Energy Market Update

Weekly Energy Industry Summary

Commodity Fundamentals

Week of October 7, 2024

By The Numbers:

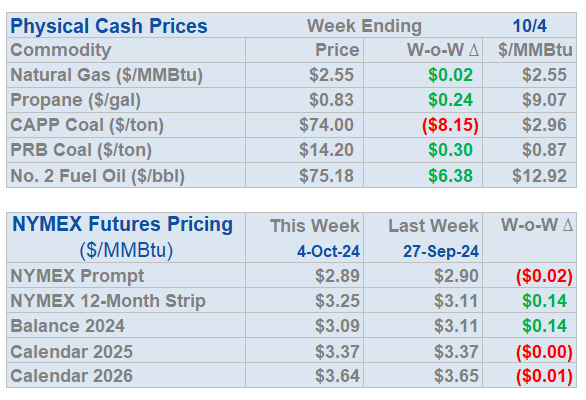

NG '24 prompt-month NYMEX settled at $2.75/MMbtu, down $.11/MMbtu, on Monday, October 7.

WTI '24 prompt-month crude oil settled at $77.14/bbl., up $2.88/bbl., on Monday, October 7.

Natural Gas Fundamentals - Neutral

Prompt-month NYMEX natural gas futures settled at $2.75 per MMbtu, down $.11 per MMbtu on Monday, October 7.

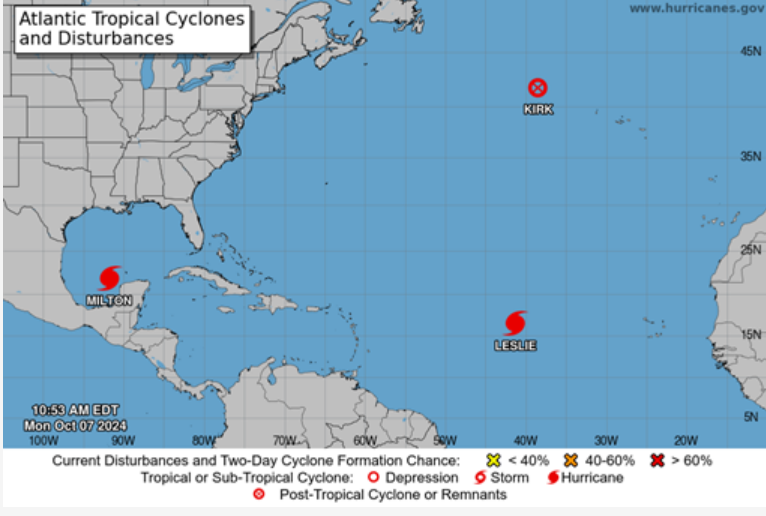

Hurricane Milton is heading toward the central west coast of Florida expected to make landfall early Thursday morning.

The expectation for rain and power outages helped move the prompt-month NYMEX natural gas contract lower.

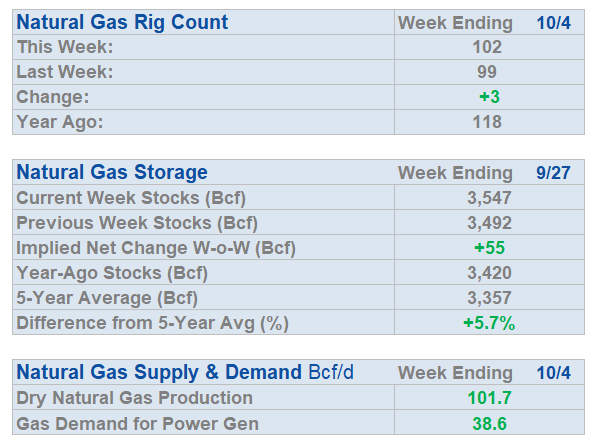

Natural gas production, month-to-date (October), has averaged 101.2 Bcf per day, versus 101.8 Bcf per day for the same period last year.

Electric power generation demand for gas, month-to-date (October), has averaged 38.4 Bcf per day versus 35.3 Bcf per day for the same period last year.

LNG exports month-to-date (October) averaged 12.3 Bcf per day versus 12.8 Bcf per day for the same period last year.

Natural gas exports to Mexico, month-to-date (October), averaged 6.3 Bcf per day versus 6.6 Bcf per day for the same period last year.

Natural gas strip prices, 2025-2029 are; $3.36, $3.67, $3.72, $3.62, and $3.50 per MMbtu respectively.

Crude Oil - Bullish

The events and geopolitical tensions remain in this market providing the potential for upside in crude oil. For this reason, the headline on the market condition of crude oil remains "Bullish" until further notice.

Crude oil is up 10% over the past week as tensions in the Middle East build.

An Israeli response to the Iranian ballistic missile attack is pending with many analysts saying that a key potential target is Iran's oil and gas infrastructure and shipping.

Iranian oil tankers have moved away from its largest export terminal at Kharg Island anticipating a potential Israeli response.

The near-term crude oil market will continue to be driven by events in the Middle East. A substantive attack on Iranian crude assets would be bullish of crude oil.

If a broader response from Israel or a wider attack from Iran or Yemen occurs on Saudi production, that would signal potential for a much higher oil price response.

Economy - Neutral

Payrolls increased by 254,000 in September, considered a strong jobs report.

The U.S. unemployment rate is 4.1%.

Stocks moved up on the jobs report.

The ten-year treasury moved above 4%.

Expectations for another rate cut in October or November are diminished.

Oil prices are up 10% over the past week.

The U.S. economy grew at 3% in the latest quarter.

The dock workers strike has been delayed.

The U.S. government is running a $1.9 trillion deficit so far in fiscal year 2024.

Interest payments on the national debt will top $1 trillion this year, the highest in history.

Weather - Neutral/Bullish

All eyes are on Hurricane Milton. The powerful storm is set to make landfall on the central west coast of Florida early Thursday morning.

A cold front will move into the Midwest and Northeast next week bringing with it the first real heating demand of the season.

