Working natural gas in storage currently stands at 3,126 Bcf, which is 192 Bcf (6.1%) lower than this time last year, and 192 (6.1%) below the five year average.

The February 2018 NYMEX future was relatively flat at just over $3.00/MmBTU, and has since plummeted to $2.87/MmBTU.

Outlook for the Balance of Storage Season:

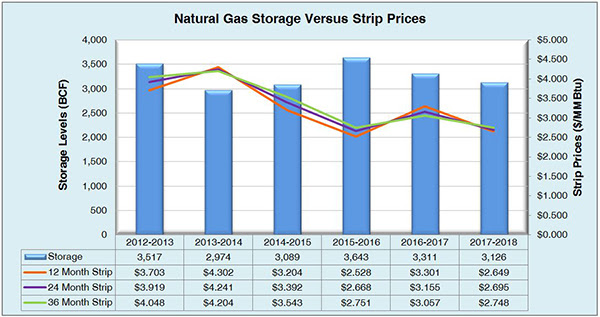

The graph below compares historical 12, 24 and 36 month strip prices and storage levels for the past 5 years.

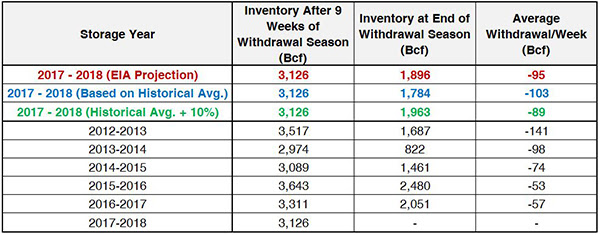

The following table shows the injection numbers we will need to average by week to hit selected historical levels:

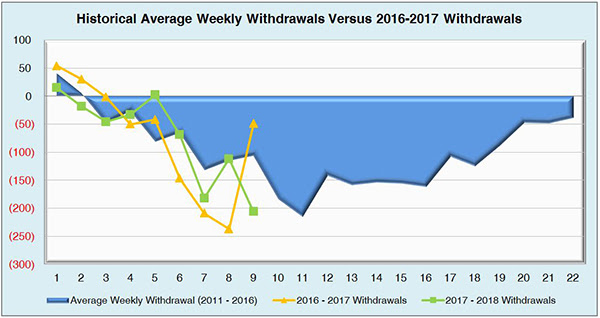

The following two graphs show current natural gas in storage compared to each of the last 5 years and weekly storage averages and patterns.

The graph below shows the injections through the current week over the past 5 years.

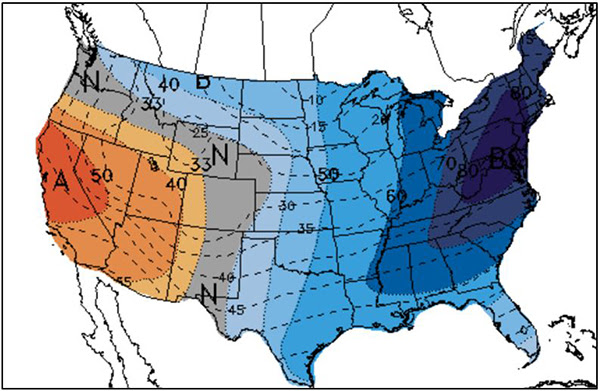

Finally, the graphics below depicts the 6 to 10 day temperature range outlook from the National Weather Service.

Current Week’s Outlook

Future Outlook