UEC Insights: June 26, 2025

Market Update

Natural gas prices have dropped sharply this week after a strong run-up earlier in June. Prices have dipped from a high of $4.11 to current prices of $3.52/MMBtu. The market had been reacting to forecasts of extreme heat, but updated weather outlooks have cooled expectations. Even with some recent maintenance, natural gas production has held steady at 105 Bcf per day - keeping supply strong while demand has lagged.

There’s a number of factor at play this week. Early predictions of widespread, intense heat didn’t materialize. Forecasts for early July now show more typical, “normal” summer temperatures in key regions like the Northeast, Midwest, and Texas. In PJM, there’s a good chance that one or both days may be used as part of the five coincident peak days. Monday’s hour 18 had a peak load of 160,157 MW.

Storage continues to build quickly. We’ve had seven straight weeks of large injections, and this week’s number is also expected to be well above average at a build in the mid 80’s. That means we’re moving into the hottest part of summer with more than enough gas in the reserve. Gas inventory is 2,802 Bcf and 6.1% over the 5-year average.

With weather-driven demand falling short, spot and real-time gas prices are under pressure. This is dragging down longer-term prices as well. Currently, Cal 27 & 28 are trading at a discount to Cal 26.

Traders are closely watching the current truce between Israel and Iran. Any shifts in the is quickly changing situation could ramp up volatility in various fuels markets.

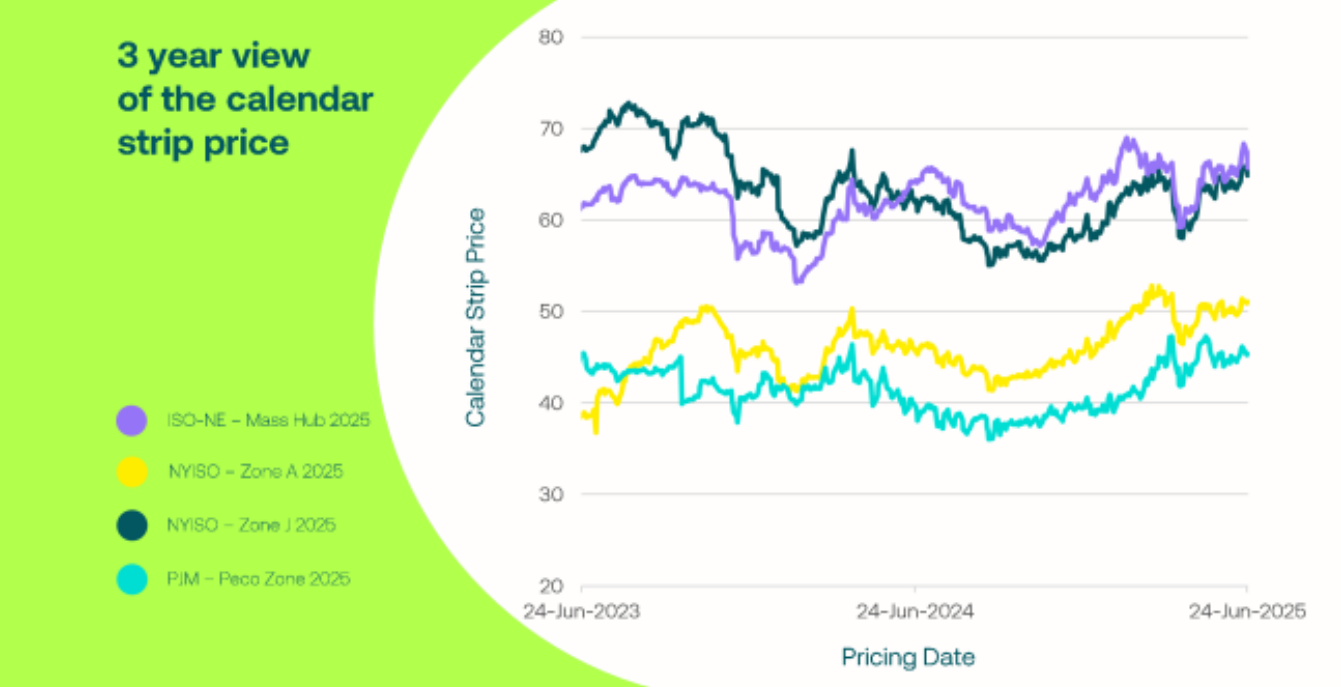

Extreme Heat Pushes Power Demand and Prices Higher Across the Northeast

A scorching heat wave hit the U.S. Northeast and Mid-Atlantic starting June 23, triggering scaring power demand and sharp price increases across key markets.

Grid operators including PJM interconnection, ISO-New England, and the New York ISO issued emergency weather alerts and called on demand response resources to help manage strain on the grid. PJM, which serves parts of 13 states, forecasted power demand to peak above 161,000 MW, with real-time prices spiking as high as $268.89/MWh in the Dominion Zone.

New York also faced soaring temperatures, prompting Governor Kathy Hochul to declare a state of emergency in 32 counties. NYISO reported real-time prices exceeding $200/MWh in most zones, with NYC’s Zone J reaching $267.22/MWh. The state’s demand was expected to approach 30,000 MW, nearing its summer peak forecast of 31,471 MW.

In New England, Boston braced for temperatures above 100°, with ISO-NE projecting demand to exceed 25,000 MW. Mass Hub power prices jumped nearly $36 day-over-day, reaching $189/MWh.

As the heat wave continues, power prices remain elevated, though slight moderation is expected alter in the week. Grid reliability measures remain in place, and businesses with flexible usage are encouraged to participate in demand response programs to support system stability.

PJM Proposes Capacity Market Enhancements in Quadrennial Review

PJM interconnection has outlined its proposed updates to the capacity market as part of its quadrennial review process, aiming to better align with the evolving dynamics of the grid. Presented at a June 16 Market Implementation Committee meeting, focuses on refining the demand curve structure, updating cost of new entry assumptions, and adopting a forward-looking approach to energy and ancillary services (E&AS) revenue offsets.

One key recommendation is using a combined cycle gas unit as the new reference resource for setting the Cost of New Entry. PJM also proposes moving to a forward-looking Net E&AS offset, better reflecting future market conditions instead of relying solely on historical data.

These changes come amid industry-wide pressures such as supply chain delays and rising equipment costs, which have challenged traditional capacity planning assumptions. Despite suggestions from the Brattle Group to adopt more transformative approaches like a Marginal Reliability Impact (MRI) demand curve, PJM opted to retain the current three-point Variable Resource Requirement (VRR) curve structure. The organization emphasized that these sweeping changes fell outside the current scope of review.

As PJM nears the conclusion of this review cycle, stakeholders are closely monitoring the developments. The updates are expected to ensure a more actiev and cost-reflective capacity market, reinforcing investment signals while maintaining system reliability.