The cold front will give way at the tail end of the 11-15 day period ushering in a warm up in the Midwest and Northeast.

Weekly Natural Gas Report:

Inventories of natural gas in underground storage for the week ending September 27, 2024 are 3,547 Bcf; an injection of 55 Bcf was reported for the week ending September 27, 2024.

Gas inventories are 190 Bcf greater than the five-year average and 127 Bcf greater than the same time last year.

Values reflect week ending Oct. 4, 2024

Prices reflect week ending Oct. 4, 2024

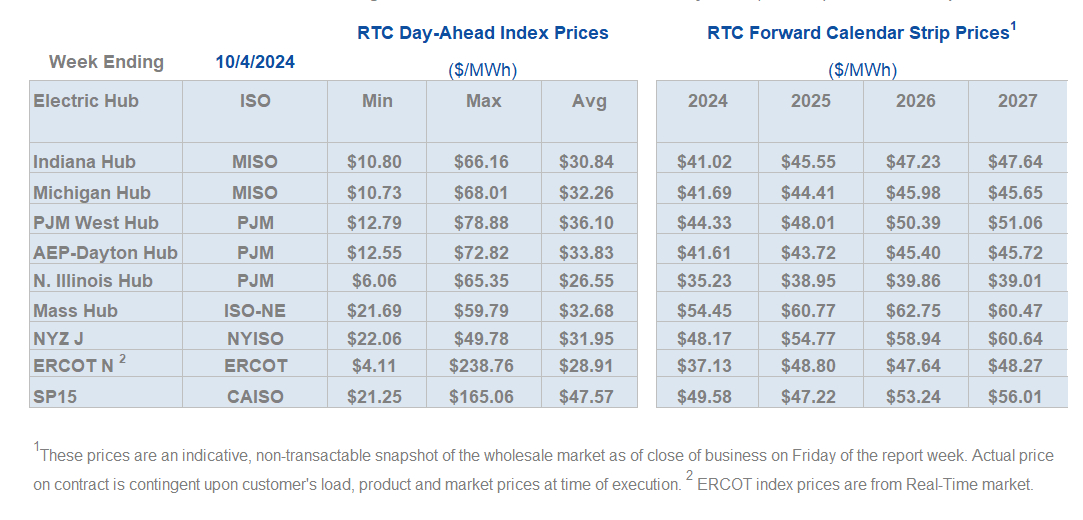

Weekly Power Report:

