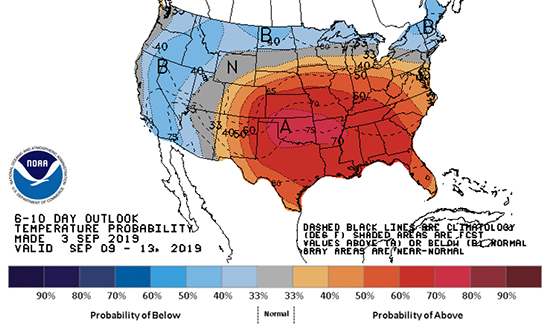

After a succession of trading days that remained mostly sideways, the market has begun to respond to a bearish 84 Bcf injection that exceeded expectations and the five-year average while matching the injection for the same time period last year. Despite the majority of the Lower 48 skewing hotter than normal during the reporting period, NYMEX futures are sliding back into a somewhat bearish state for the shoulder season. Major demand regions such as the southern U.S. and Northeast are forecasted to be warm to normal for the beginning of October, but any sustained heat by that point will be regarded as bearish. Real Time power hub prices in ERCOT have returned to mostly normal ranges following the erratic month of August, while the rest of the major price points aren’t expected to see much movement unless a particularly cold winter materializes. Next week will be another injection to watch as the effects of Tropical Storm Imelda on Houston’s demand will be defined and could lead to another bearish build.

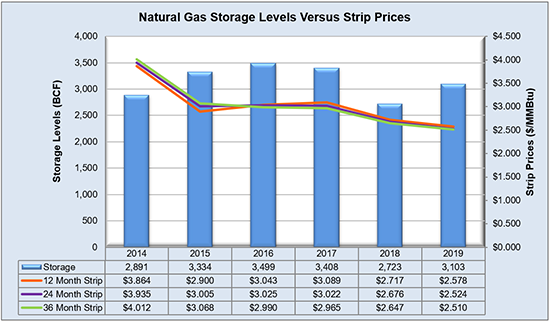

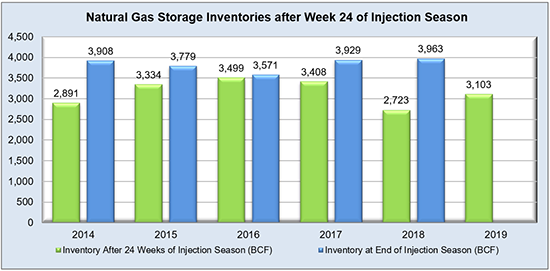

Working natural gas in storage currently stands at 3,103 Bcf, which is 393 Bcf (14.5%) higher than this time last year and 75 Bcf (-2.4%) lower than the five-year average.

The October 2019 NYMEX Futures price began the day around $2.62/MMBtu prior to the report’s release and dropped to $2.55/MMBtu after the report was posted.

Outlook for the Balance of Storage Season:

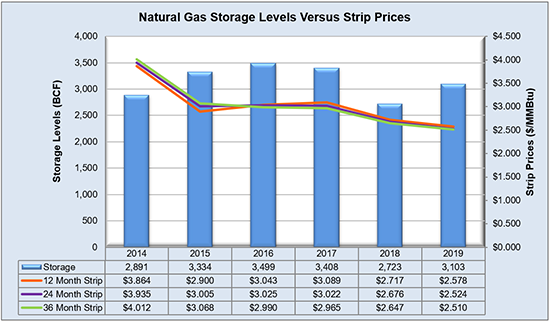

The graph below compares historical 12, 24 and 36 month strip prices and storage levels for the past 5 years.

The following table shows the injection numbers we will need to average by week to hit selected historical levels:

