Energy Market Update

Weekly Energy Industry Summary

Commodity Fundamentals

Week of October 28, 2024

By The Numbers:

NG '24 prompt-month NYMEX settled at $2.31/MMbtu, down $.25/MMbtu, on Monday, October 28.

WTI '24 prompt-month crude oil settled at $67.38/bbl., down $4.40/bbl., on Monday, October 28.

Natural Gas Fundamentals - Neutral/Bearish

Prompt-month NYMEX natural gas futures settled at $2.31 per MMbtu, down $.25 per MMbtu on Monday, October 28.

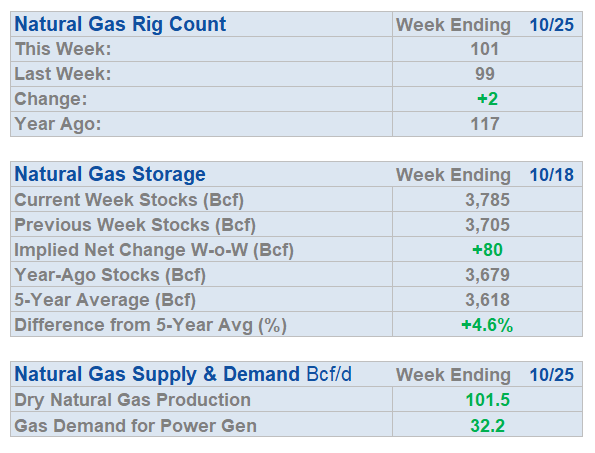

Natural gas production, month-to-date (October), has averaged 101.6 Bcf per day, versus 102.9 Bcf per day for the same period last year.

Electric power generation demand for gas, month-to-date (October), has averaged 34.6 Bcf per day versus 33.3 Bcf per day for the same period last year.

LNG exports month-to-date (October) averaged 13 Bcf per day versus 13.6 Bcf per day for the same period last year.

Natural gas exports to Mexico, month-to-date (October), averaged 6.2 Bcf per day versus 6.4 Bcf per day for the same period last year.

Natural gas strip prices, 2025-2029 are; $3.12, $3.57, $3.68, $3.58, and $3.47 per MMbtu respectively.

Crude Oil - Bullish

The events and geopolitical tensions remain in this market providing the potential for upside in crude oil. For this reason, the headline on the market condition of crude oil remains "Bullish" until further notice.

Crude oil took a dive yesterday settling at $67.38 per barrel, down $4.40 per barrel.

Israel has, for the time being, chosen not to attack Iranian oil assets and has focused on military targets.

Global demand is relatively weak.

China is in a recession.

Europe is generally recessionary or very weak in terms of growth.

The U.S. is chugging along at about 2.5 to 3.0 percent GDP growth.

All eyes turn to the results of the election, one week from today.

Economy - Neutral

The ten year Treasury hit 4.24%, its highest level since July.

The average rate on a standard 30-year-fixed rate mortgage was 6.54%, up nearly a half point from last month.

This year's high for a 30 year mortgage was 7.22%.

Retail sales in September rose 0.4%, "better than expected."

The inflation rate hit 2.4% in September, topping "expectations."

Hurricane Milton may have a big price tag -- $175 billion, CNBC reports.

September consumer confidence fell in September, the most in three years.

Sales of existing homes slowed in September to the weakest pace in 14 years.

Weather - Bearish

After a brief cool down in the Midwest and East, things are generally warming up a bit.

The 16-30 day outlook is warmer in the East and South and cooler in the West.

Weekly Natural Gas Report:

Inventories of natural gas in underground storage for the week ending October 18, 2024 are 3,705 Bcf; an injection of 80 Bcf was reported for the week ending October 18, 2024.

Gas inventories are 167 Bcf greater than the five-year average and 106 Bcf greater than the same time last year.

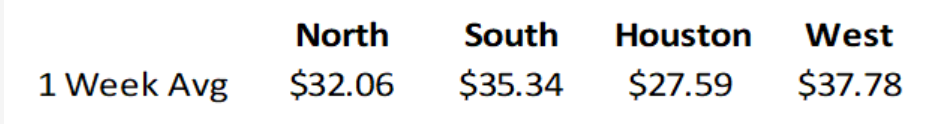

Values reflect week ending October 25, 2024.