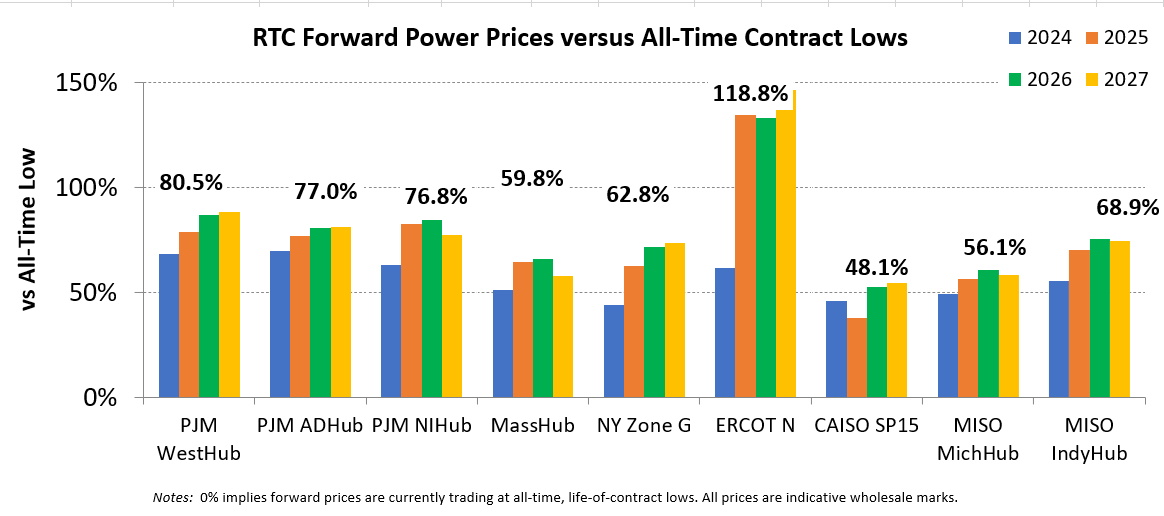

Prices reflect week ending Oct. 4, 2024

Prices reflect week ending Oct. 4, 2024

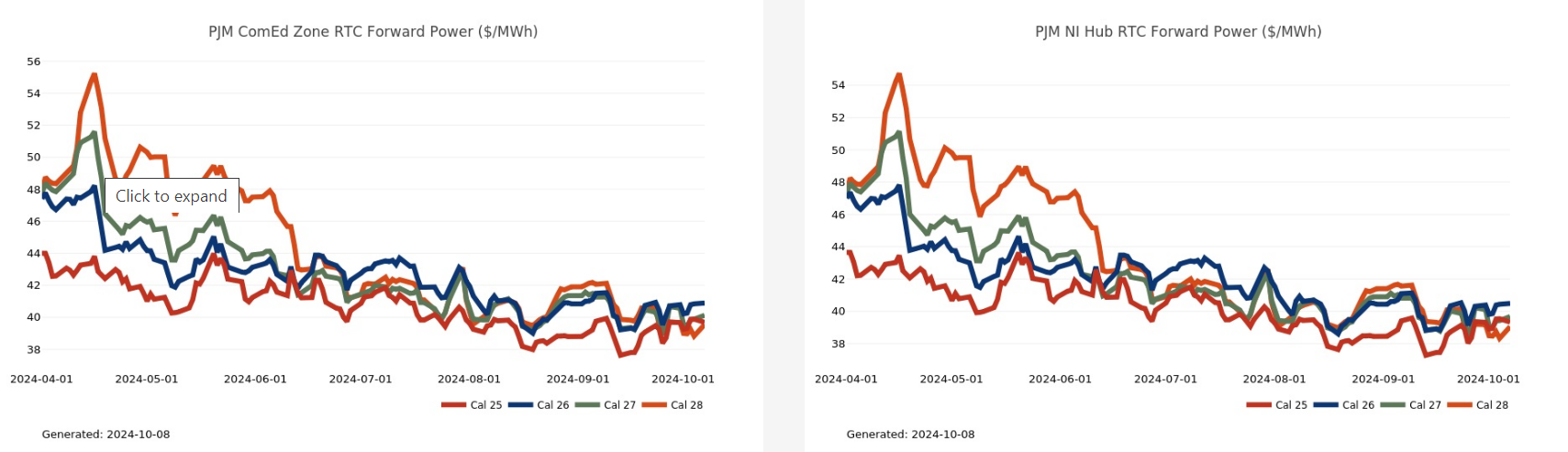

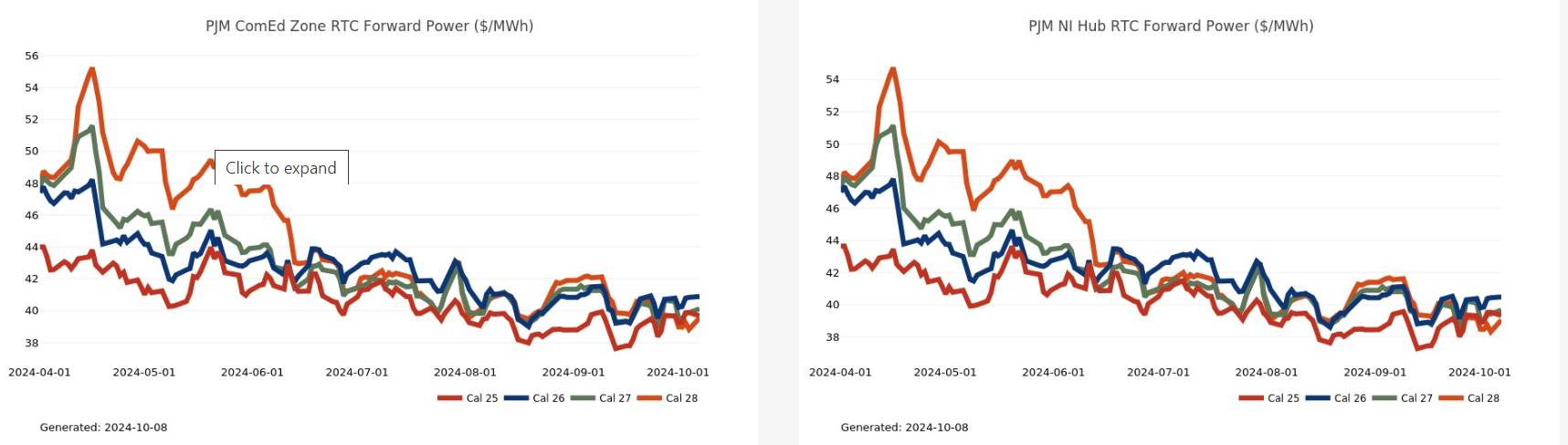

Mid-Atlantic Electric Summary

The Mid-Atlantic Region’s forward power prices were lower once again over the past week as natural gas prices tailed-off at the end of last week. The November Nymex natural gas futures declined significantly as Hurricane Milton intensified over the weekend, posing serious risks to Florida’s Gulf Coast. The market continues to weigh the mild fall weather and lower cooling demand against falling production and another destructive storm in the Gulf of Mexico this week. While still a major hurricane, Milton did weaken overnight with the storm going through an eyewall replacement cycle. The path forward will be more toward the Northeast and Milton will regain some strength today as it moves through a favorable environment and grows in size. Future power prices were -1% lower over the past week in the Mid-Atlantic, with the near-term 2025-2026 strips unchanged and the 2027-2029 strips 2% higher. Month-to-date day-ahead index prices in West Hub for October are averaging $35.47/MWh, which is 15% higher than September’s final settlement price average of $30.93/MWh.

OPSI Call for PJM Action Prior to 2026/27 Capacity Auction - On 9/27, the Organization of PJM States, Inc. (OPSI) sent a letter to the PJM Board of Managers voicing concerns over the 2025/26 Base Residual Auction (BRA) results and calling for action prior to the 2026/27 BRA scheduled to commence in December. OPSI cited the IMM’s report concluding that recent auction results “were significantly affected by flawed market design decisions” as well as “the exercise of market power” and thus “do not solely reflect supply and demand fundamentals,” and expressed concerns around the maximum capacity price for the 2026/27. OPSI notes its support for PJM working with the IMM to look further into resources that did not offer but expresses concern that these actions may not impact the 2026/27 BRA. OPSI recommends that the PJM Board direct its staff to act prior to the 2026/27 BRA and outlined six priorities with specific timeframes for action.