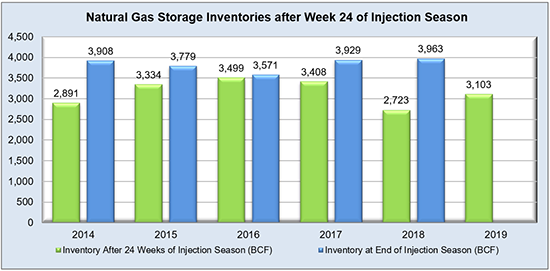

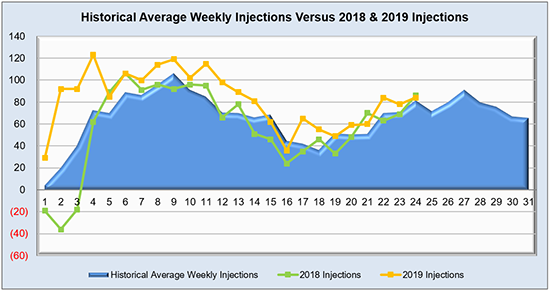

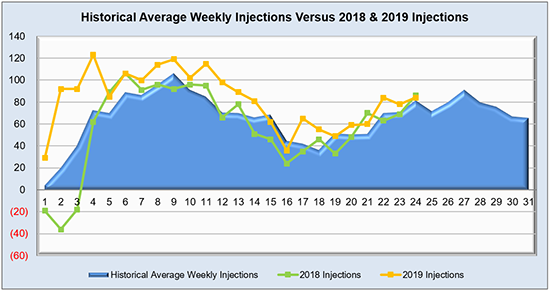

The following two graphs show current natural gas in storage compared to each of the last 5 years and weekly storage averages and patterns.

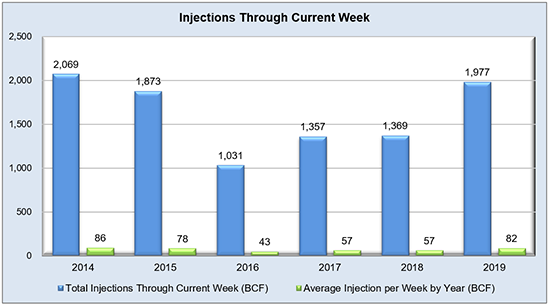

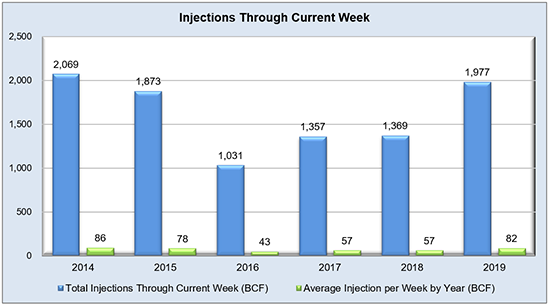

The graph below shows the injections through the current week over the past 5 years.

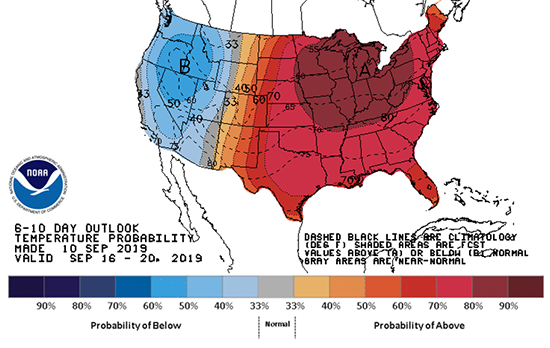

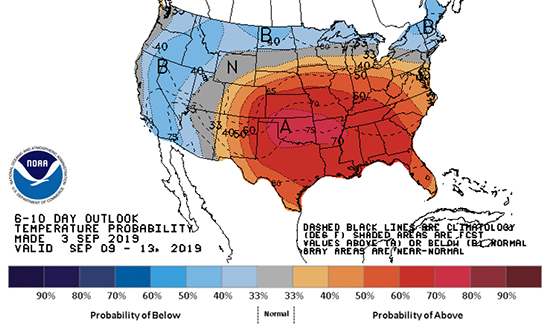

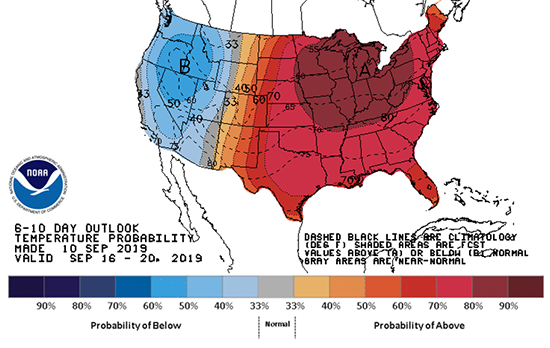

Finally, the graphics below depicts the 6 to 10 day temperature range outlook from the National Weather Service.

Current Week’s Outlook

Future Outlook