Market Update: August 2024

Aug 2024 natural gas contract retired yesterday as prompt month. It closed down ten cents on the day at $2.08/MMBtu. This is also down from $2.25 on the week. As the new prompt month, Sep 2024 is currently trading at $2.04.

Prices are softer yesterday and today with the release of the new weather forecast. The 8-14 day forecast shows some cooling in the northern part of the U.S. This is good news for places like Chicago and Detroit. Production continues to remain strong at 102 Bcf per day.

For week ending Jul 26, the natural gas storage expectation is for a build in the mid 30’s which is in line with the 5-year average. There were concerns whether we’d end the storage season with 4 TCF in the ground. Storage in the ground started the build season etching a new 5-year upper limit. However, in the last three months we’ve seen below average builds that have slowly brought our storage levels in line with the upper limit.

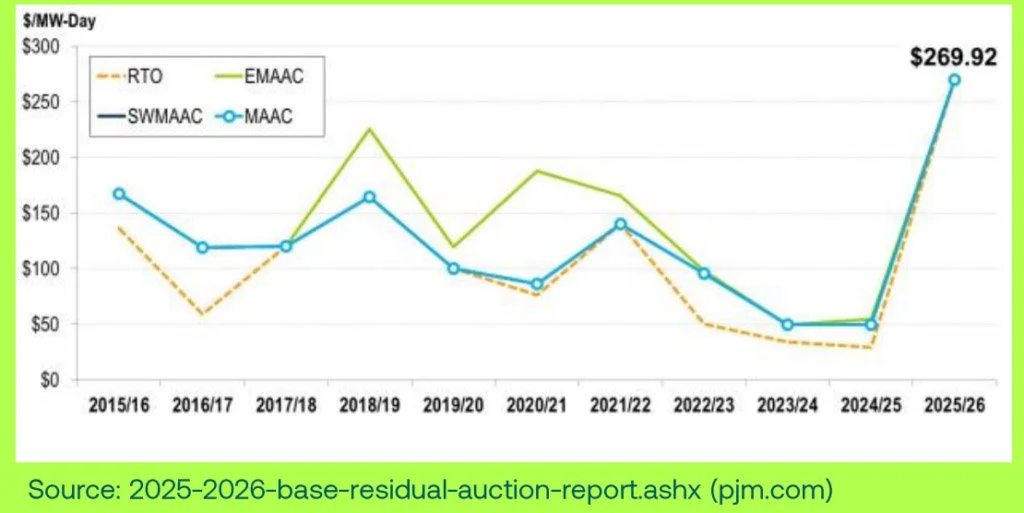

Yesterday, PJM announced the results of its planning year 25/26 base residual auction. Prices were significantly higher than PY 24/25 by 10x.The higher prices is attributed to diminished supply to due to the shuttering of 6.6 GW of generation without replacement. There is also an increase in expected demand of 2.5%to 153 GW. Peak load contributions (PLC) set this summer will affect capacity charges starting Jun 2025. For those who can control their demand, there is still time to reduce your PLC during high demand hours.

PJM Capacity BRA Auction Indicates Significant Cost Increase for 2025/2026 Delivery Year

The recent PIM Base Residual Auction (BRA)for capacity auction-has seen a dramatic increase in costs for securing resources to meet the reliability requirements for the 2025/2026 Delivery Year. The auction cleared at $269.92 per megawatt-day (MW-cay) for much of the PIM footprint, a significant jump from the $28.92 per MW-day achieved in the previous auction for the 2024/2025 Delivery Year. This stark increase underscores the evolving challenges in maintaining grid reliability and highlights the substantial financial shifts occurring within the energy sector.

This year’s auction has procured 135,684 MW of capacity for the period from June 1,2025, through May 31,2026. In addition to the auction-secured capacity, there is a Fixed Resource Requirement (FRR) obligation of 10,886 MW, bringing the total required capacity to 146,570 MW. The increase in auction prices reflects the need for significant investment in both new and existing generation resources to meet future demand and ensure grid stability.

The rise in capacity prices is driven by several factors.The transition towards renewable energy and the integration ofadvanced technologies require substantial upfront investments,which are reflected in the higher auction prices.Additionally,economic conditions such as supply chain disruptions and inflationary pressures have increased the costsassociated with energy projects,further contributing to the surge in capacity prices.

Comparatively, the reserve margin—the difference between the total capacity and peak demand-has decreased from 20.4% for the 2024/2025 Delivery Year to 18.5% for the 2025/2026 Delivery Year. This reduction in reserve margin indicates a tighter supply-demand balance, adding to the urgency and cost of securing sufficient capacity. Despite these higher costs, the PIM capacity auction remains a crucial tool for ensuring long -term grid reliability.

In summary, the recent PIM capacity auction has resulted in a significant increase in clearing prices, with costs rising from $28.92 to $269.92 per MW-day. The total procured capacity and FRR obligations amount to 146,570 MW, reflecting an 18.5% reserve margin. This increase in costs highlights the ongoing challenges and financial implications of maintaining a reliable energy grid amidst evolving market conditions and economic pressures.

Reminder this is the BRA and there is one additional final auction in February of 2025 that will set the final prices. When evaluating offers from suppliers it is important to ensure that they are pricing in the BRA results that were published7/30/24 from PIM. When evaluating supplier offers, it is important to ensure they are pricing in the BRA results published 7/30/24 from PM. If the BRA is not used, you will see a significant variance in price offerings from Smartest Energy as we have implemented these projected future costs into our models on 7/31/24. Capacity costs are outside of a suppliers control and are ultimately the responsibility of the rate payer regardless of where supply is secured. We will continue to keep you updated as changes occur.