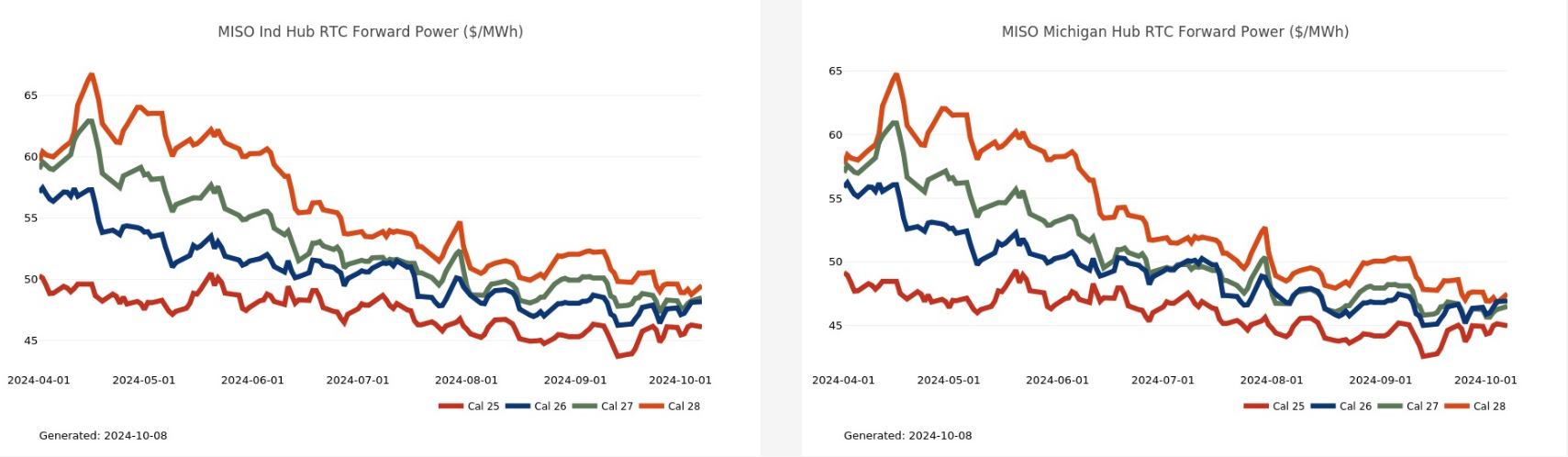

Great Lakes Electric Summary

The Great Lakes Region’s forward power prices were lower once again over the past week as natural gas prices tailed-off at the end of last week. The November Nymex natural gas futures declined significantly as Hurricane Milton intensified over the weekend, posing serious risks to Florida’s Gulf Coast. The market continues to weigh the mild fall weather and lower cooling demand against falling production and another destructive storm in the Gulf of Mexico this week. While still a major hurricane, Milton did weaken overnight with the storm going through an eyewall replacement cycle. The path forward will be more toward the Northeast and Milton will regain some strength today as it moves through a favorable environment and grows in size. Future power prices were -1% lower over the past week in the GLR, with the near-term 2025-2026 strips unchanged and the 2027-2029 strips 2% higher. Month-to-date, day-ahead index prices in ComEd for October are averaging $26.57/MWh, which is only -1% lower than September’s final settlement price average of $26.92/MWh, while the same prices in AdHub are averaging $33.70/MWh or 12% higher than September’s final settlement price average of $30.08/MWh.

OPSI Call for PJM Action Prior to 2026/27 Capacity Auction - On 9/27, the Organization of PJM States, Inc. (OPSI) sent a letter to the PJM Board of Managers voicing concerns over the 2025/26 Base Residual Auction (BRA) results and calling for action prior to the 2026/27 BRA scheduled to commence in December. OPSI cited the IMM’s report concluding that recent auction results “were significantly affected by flawed market design decisions” as well as “the exercise of market power” and thus “do not solely reflect supply and demand fundamentals,” and expressed concerns around the maximum capacity price for the 2026/27. OPSI notes its support for PJM working with the IMM to look further into resources that did not offer but expresses concern that these actions may not impact the 2026/27 BRA. OPSI recommends that the PJM Board direct its staff to act prior to the 2026/27 BRA and outlined six priorities with specific timeframes for action.

