Working natural gas in storage currently stands at 2,738 Bcf, which is 357 Bcf (15.0%) higher than this time last year and 111 Bcf (-3.9%) lower than the five-year average.

The September 2019 NYMEX Futures price began the day around $2.16/MMBtu prior to the report’s release and increased to $2.26/MMBtu after the report was posted.

Outlook for the Balance of Storage Season:

The graph below compares historical 12, 24 and 36 month strip prices and storage levels for the past 5 years.

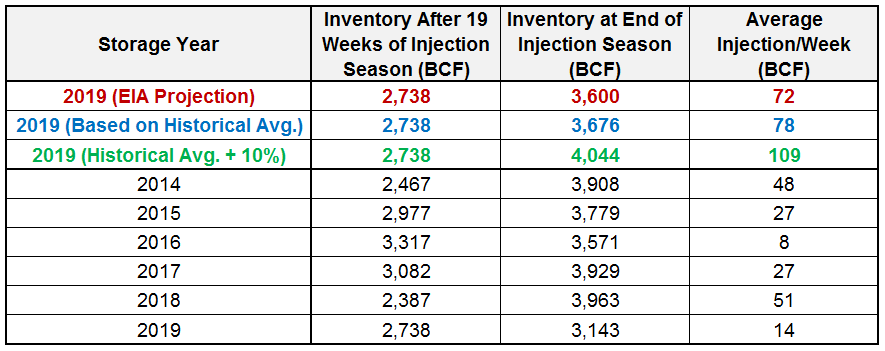

The following table shows the injection numbers we will need to average by week to hit selected historical levels:

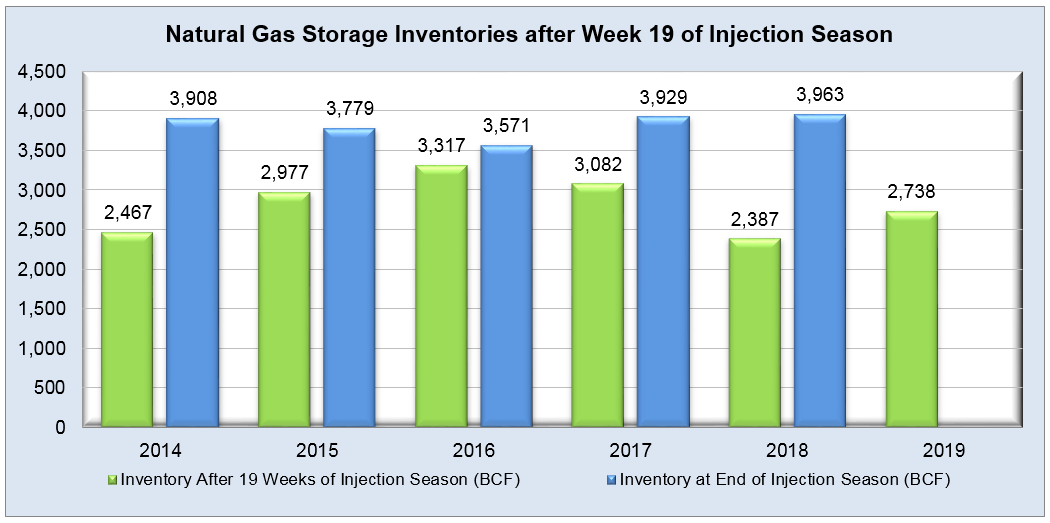

The following two graphs show current natural gas in storage compared to each of the last 5 years and weekly storage averages and patterns.