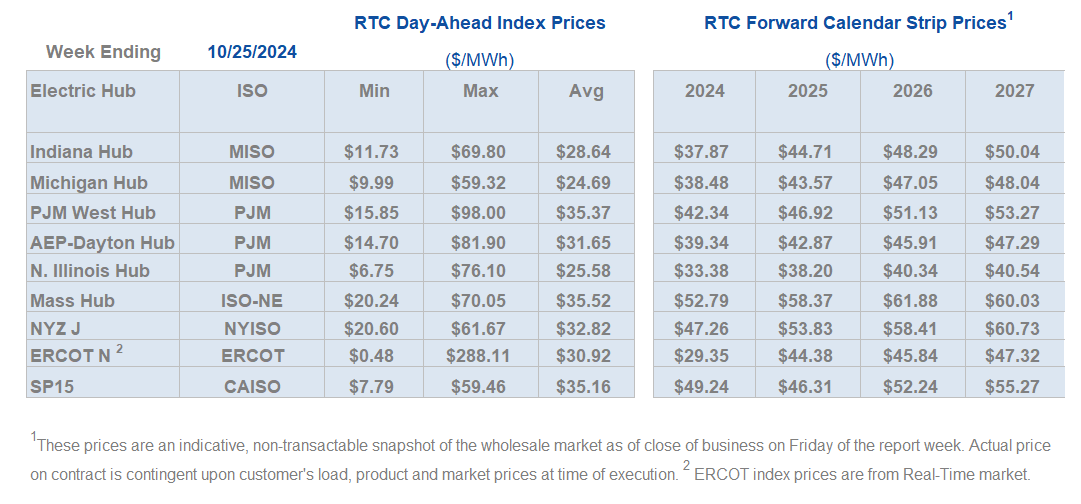

Prices reflect week ending October 25, 2024.

Weekly Power Report:

Prices reflect week ending October 25, 2024.

Prices reflect week ending October 18, 2024.

