rules allowing ComEd to cluster interconnection studies, and execution of a FERC-jurisdictional Transmission Security Agreement (TSA) to guarantee minimum annual transmission payments for 10 years, based on projected load. If actual payments fall short, the difference will be recovered and credited to other customers. The proposed tariff revisions also authorize ComEd to prioritize large load projects if they have been certified as priority by the Illinois Department of Commerce and Economic Development. ComEd asks that its tariff changes be allowed to go into effect on 8/7. The ICC has 45 days to suspend the tariff for review or the changes automatically go into effect.

Northeast Energy Summary

ISO New England has announced the retirement of President and CEO Gordon van Welie, effective 1/1/26, after a 25-year career with the ISO. Dr. Vamsi Chadalavada, Executive Vice President and Chief Operating Officer, will succeed Gordon to become the ISO's next President and CEO. During his tenure as CEO, Van Welie led a variety of strategic initiatives to maintain system reliability and competitive wholesale electricity markets during significant shifts in the region’s policies, generation sources, and technologies. In the last few years, under his leadership, ISO has implemented new Region Energy Shortage Threshold and Probabilistic Energy Adequacy tools, the Day-Ahead Ancillary Services Market, and Longer-Term Transmission Planning for regional projects. Chadalavada joined the ISO in 2004 and has held the position as COO since 2008. Chadalavada will take over as CEO in the new year and lead the ISO through implementation of reforms that transform the region’s capacity market to a prompt, seasonal design with resource accreditation.

On 6/30, The National Association of Regulatory Utility Commissioners (NARUC), in collaboration with the National Association of State Energy Officials (NASEO), published a report titled Developing State Advanced Nuclear Energy Strategic Frameworks: Guidance for State Energy Offices and Public Utility Commissions. The report aims to assist public utility commissions and State Energy Offices in leading and contributing to the development of strategic frameworks for nuclear energy generation projects within their respective states. The report advises states to follow a series of actionable steps to evaluate and integrate advanced nuclear technologies into their energy plans effectively and emphasizes the importance of collaboration among state energy offices, public utility commissions, and private-sector partners for the successful deployment of advanced nuclear technologies and the enhancement of energy resilience. Moreover, the report identifies several potential funding sources for advanced nuclear projects, including state and federal grants and programs, public-private partnerships, utility investments, research institutions and universities, international funding sources such as the International Atomic Energy Agency (IAEA) and the World Bank, private investors and venture capital, and philanthropic organizations dedicated to clean energy and sustainability. The guidance was developed under the NARUC-NASEO Advanced Nuclear State Collaborative, an initiative supported by the U.S. Department of Energy Office of Nuclear Energy-NARUC Nuclear Energy Partnership and aims to assist states in developing robust frameworks for advanced nuclear energy projects, fostering collaboration, securing funding, and learning from successful partnerships. A public webinar will be held on 7/18, when the report authors will share an overview and key takeaways. Earlier this year, NASEO launched the Advanced Nuclear First Mover Initiative, led by state co-chairs New York, Indiana, Kentucky, Tennessee, and Wyoming, followed by participating states Louisiana, Maryland, Pennsylvania, Utah, Virginia, and West Virginia. These eleven states have committed to accelerating advanced nuclear projects by exploring opportunities to reduce financial and technology risks, devising supportive market adoption policies, defining supply chain needs, streamlining federal permitting, developing coordinated procurement options, exploring state-federal-private financing structures, and creating public-private partnerships.