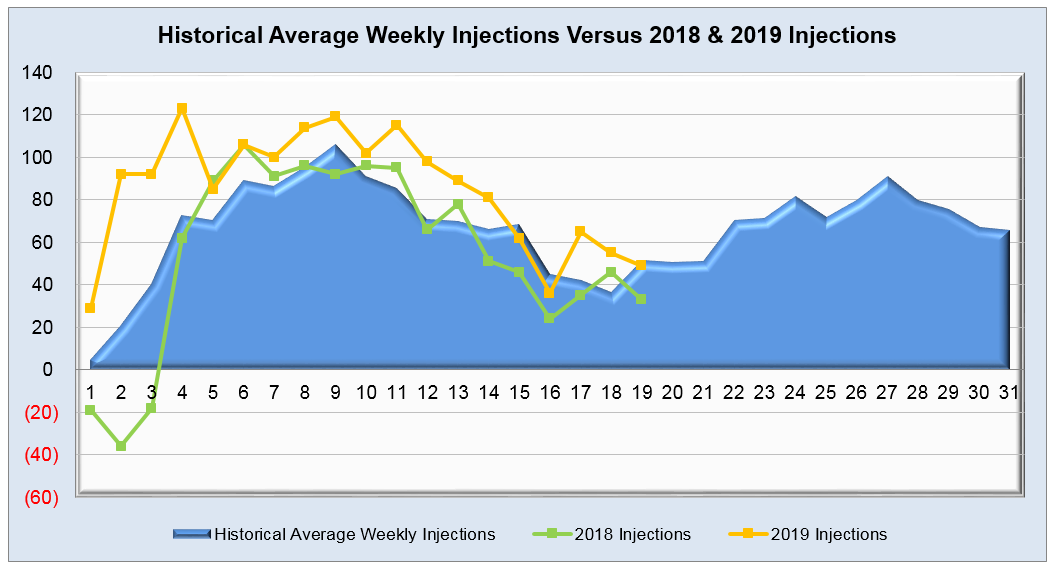

The graph below shows the injections through the current week over the past 5 years.

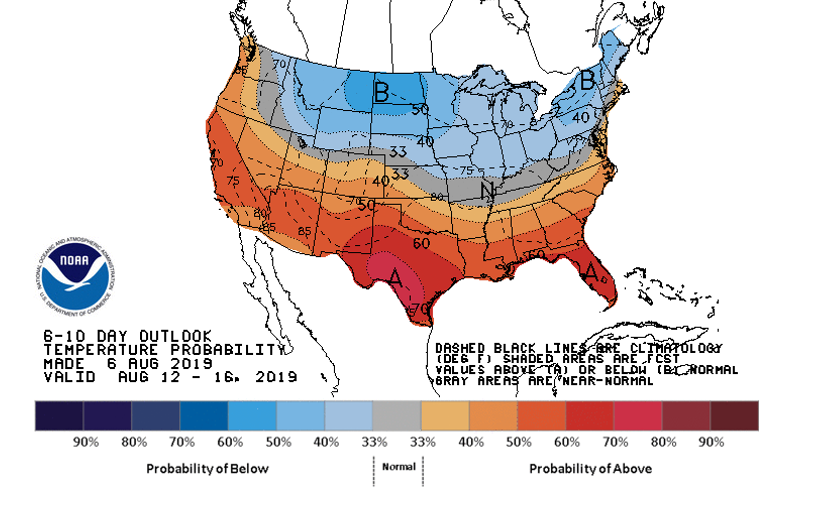

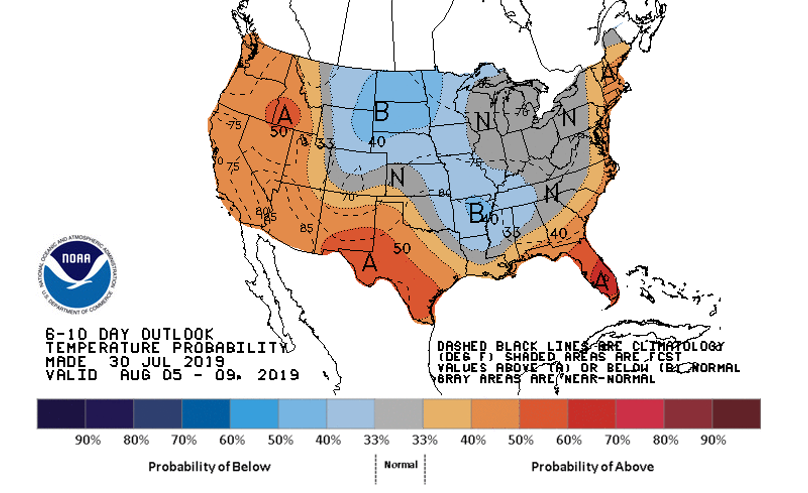

Finally, the graphics below depicts the 6 to 10 day temperature range outlook from the National Weather Service.

Current Week’s Outlook

Future Outlook