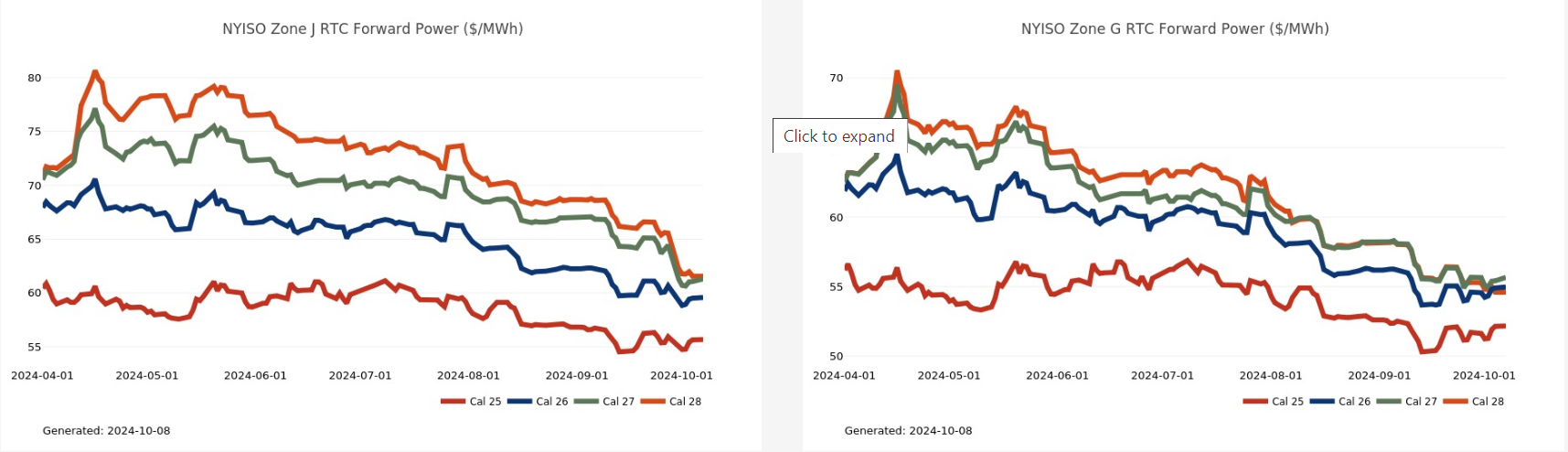

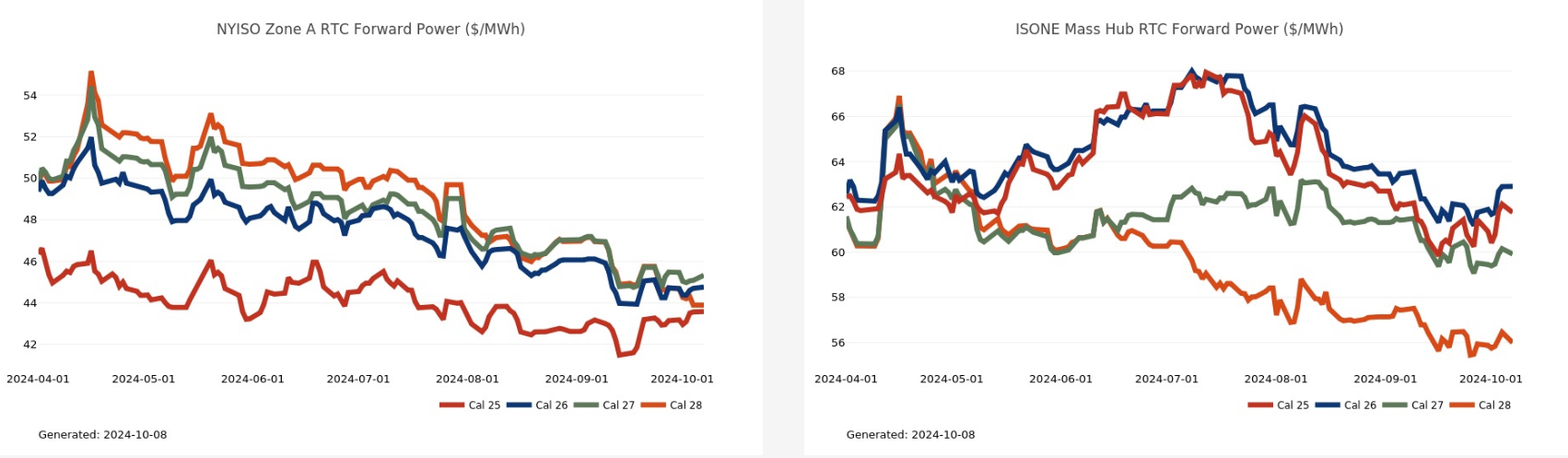

Northeast Energy Summary

A quick review of the summer’s (and September’s) New England day-ahead index settlement show monthly averages quite subdued as low regional natural gas prices and a lack of unplanned outages led to favorable power prices. On a monthly average basis, June through September averaged 35, 46, 36, and $32/MWh, respectively. With corresponding Algonquin (New England delivered) natural gas averaging 1.93, 1.83, 1.62, and $1.81/MMBtu, respectively. October-to-date is in the same range for both power and natural gas at $36/MWh and $1.64/MMBtu. Year-to-date day-ahead power is averaging $36.89/MWh, a tick below 2023’s Jan-Dec average of $37.04/MWh. The balance of the year may bring up the 2024 average with increased seasonal heating demand expected which will likely lead to higher hourly prints. Additionally, any occurrences of significant cold shots would elevate index settlements. Any customers exposed to the floating index market should understand these budgetary and cost risks heading into the winter.

The NYISO issued a draft report on October 4th stating it expects to have adequate transmission capacity for the upcoming winter, assuming a winter peak load of 23,800 MW. The study evaluated thermal transfer load and dispatch conditions within New York’s power system, taking into account 935 MW of new capacity generation added since last winter, as well as external transfer capabilities with IESO, PJM, and ISONE. Combined capacity resources, including the states own power generation capacity as well as 759 MW of external net capacity resources, will ensure adequate resources with more than a 70% margin above of forecasted resource needs this winter.

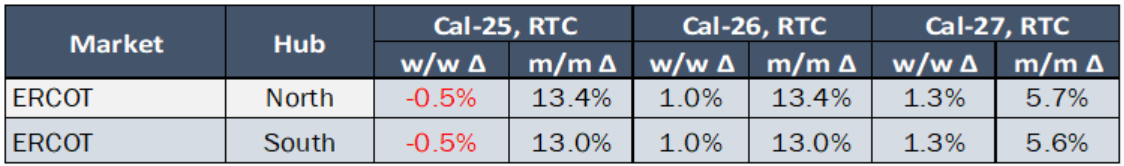

ERCOT Energy Summary

For the coming week, it was hot on Monday but there is finally light at the end of the summer tunnel. The forecast grew a little hotter in the near term with lower and middle 90s in the forecast through Sunday 10/13. A stronger cold front will move through next week. This breaks the heat and brings some below normal temperatures into the forecasts in the second half of next week. The pattern will rewarm in the 11-15 day, but it doesn’t look as hot as the current pattern.

Tropics Update: Milton formed on Friday and has quickly been gathering strength and is likely to become a category 5 storm by Tuesday as it heads to the Florida coast to make landfall on Wednesday. Out in the Atlantic, hurricane Leslie is moving west but it is expected to turn north this week and remain a “fish” storm. The speed at which Milton formed in the southern Gulf of Mexico over the last 72 hours illustrates how storms can form quickly in October as conditions, both water temperatures and wind flow remain favorable for storm development.