Mid-Atlantic Electric Summary

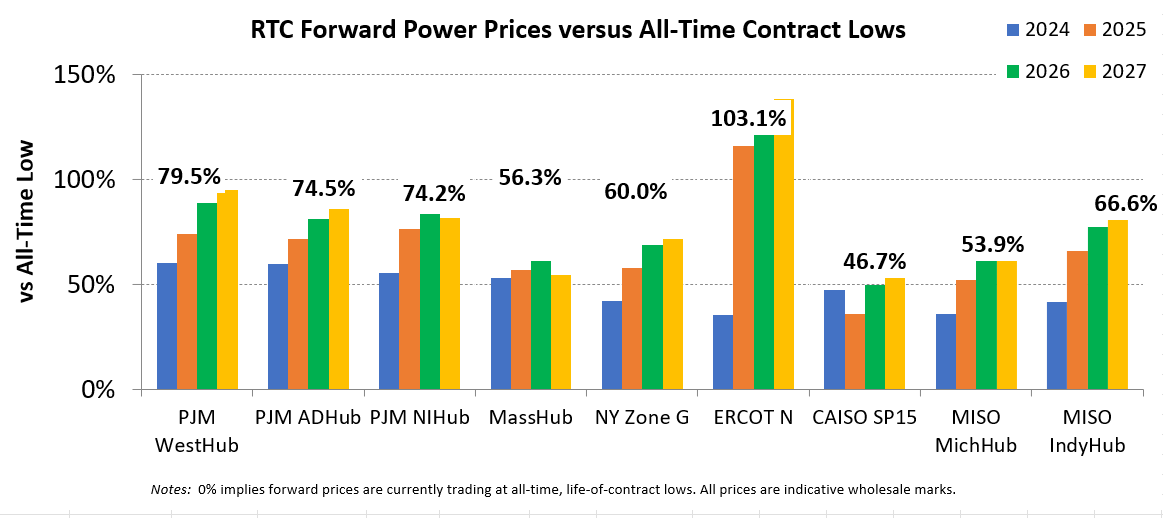

The Mid-Atlantic Region’s forward power prices were higher on the week with more price support on the back end of the price curve than the near-term. Natural gas prices attempted another rally last week but were turned back, once again, amid warmer temperature forecasts heading into November. Though we can pick out some fall-like temperatures in a few regions, it feels more like spring or early summer across much of the nation. A more westerly flow has introduced mild air into the pattern with cold air hard to come by. The 11-15 day promises some cooler changes, but as mentioned before, a lack of cold air in the pattern limits the impacts of any cold fronts. A lack of supply concerns, through winter, continue to keep near-term prices at bay while long-term resource adequacy concerns associated with increased data center demand and lagging electricity supply, continue to provide price support further-out on the price curve. Future power prices were 1% higher over the past week in the Mid-Atlantic region, with the near-term 2025/26 strips 1% higher, while the 2027-2029 strips were unchanged. Over the past month, those forward strips saw more price support on the later years with the 2026/29 terms trading 6% higher, while the prompt-year 2025 traded only 1% higher. Month-to-date day-ahead index prices in West Hub for October are averaging $35.82/MWh, which is 16% higher than September’s settlement price average but -4% lower than last year’s October average.

Resource Adequacy Remains Hot Topic in PJM - The week began with the Organization of PJM States (OPSI) conducting its annual public meeting on 10/21-10/22 where resource adequacy dominated the agenda and ended with Electric Distribution Companies (EDCs) and Load Serving Entities (LSEs) presenting their large load adjustment contracts the Load Analysis Subcommittee (LAS) demonstrating the rapidly increasing demand for electricity. Only four EDC/LSEs requested large load adjustments for the 2024 load forecast compared to eleven EDC/LSEs requesting adjustments for the 2025 forecast. These adjustments will be incorporated by PJM if not already captured by PJM’s econometric forecast, which relies on historical demand for electricity. PJM will provide its preliminary load forecast at the 11/25 LAS meeting. PJM also notified its members, this week, of its plan to bring two tariff proposals to the 11/21 Members Committee in advance of FERC filings under PJM’s 205 authority over the Tariff. The first proposal is the Reliability Resource Initiative (a.k.a. Expedited Reliability) to create a one-time opportunity allowing new reliable, shovel-ready generation projects to be studied in Transition Cycle #2 and resulting in a 14-month improved timeline compared to Cycle 1. The second proposal pertains to capacity market adjustments anticipated to include, at a minimum, a return to the combustion turbine as the reference resource for the capacity market demand curve and potential inclusion of the Brandon Shores and Wagner reliability must run units (RMRs) in the capacity market. PJM will conduct a Special MRC on 11/7 to discuss both topics with stakeholders in advance of Members Committee review.

Great Lakes Electric Summary

The Great Lakes Region’s forward power prices were higher on the week with more price support on the back end of the price curve than the near-term. Natural gas prices attempted another rally last week but were turned back, once again, amid warmer temperature forecasts heading into November. Though we can pick out some fall-like temperatures in a few regions, it feels more like spring or early summer across much of the nation. A more westerly flow has introduced mild air into the pattern with cold air hard to come by. The 11-15 day promises some cooler changes, but as mentioned before, a lack of cold air in the pattern limits the impacts of any cold fronts. A lack of supply concerns, through winter, continue to keep near-term prices at bay while long-term resource adequacy concerns associated with increased data center demand and lagging electricity supply, continue to provide price support further-out on the price curve. Future power prices in the GLR region were 1% higher over the past week for the 2025/26 strips, while the 2027-2029 strips were unchanged. Over the past month, those forward strips saw more price support in the later years with the 2027/29 terms trading 7% higher, while the prompt-year 2025 was -1% lower. Month-to-date day-ahead index prices in ComEd are averaging $26.28/MWh or -2% lower over the past month and -15% lower over the past year, while in AdHub the average price is $33.53/MWh or 16% higher than last month and -4% lower than the last year at this time.