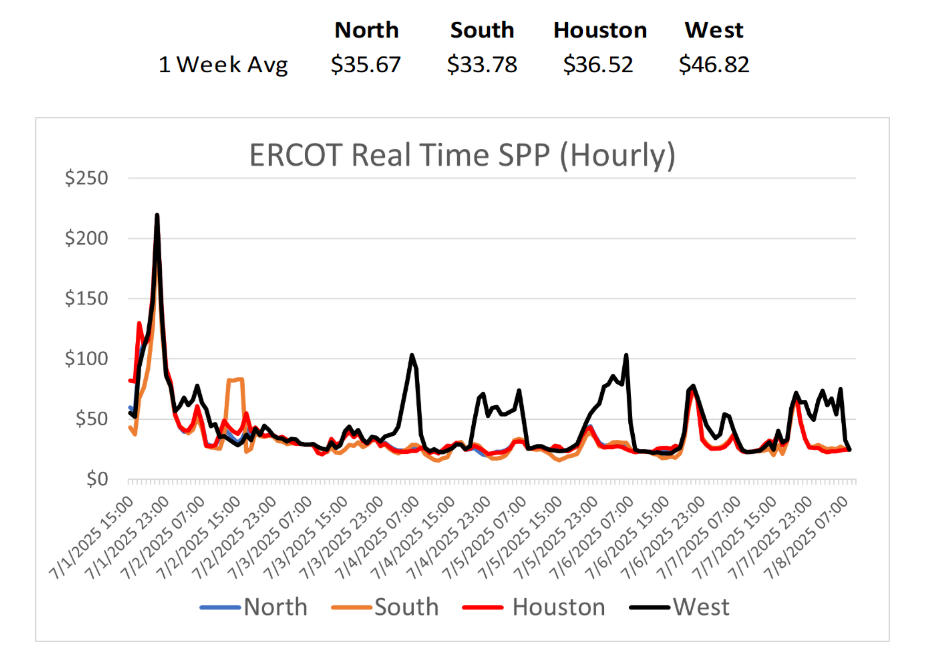

ERCOT Energy Summary

The storms last week dampened temperatures across Texas, with daytime highs only getting into the low 90’s and overnight lows in the mid 70’s. Wind was moderate at under 10 GW last week but low temperatures kept demand in check. Solar output was consistent all week.

To understand the weather pattern that brought heavy rain and devasting flooding to Texas this past holiday weekend, see the map below.

A dual ridge pattern has set up over North America (see two above average temperature areas in orange that border each), with one over the West and another off the East Coast. This produces a trough over the Mid-Continent where storm activity is increased. The eastern ridge is pumping tropical moisture into Texas, and storm activity is feeding on this, producing heavy rainfall events and lower-than-normal daytime temperatures. A long as this pattern persists, long periods of extreme heat in Texas are less likely with elevated chances for heavy rain events.

Source: Storm Vista

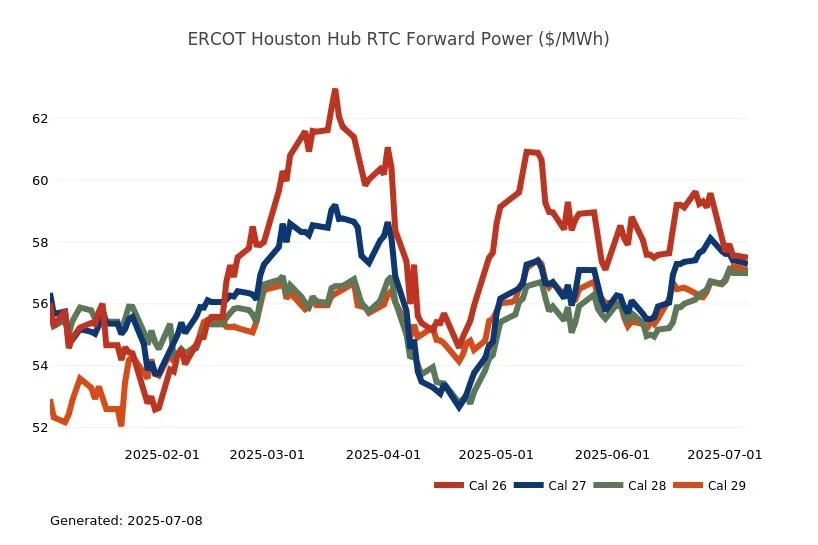

ERCOT Forward Prices

The forward calendar strips week over week and month over month basis were the following:

Source: ERCOT

ERCOT Real Time Prices

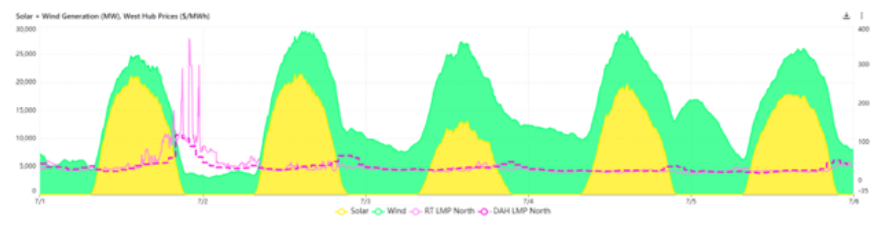

Wind and Solar Output

The only day last week that saw volatility in pricing was on July 1st when solar output was strong during the day but wind was its weakest all week and then only a few GW (~4 GW) at sunset in the early evening hours which contributed to volatility with real time prices getting to $300/MWh in 5 min interval pricing. Wind output was stronger the rest of the week and prices remained in check.

Recent Solar, Wind and Battery Milestones:

Combined renewables record was set the week of June 21st at 12:55 CT with 47,040 MW vs load of 73,320 MW or 64% of ERCOT load.