Source: NOAA

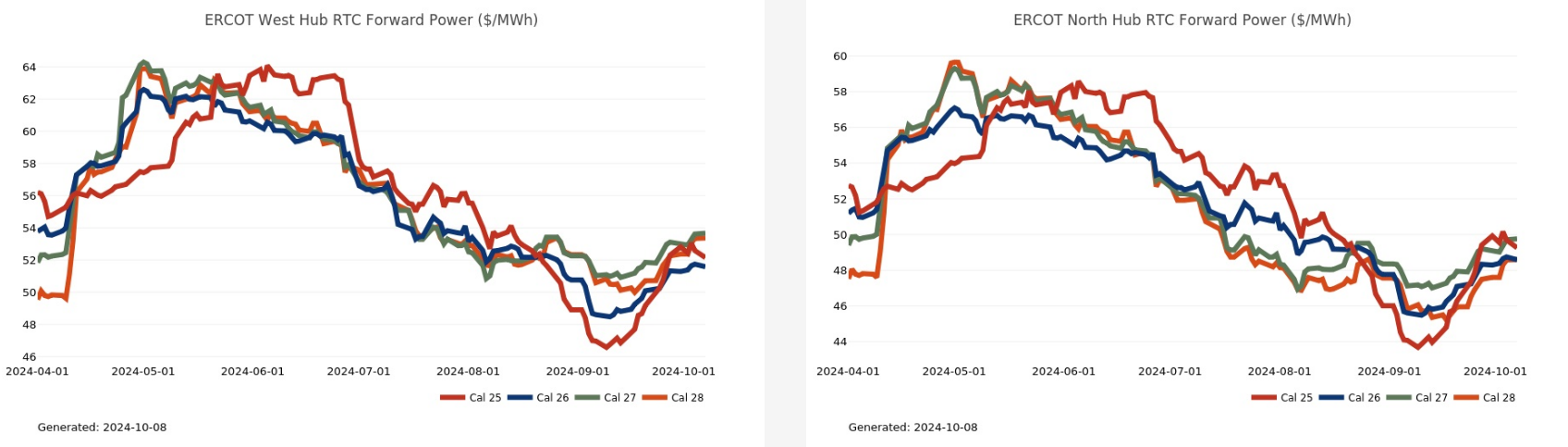

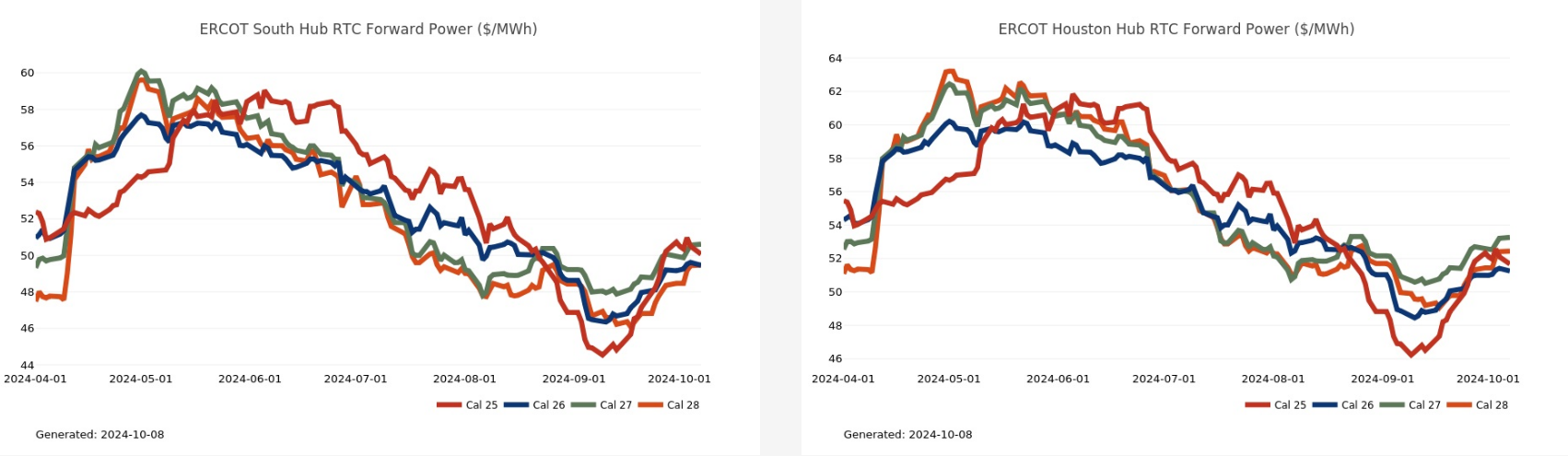

Forward Calendar Price Review Last Week

ERCOT Wind & Real Time Prices (Load Zone SPP): ($/MWh) over Prior Week

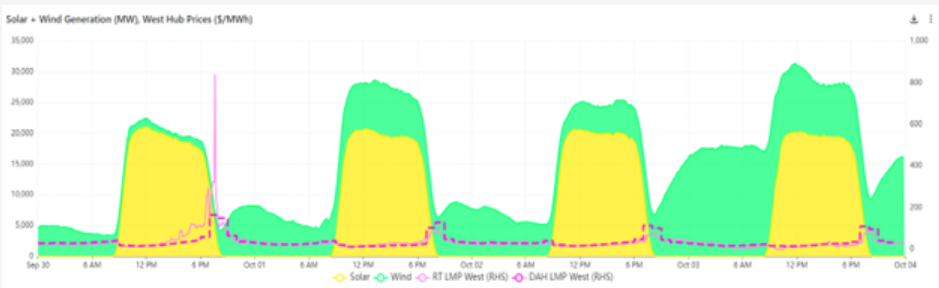

The The chart below shows solar and wind production (MW) on left axis vs. the ERCOT West Zone price both Day Ahead and Real Time in $/MWh on the right axis.

Wind generation was low on September 30th from 7-8 pm CT at 2.7 GW from 8-9 pm, prices spiked to $840/MWh.