Resource Adequacy Remains Hot Topic in PJM - The week began with the Organization of PJM States (OPSI) conducting its annual public meeting on 10/21-10/22 where resource adequacy dominated the agenda and ended with Electric Distribution Companies (EDCs) and Load Serving Entities (LSEs) presenting their large load adjustment contracts the Load Analysis Subcommittee (LAS) demonstrating the rapidly increasing demand for electricity. Only four EDC/LSEs requested large load adjustments for the 2024 load forecast compared to eleven EDC/LSEs requesting adjustments for the 2025 forecast. These adjustments will be incorporated by PJM if not already captured by PJM’s econometric forecast, which relies on historical demand for electricity. PJM will provide its preliminary load forecast at the 11/25 LAS meeting. PJM also notified its members, this week, of its plan to bring two tariff proposals to the 11/21 Members Committee in advance of FERC filings under PJM’s 205 authority over the Tariff. The first proposal is the Reliability Resource Initiative (a.k.a. Expedited Reliability) to create a one-time opportunity allowing new reliable, shovel-ready generation projects to be studied in Transition Cycle #2 and resulting in a 14-month improved timeline compared to Cycle 1. The second proposal pertains to capacity market adjustments anticipated to include, at a minimum, a return to the combustion turbine as the reference resource for the capacity market demand curve and potential inclusion of the Brandon Shores and Wagner reliability must run units (RMRs) in the capacity market. PJM will conduct a Special MRC on 11/7 to discuss both topics with stakeholders in advance of Members Committee review.

Northeast Energy Summary

On October 17, the House and Senate Chairs of the Massachusetts Technology, Utilities, and Energy Committee announced that they have come to an agreement for a final omnibus climate bill. The climate bill, which primarily makes changes to siting and permitting for energy infrastructure, stalled at the end of session when House and Senate conference committee members could not reach agreement on several provisions including Senate-backed language to prohibit competitive electricity supply shopping by individual residential customers. Legislative negotiations resumed when Governor Healey submitted her 2024 Supplemental Budget which included the siting and permitting language, thereby signaling the Administration’s priorities and frustration with the lack of progress on these issues. While final language has not been released, the House and Senate have indicated that their agreed-upon language includes siting and permitting reform, adds nuclear to the definition of clean energy, and allows the state to purchase power from New England’s nuclear plants. By adding nuclear to the definition of clean energy, nuclear generators will be permitted to compete in state procurements for carbon-free energy. The Senate chair also stated that the bill includes “lots of important breakthroughs [for] outfitting the state with an EV charger network [and] some very important housekeeping details around heat pumps.” Because Massachusetts is in informal sessions, a single vote can kill the bill and therefore it will not contain provisions which stalled the bill in July, such as the retail electricity market ban.

On October 11, NYSERDA submitted its Clean Energy Standard Tier 4 REC Implementation Plan Proposal to the Public Service Commission for approval (Case 15-E-0302). The plan provides a description of the Tier 4 compliance obligations and the Tier 4 Renewable Energy Credit (REC) sale process and structure. In September 2021, Governor Hochul announced NYSERDA had selected the Clean Path NY (CPNY) project and the Champlain Hudson Power Express (CHPE) project as part of NYSERDA’s Clean Energy Standard (CES) Tier 4 solicitation. Subsequently, the PSC approved the contracts and directed NYSERDA to file an implementation plan describing Tier 4 compliance obligation calculations. NYSERDA will be acquiring Tier 4 RECs through long-term contracts with CHPE and CPNY and proposes to re-sell the Tier 4 RECs to load-serving entities (LSE) proportional to their load shares (at cost) for their respective Tier 4 CES compliance obligations. NYSERDA also proposes to sell Tier 4 RECs through voluntary sales to other buyers, consistent with its current practice for Tier 1 RECs, reducing LSE obligation and subsequently offsetting the cost of the Tier 4 program for ratepayers.Like other CES programs, NYSERDA proposes a “pay-as-you-go” methodology, resulting in LSEs submitting payments on a monthly basis. NYSERDA will establish an annual Tier 4 REC rate at the beginning of each year using forecasted load and forecasted volume of RECs, with a reconciliation process at the end of the year reflecting actual volumes, cost, and statewide load.