Solar reached a record of 27,036 MW on May 12th while wind peaked at 28,470 MW on March 3rd. Batteries reached maximum discharge of 5,970 MW on April 10th.

Generator Outages:

Thermal outages were above 9 GW last week and should continue to decline as we head into late July. The back half of July through the first half of August is usually the warmest period for summers in Texas.

https://www.gridstatus.io/graph/ercot-outages?iso=ercot&outageType=thermal

Source: ERCOT & Grid Status

Washington DC Update: One Big Beautiful Bill Signed by President Trump

The House and Senate both pulled separate all-night sessions to each pass the final version of President Trump’s reconciliation bill, the One Big Beautiful Bill (OBBB) by the Presidents self-imposed deadline of July 4th. The House passed the measure by 218-214 and the Senate by 51-50.

The OBBB will pare back some of the clean energy credits for wind and solar generation in the Inflation Reduction Act (IRA). President Trump commented when signing the OBBB, “China is right now building 68 coal-generating plants, and we’re putting up wind,” Trump said. “Wind – it doesn’t work, I’ll tell you.”

Here is an overview of the clean energy credits:

Credit 45 Y/48 E (Renewables) –

For wind and solar projects, they must begin construction within 12 months of enactment or be placed in service by the end of 2027 to qualify for the credit

Retains transferability

The punitive excise tax that was in the Senate Finance Committee draft was dropped – this would have placed a 30% excise tax on any wind/solar project that is placed in service post 12/31/27 if it contained any materials or material assistance from FEOC countries.

Electric Vehicles (EVs)

Terminates tax credits for electric vehicles on 9/30 and EV charging infrastructure in June 2026

Texas Supreme Court Update:

The Texas Supreme Court on June 27th issued a decision regarding claims over February 2021’s Winter Storm Uri damage. Businesses and individuals had sued utilities claiming they were negligent in causing widespread outages and blackouts. The Texas high court ruled that the “plaintiffs did not provide enough evidence to show Oncor, CenterPoint Energy and AEP Texas were “purposely negligent” or caused a nuisance when they were ordered to cut power as ERCOT struggled to meet overwhelming demand following Winter Storm Uri” Writing for the court’s unanimous decision, Justice Debra Lehrmann dismissed the claims of intentional nuisance, saying the plaintiffs did not allege sufficient facts to survive a motion to dismiss. She held that the plaintiffs, “as a matter of law, cannot allege” that the utilities “created” or “maintained” a nuisance.

Source: RTO Insider

Texas Energy Fund Update:

TEF Completion Bonus Prioritization Proposal - On 7/1, the Texas Energy Fund (TEF) administrator submitted a filing to the Public Utility Commission of Texas (PUCT), presenting commissioners with a proposal to prioritize applications within the TEF completion bonus program. The program has received 11 applications representing 3,502 MW, and staff anticipate increasing interest and participation. The proposal suggests prioritizing speed to market by only reviewing applications within one year of the proposed commercial operations date (COD). This approach aims to allocate resources to projects that can be constructed and energized earliest. Projects with later dates will remain eligible within the program pool but future awards will depend on fund availability. If two eligible applications have the same interconnection month, priority will be given to the application with the larger nameplate capacity. In the case of applications of equal size, priority will be given to the facility located in a load zone not already represented within the program. Any project considered for possible award will not be presented to the PUCT for Notice of Eligibility approval until the project is within six months of the stated COD. It is anticipated that the commission may decide on the staff’s proposal at the next scheduled open meeting on 7/10.