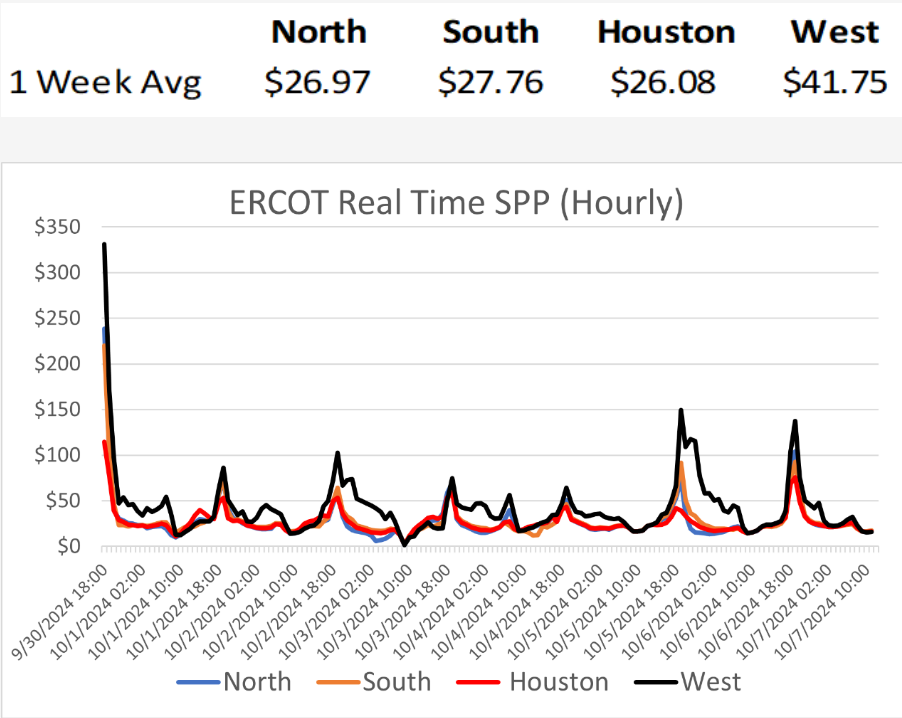

ERCOT Real Time Prices

Real time prices saw one spike last week on September 30th during the evening ramp but prices were moderate the rest of the week. There was minimal zonal congestion with only some West zone congestion on October 6th.

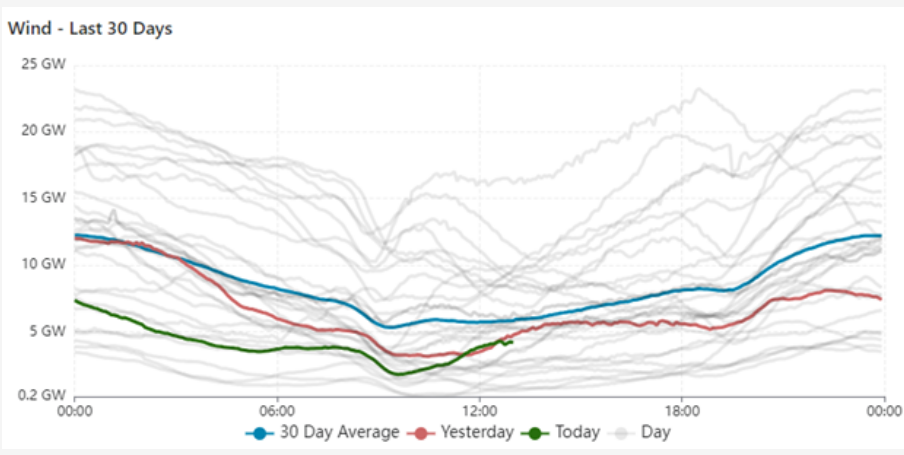

Wind Generation

Wind output was weak again overall recently as the 30-day average has dropped lower.

Generator Outages:

ERCOT is moving into outage season as thermal generators outages rose last week after several weeks of being steady at 8 GW last week. Outages are currently at 15 GW and will likely continue rising in October as above average temperatures fade.

TX News

Senate Load Growth Hearing - On 10/1, the Texas Senate Committee on Business and Commerce received testimony on managing Texas sized growth and innovation in power generation. The committee largely focused on the expansion of batteries in the ERCOT market and how renewable subsidies continue to impact market outcomes and the types of generation entering the queue. The committee discussed ways to expand batteries in rural communities such as by granting authority to counties to determine siting or permitting of installation. The Texas Energy Fund was acknowledged to be another subsidy intended to skew the market in the direction of the legislature’s preferred direction.

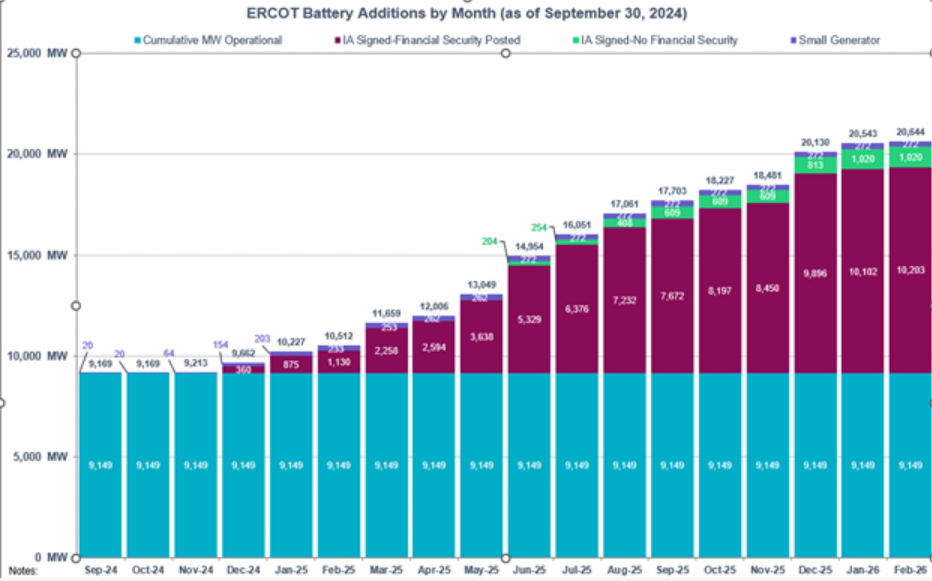

As the chart below illustrates, current battery capacity as of 9/30/24 in ERCOT stands at 9,149 MW and is expected to get to 9,662 MW by December31st. It is estimated that battery capacity could double by the end of 2025 to 18 GW. Whether all those projects get done in the next 15 months is open question but growth in coming.