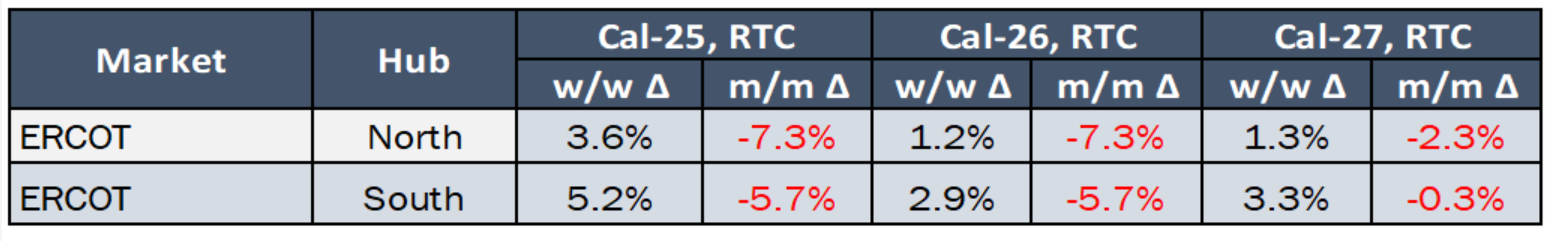

ERCOT Energy Summary

Last week, temperatures averaged in the mid 70’s across Texas with overnight lows in upper 60s and daytime highs in the upper 80’s and a few 90F in Austin and Houston.

Turning to this week, low temperatures this morning are more like what you would expect during the summer with daytime highs in the middle to upper 80s. A cool front will temper the heat Thursday and Friday but remains warmer than normal due to a lack of cold air in the pattern but gives us a break from unseasonable heat. The forecasts warm up again this weekend into early next week, but not as hot as the recent pattern. The pattern is shown cooling off in the 11-15 day. The American model is stronger with the cool down and has some below normal temperatures in the 11-15 day. Meanwhile, the European model is not as cool and closer to normal. Either way it is a milder pattern with the American offering some chilly overnight…40s.

Tropics Update: Tropical activity has gone quiet; the season is very likely effectively over.

Forward Calendar Price Review Last Week:

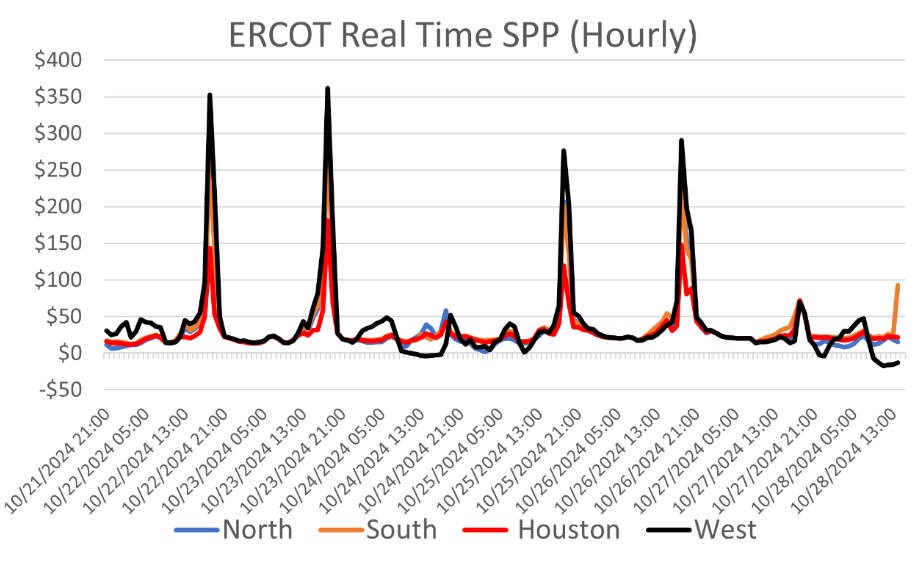

ERCOT Wind & Real Time Prices (Load Zone SPP): ($/MWh) over Prior Week

The chart below shows solar and wind production (MW) on left axis vs. the ERCOT West Zone price both Day Ahead and Real Time in $/MWh on the right axis.

