Working natural gas inventories currently stand at 1,446 Bcf. This figure is 667 Bcf (31.6%) less than this time last year and 329 Bcf (18.5%) below the five year average.

The April 2018 NYMEX Futures price started around $2.658/MMBtu prior to the report’s release and has since decreased to $2.631/MMBtu.

Outlook for the Balance of Storage Season:

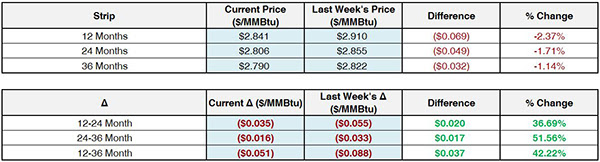

The graph below compares historical 12, 24 and 36 month strip prices and storage levels for the past 5 years.

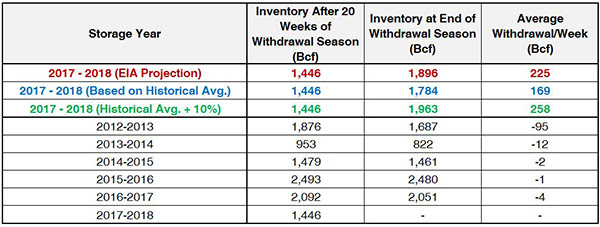

The following table shows the injection numbers we will need to average by week to hit selected historical levels:

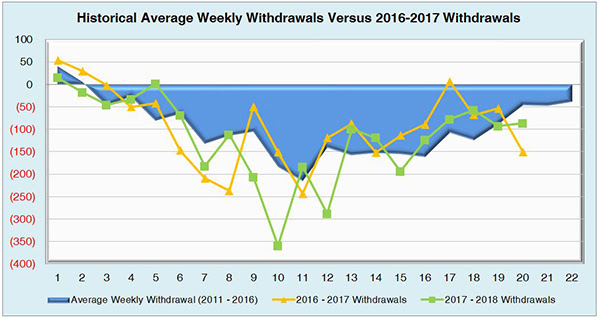

The following two graphs show current natural gas in storage compared to each of the last 5 years and weekly storage averages and patterns.

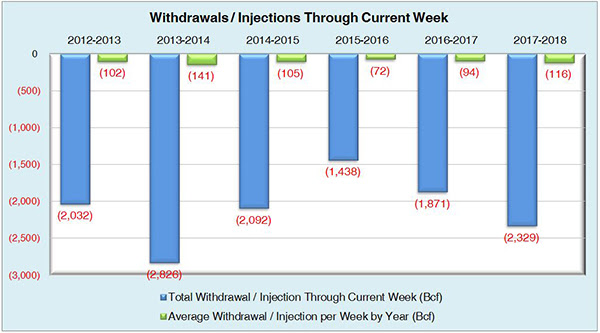

The graph below shows the injections through the current week over the past 5 years.

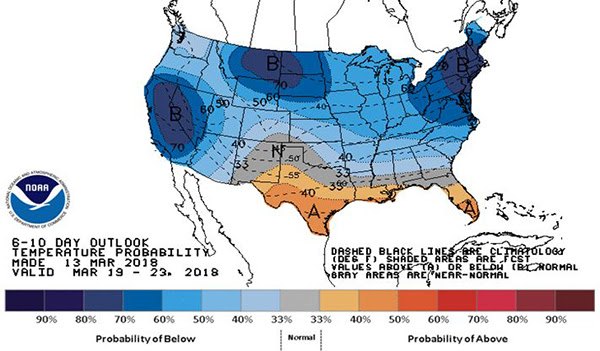

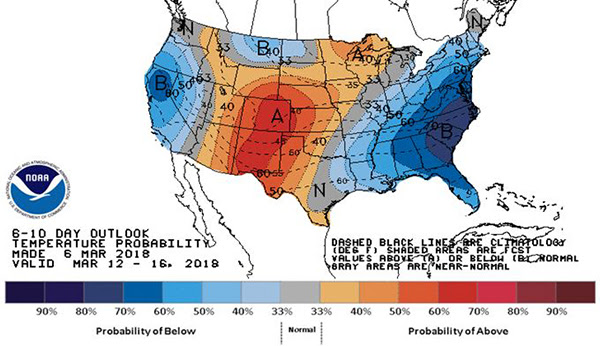

Finally, the graphics below depicts the 6 to 10 day temperature range outlook from the National Weather Service.

Current Week’s Outlook

Future Outlook