The Texas Geothermal Energy Alliance testified, suggesting application of a reliability factor to projects in the ERCOT interconnection queue in response to a question from Senator King on how to increase reliability with the growth of intermittent renewables. Advanced nuclear reactors were briefly discussed with an emphasis on the timing of the technology to be available on a commercial level. A suggestion of 2030 and beyond was the timeline provided caveated by the NRC process. Members of the Advanced Nuclear Reactor Working Group proposed that Texas seek limited delegation authority to allow Texas to have site approval and the ability to confirm a facility is being built to licensed specifications to expedite the approvals of new nuclear using previously approved plans by NRC.

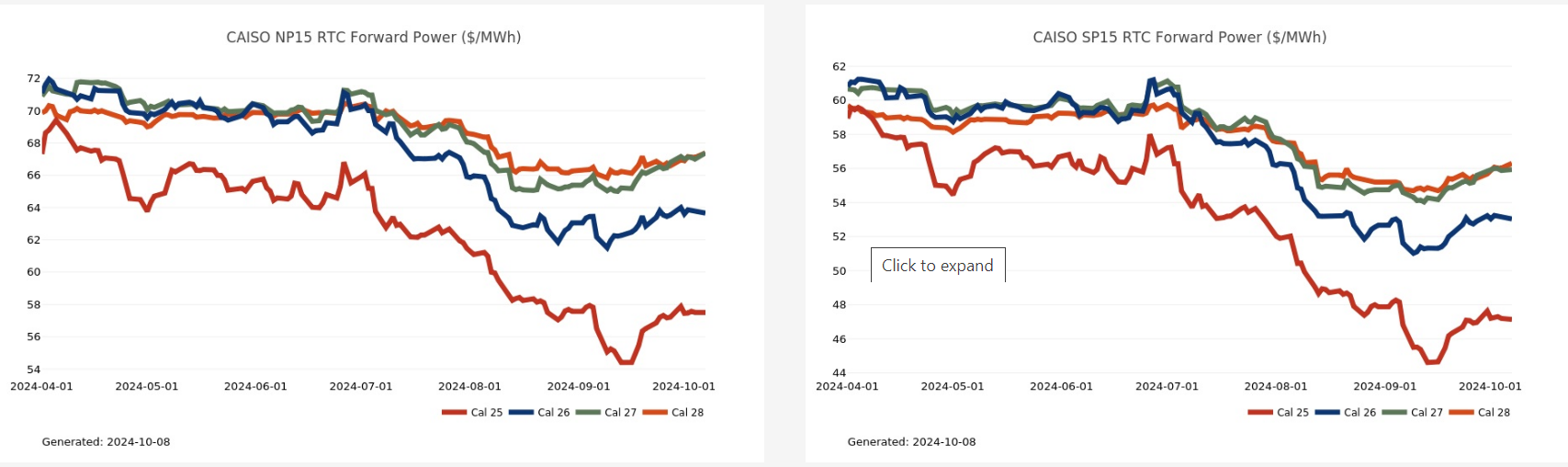

CAISO, Desert Southwest and Pacific Northwest Energy Summary

Although temperatures across the West will be decreasing slightly from record levels seen over the weekend, we still expect above to much above normal conditions to continue for the balance of this week carrying into next week. This means upper 80s and 90s continue through the interior LA Basin and up through the central Valley. In the Pacific NW, highs in the 60s and 70s will be common with overnight lows in the 40s and 50s, producing a low cooling demand and minimal heating demand pattern. The DSW cities will continue to have highs in the 90s to mid-100s, keeping late season cooling demand strong over the next week to 10 days. The lean among forecasts is for this pattern to carry through most of October. No complaints from your local reporter.

What is shaping up to be the West’s second summer is driving strong cooling demand and translating to strong natural gas demand. The second summer is unlike the first in that California gas prices have moved into the rare air above $4.50 per MMBtu at PG&E’s city gate while SoCal’s city gate is above $3.60. There are a few key issues driving prices north of any previous point this summer season despite the cooling demand falling well below the peaks seen in either July or early September. Gas system operators are looking ahead to winter and as such, pipeline maintenance has increased. Less import capacity means dispatchers must lean on storage cavern gas even when sendouts fall below the summer extremes. Market psychology is also playing a role as the start of heating season (November 1) is closing fast so the storage math is more heavily weighting the time element. During the summer when there was a surplus of storage and winter was far off in the distance, operators had gas to burn, literally, and little concern for the ability to replace it before the end of the injection season. Now, with the heating season close and extra parking spots in storage caverns that need to be filled, there is little motivation to sell gas below the prompt month price. This combination of factors has pushed prices higher for that marginal molecule. Additionally, outage season on thermal gen units is underway in preparation for winter and Palo Verde Unit 2 is slated to begin a five week refueling outage by the end of this week adding to the demand for gas and pressing less economic units in the natural gas fleet to fire up.

Day Ahead index prices out of the CAISO for flow today failed to meet Monday’s levels even though city gate gas prices were higher, printing roughly $71 MWh at NP15 and $48 at SP15 for the sixteen-hour peak period. Congestion between the two hubs has blowback out to levels above $20 MWh reflecting the reduced output of the one of the Diablo Cyn units and the transmission bottleneck that shows up in the S to N direction when the solar farms in SP15 swamp the grid midday w/ megawatts. Price action in the real time last night in NP15 is worth noting as the peak hour blew out to $686 for HE20 in NP15 while there were consistent triple digit settlements from HE15 – HE22.

Governor Newsome signed a bill amending the state’s corporate climate disclosure laws last week. He put his John Hancock on Senate Bill 219, amending two landmark corporate climate laws: the Climate Corporate Data Accountability Act (SB253) and the Climate-Related Financial Risk Act (SB261). Senate Bill 219 changes the existing laws by extending the deadline for CARB to finalize regulations for reporting GHG emissions to July 1, 2025. While the timeline for Scope 1 and 2 GHG emissions disclosures remains unchanged, w/ reporting beginning in 2026, the deadline for Scope 3 emissions may face a slight delay, though the first reports are still expected in 2027. Senate Bill 219 also allows GHG reports to be consolidated at the parent company level and relaxes the timing of the required fees.