Wind generation was low on Sept 30th from 7-8 pm CT at 2.7 GW from 8-9 pm, prices spiked to $840/MWh.

Source: ERCOT & Gridstatus.io/ERCOT dashboard

ERCOT Real Time Prices

Real time prices saw some spikes in the peak net load hours of HE 18-21 on 10/21 & 10/23. Prices were higher in the mid 30’s across all zones with the exception of the Houston zone.

Source: ERCOT

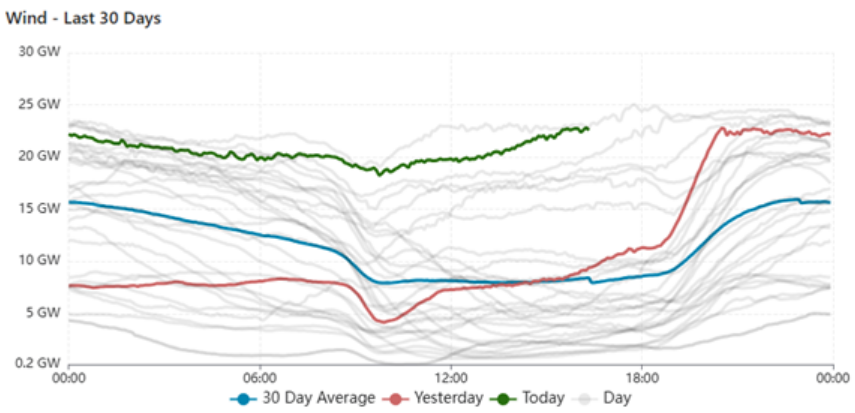

Wind Generation

Wind output continued to be strong last week as continued seasonal temperatures in Texas have delivered higher wind speeds.

Source: ERCOT

Generator Outages:

Source: ERCOT & Grid Status

ERCOT/TX News

On October 25th, ERCOT’s Supply Analysis Working Group met and the topic for discussion was changes to the biannual Capacity, Demand & Reserve Report that is released every May and December. ERCOT is evaluating how to make changes to the CDR to better reflect the growing influence of expanding levels of both solar capacity (+20 GW) along with existing wind capacity (35 GW) and expanding battery capacity (+6 GW). Where ERCOT had traditionally focused serving system peak loa between 4-6pm CST (HE 16:00-18:00), it is increasingly focusing on the emerging net load hours of 7-9 pm CT. Below is a list of proposed changes to future CDRs:

Peak load information: A forecasted peak Net Load by hour for different will be included as ERCOT shifts from focusing on just the system load peak.

Effective Load Carrying Capabilities (ELCCs): Historically ERCOT used peak average capacity contributions for wind and solar resources and will now shift to ELCC for renewables as well as for battery storage systems.

New Solar Regions and Seasonal CDRs: A Planning Reserve Margin will be for all four seasons and solar coverage will go from system wide to now be broken out into West, Far West and Other.

Getting onto the CDR List: a new resource will now have to have to show the “required financial security for interconnection facility construction.”

Enhanced Retirement reporting: Previously retirements were only included when a formal Notification of Suspension of Operations (NSO) was submitted to ERCOT. Now, units that have publicly announced retirements will be listed in a separate category.

Including battery storage (Energy Storage Resources): ESRs will now include existing and planned ESRs

Revised Emergency Response Service (ERS): The level of ERS capacity has ben modified to reflect the amount ERS procurement by ERCOT.

Mothballed Generation: The probability of return of mothballed generation is increased from 50% to 75%.

