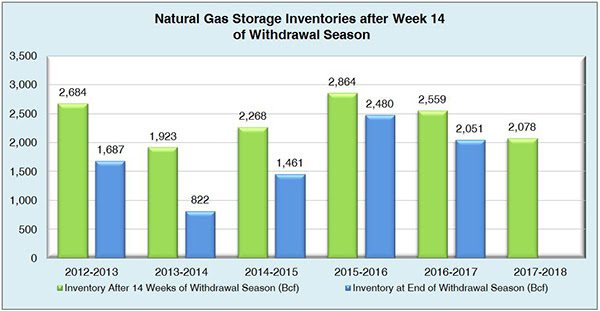

Working natural gas inventories currently stand at 2,078 Bcf. This figure is 503 Bcf (19.5%) less than this time last year and 393 Bcf (15.9%) below the five year average.

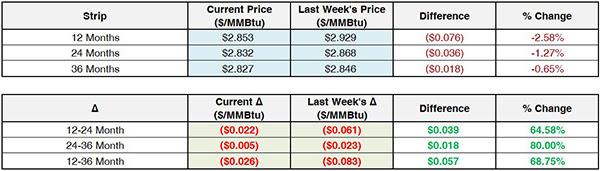

The March 2018 NYMEX Futures price started around $2.73/MMBtu prior to the report’s release and has since dropped to $2.71/MMBtu.

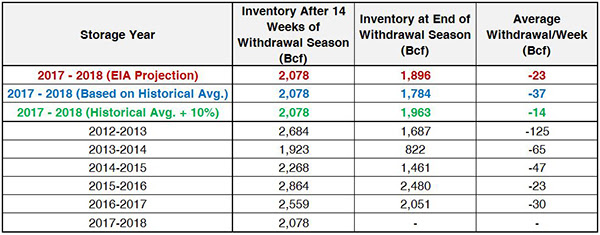

Outlook for the Balance of Storage Season:

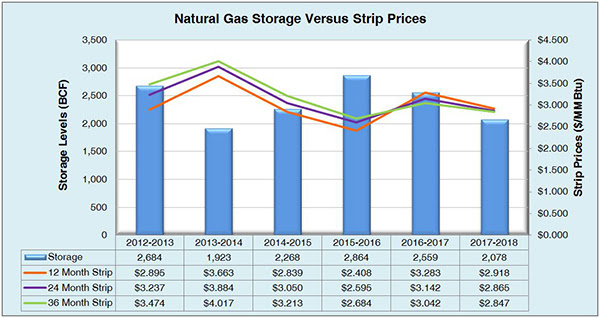

The graph below compares historical 12, 24 and 36 month strip prices and storage levels for the past 5 years.

The following table shows the injection numbers we will need to average by week to hit selected historical levels:

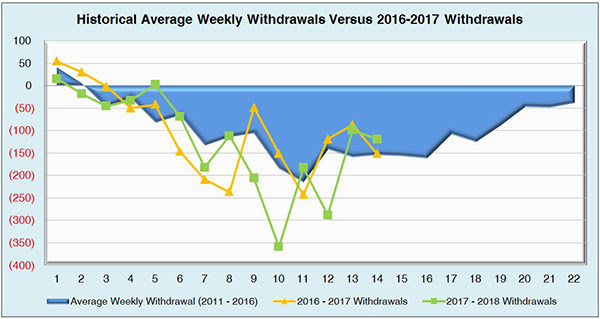

The following two graphs show current natural gas in storage compared to each of the last 5 years and weekly storage averages and patterns.

The graph below shows the injections through the current week over the past 5 years.

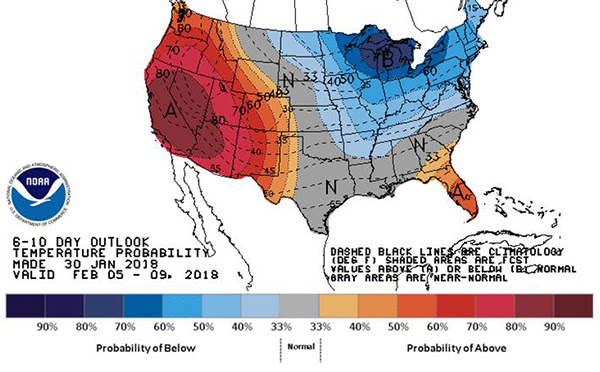

Finally, the graphics below depicts the 6 to 10 day temperature range outlook from the National Weather Service.

Current Week’s Outlook

Future Outlook