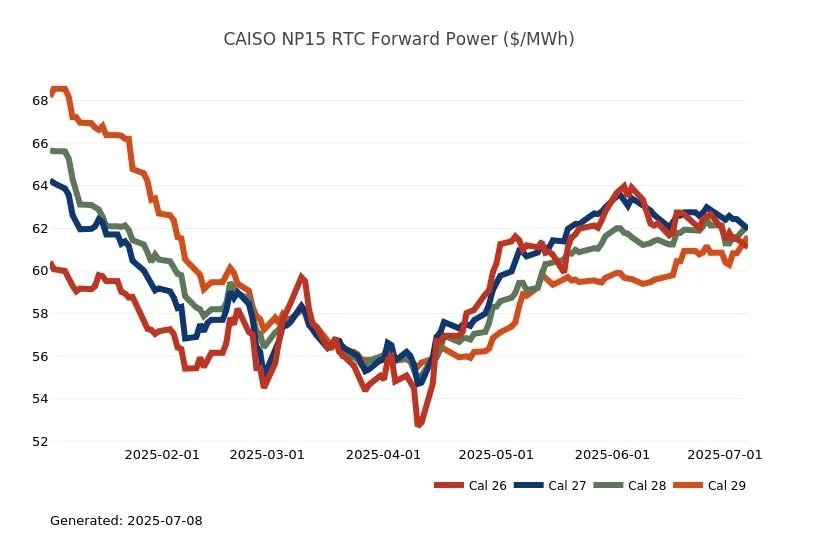

CAISO, Desert Southwest and Pacific Northwest Energy Summary

A ridge builds over the West today, effectively suppressing the monsoon and leading to hotter than normal conditions. Current forecasts are calling for heat to escalate over the next 72 hours with Thursday showing NorCal tapping triple digit highs in Sacramento while the LA Basin has Burbank sitting at 960 on Wednesday. We’re in that time of the year when a big gradient opens up between coastal and inland areas, we could easily see a 200 spread given the Burbank temperature noted while LAX only peaks out in the upper 70s. Phoenix is looking to hit the 110s from today to Thursday, peaking at 115° on Weds, a high print that would be just one degree shy of the daily record (116° set last year). Daily record warm lows are in the forecast across the western region. Further north, Las Vegas looks to reach the mid and upper-100s in each of the next 10 days, while Salt Lake City peaks in the upper 90s Tuesday-Wednesday and maybe even warmer next week. This may only be the beginning as several weather gurus are of the opinion that the back half of July is going to be consistently hot in the Golden State and continue to favor the main heat ridge centered over the interior West and Pacific Northwest.

While the heat coming into the forecast will put upward pressure on city gate cash basis and balance of the month prices, at least the long weekend passed without any operational flow order (OFO) notices tied to PG&E or in SoCalGas land even as it is now into its second week of dealing with the long-term maintenance work. The bias for the bigger picture natural gas landscape is maintenance will exert upward pressure on prices especially if heat locks in for the second half of July and August. As noted previously, the maintenance plan is set to run out through late 2026 and is significant for its length more so than the severity of the cuts to throughput capacity. In terms of day-to-day balancing, the operators will only really miss this capacity in the tight days of winter. But the long-term cumulative effect on storage should also spark concern. In late June, SoCalGas also announced maintenance for the Topock Sub Zone. This is expected to wrap up at the end of October 2025 and will often force them to draw molecules from storage through this summer. This compounds the bite they will feel from their long-term North Zone maintenance.

On the power front, the demand for natural gas is present across the heavy load block for Monday as both generation hubs cleared a $44 handle. We expect more of the same type of movement, knowing the forecast is going to be getting quite warm along the coast and inland. We need to keep an eye on the PNW given their hydro landscape tightened up over the past couple of weeks and things look rather dry which makes it even tougher on the system operators who must balance fish obligations while making sure they have enough to last deep into the summer months. The CPC released their latest seasonal drought outlook last week looking out through the end of September. That outlook projects further increases in drought across areas of the Northwest, Great Basin, and central California, while improvement is favored in the lower Four Corners, the Midwest, and Florida. The recent increase in dryness/drought and expected further increase in the Northwest bodes poorly for the water supply expectations in the region. The Dalles Dam is currently forecast to have streamflow at 77% of average for the April-September period. This is not far off from last year’s result (74%) and would be just the second time (1987-88 being the first) in records dating back to 1949 with two consecutive years of streamflow under 80% of average.

The CPUC issued decisions recently pertaining to Local Capacity Obligations, Flexible Capacity Obligations, and Refinements of the Resource Adequacy Program that retail suppliers must live to. This decision in the R.23-10-011 matter adopts Local Capacity Requirements for 2026-2028, Flexible Capacity Requirements for 2026, and refines the planning reserve margin lifting it from its current 17% level to an 18% PRM beginning in 2026. Also signed were rules in the section D.25-06-048, Item 22. R.25-02-005 which applies to the RA Market Price Benchmark. This decision implements revisions to the methodology the Commission uses when calculating the RA Market Price Benchmark (MPB) utilized in calculating the Power Charge Indifference Adjustment (PCIA) that all retail customers pay. The Commission is statutorily mandated to ensure that the movement of customers from bundled electric services to unbundled service does not shift costs to customers that remain w/ the utility or those that depart for Community Choice Aggregator or Direct Access service. The first revision adopts a single RA MPB utilizing the time restriction on transaction data currently applicable to the local RA MPBs. The second revision removes affiliate, swap, and duplicative sleeve transactions from the calculation. It is unclear whether this will shift prices significantly enough to move the PCIA charge in a material way.