Full reporting of Spring and Fall data will begin in the May 2025 CDR. Questions raised at the meeting about load forecasting for large loads such as data centers and whether they need to be contracted with utilities for interconnection agreements to be included in the CDR. Large data centers that are not price sensitive tend to have steady load factors but large loads such as crypto miners is harder to forecast because (per Platts) “On the other hand, Bitcoin miners are fodder for the next NPRR. … Price-responsive demand is probably one of the most complicated aspects of changing the CDR going forward, because we have to rely on survey data.”

Source: ERCOT

CAISO, Desert Southwest and Pacific Northwest Energy Summary

Starting today, second summer in the West appears to be over. The widespread oranges and reds indicating above normal temperatures that had dominated the forecast maps for the West over the last few weeks are gone, replaced by light and dark blues, indicating below normal and much below normal temperatures will now rule. A trough situated over the Western half of the nation will provide a cooler than normal weather pattern for much of the West through the first week of November, especially across California and the DSW including Phoenix which is slated top out in the 70s and low 80s for the foreseeable future. Daytime highs will likely be limited to the 60s across much of California with overnight lows bottoming in the 40s sparking heating demand. The overall big picture outlook for the region heading into November has a general near to below normal lean across the West. This setup in the forecast looks to persist into the second week of November with cool temperatures but no real signs of meaningful cold.

One theme this summer was West cash gas prices suffering as storage levels tracked well above the prior year levels. The renewable landscape delivered with hydro having a strong water year and the influx of battery capacity breaking records, with both combining to compete with hydro outside of the midday. These components were additive to a modest winter where each operators’ storage facility exited the 2023/24 heating season with plenty of molecules left on the shelves. The SoCalGas situation around Aliso Canyon has been another big driver of the downward trending price action earlier in the year as the cavern is showing stocks at the highest level seen since the facility had issues back in late 2015. With its gas needs satisfied, the SoCal city gate price action is such that it is incentivizing the gas to go to regional power generation and not towards other regions like PG&E and/or the Rockies. This created a supply rich environment through the spring and summer months, which often forced SoCal and PG&E to call high operation flow orders (OFOs) to wave off import volumes. Energy buyers at both PG&E’s and SoCal’s city gates were the winners in this race, with those buyers at PG&E taking the top of the podium. Earlier this month, above-normal temperatures drove up the demand within California at the same time as pipeline maintenance restricted imports, thus reversing the scale and forcing storage withdrawals. Over the past couple of weeks, the desire to refill caverns prevailed and storage once again is nearing the tank tops where low prices and the chance for high OFOs will be common until any sort of winter shows up.

From a power perspective, the CAISO grid is exhibiting its own form of a high OFO as the spread between midday prices in NP15 and SP15 blows out to the widest point of the season. The lack of demand and the wealth of solar influx within the southern part of the grid has put the S to N congestion along Path 15 out to the $23 level, which equates to the lowest degree of power burn within the region during the peak period time block. It should be noted that the congestion does not fully resolve at night, so that $6 of differential in off peak power pricing puts slightly more pressure on the natural gas consumption within SoCalGas territory.

Back in 2019, the City of Berkeley became the first place in the country to ban gas hookups in new build construction. Dozens of cities, including Los Angeles and New York, piled on and approved their own similar measures. The trend alarmed natural gas producers and sparked a culture war over gas stoves and fireplaces. Berkeley’s move was challenged by the California Restaurant Association, with support from the gas industry. A federal appeals court struck down the ban early this year and the city canceled the ordinance a short time later. Unwilling to take the defeat, City Fathers will give residents of Berkeley a chance to vote in next week’s election on a renewed attempt to clamp down on the unpopular fossil fuel. On the ballot is “Measure GG,” an initiative that would require owners of commercial and multi-family buildings of more than 15,000 sq feet to pay a tax to use natural gas. The proposed tax is $2.9647 per therm, which would more than double the current delivered cost of natural gas. The tax would be charged to building owners, who would be prohibited from passing the tax onto tenants in residential or mixed-use buildings in the form of increased rent or costs. Will voters in the self-described People’s Republic of Berkeley drive out local businesses and neighbors in a gangster move to stem GHG emissions? Just like five years ago, Berkeley’s anti-gas crusade is one to watch.