Con Ed says aging natural gas plants are fine; storage advocates say a crisis is imminent.

Does New York City have sufficient resources to meet peak energy demand and, if not, how should any shortcoming be addressed? Those are two key questions facing energy planners for the Big Apple, with competing views on both.

Shortfall debate

While about 30% of New York City’s peak demand is met by natural gas turbines older than most such plants in service, Consolidated Edison (ConEd), the city’s distribution utility, sees no urgent need for new generation. A study by the New York Independent System Operator (NYISO) concluded power plants now in service “will meet reliability criteria over the 2017-2026 period.”

ConEd Resource Planning Manager Aydemir Nehrozoglu said some NYC natural gas peakers may be threatened by new air pollution control requirements, but “aging is not the same as having to be replaced.” Advocacy groups “may want them closed, but more political will, planning and execution will be needed to get to that new energy future,” he told Utility Dive.

Nehrozoglu said the peaker units “are easy to maintain” and are used “for only a couple of hours and then shut down.” ConEd does not own them and has little visibility into how viable the plants are, he acknowledged. “We would like to be able to do a generator-at-risk analysis because it matters so much to system reliability but generators don’t share that information.”

Echoing Nehrozoglu, NYISO VP Richard Dewey said the system operator’s April 2017 Comprehensive Reliability Plan “found no new resources are needed.” New York’s existing bulk power system can meet “peak electrical demand,” Dewey emailed Utility Dive. And it will continue to “meet reliability criteria over the 2017-2026 period.”

Dewey agreed “the need to maintain, upgrade or replace aging generation infrastructure requires constant attention.” But, he said, the NYISO markets “send appropriate, locational-based price signals” that “reflect scarcity and shortage conditions” to maintain reliability.

Susanne DesRoches, a deputy director in the NYC Mayor’s Office, cited the NYISO analyses in denying any near-term peak demand reliability concerns. The city’s energy efficiency programs “have helped to reduce both peak demand and general electricity usage,” she said.

She acknowledged that 70% of the in-city generating fleet, which delivers half of NYC’s energy and 80% of its peak demand, is 45 years old or more. The generation fleet’s age “is of concern” to the Mayor’s office but it is working with the NYISO and the New York Public Service Commission (PSC) on “replacement and/or repowering.”

DesRoches said her office is planning to expand its energy efficiency efforts, encourage policies that support DER, work toward new transmission and support development of New York’s offshore wind. It is also working on new “wholesale electricity market rules” that will “remove barriers or impediments for repowering with cleaner generation.”

Another View

There are other views about the current sufficiency of NYC’s peak demand resources.

A shortfall of 642 MW could develop from the aging peak capacity infrastructure in the metro NYC region, according to the September 2017 Strategen Consulting report, “New York City’s Aging Power Plants: Risks, Replacement Options, and the Role of Energy Storage.”

To reach its conclusions, Strategen used NYISO data on natural gas plants. It found that 2,860 MW of NYC’s approximately 11,600 MW of forecasted peak load is provided by turbines older than the age at which 95% of such plants retire.

Report co-author Edward Burgess questioned the efficiency of the NYISO’s capacity markets, citing the system operator’s most recent market report. “It shows existing peaker plants receiving capacity payments far exceeding their operating costs,” he said.

In addition, NYC’s peak demand needs are evolving, he noted. The NYISO’s CRP did not, he said, assume the retirement of Indian Point, changes in the availability of natural gas supply, changes in regional electricity imports, anticipated new rules restricting ozone, and potential natural gas plant retirements and diminished performance.

The Strategen report, prepared for the NY Battery and Energy Storage Technology Consortium (NY-BEST), says the advanced age of many turbines providing peak load in NYC is an opportunity to write new rules and policies that allow the city to meet its growing peak demand in ways that support its renewables and climate goals.

Constraints on transmission limit delivery of electricity to the NYISO’s Zone J, which covers NYC, the study says. But building new power plants in the highly urbanized NYC zone is also complicated, the study notes.

Broader environmental goals

Putting aside questions of whether NYC has sufficient energy capacity to meet peak demand in the coming decade, there’s also the issue of whether the city has the right resources to support its broader environmental goals.

The NYISO capacity market pays hundreds of million of dollars annually to aging gas plants that run 15% of the time or less, Strategen concludes. And fossil fuel generation does not address state and local renewable and emission reduction goals, which include an 80% reduction in NYC’s greenhouse gas emissins by 2050 and using renewables for 50% of state energy needs by 2030.

Strategen raises additional health and social justice concerns about air pollution from the aging natural gas plants. Ozone-forming nitrogen oxide (NOx) emissions and particulate matter are “a major public health problem” that’s estimated to cost the city $62 million annually, “but is likely much higher,” the report says.

The closure of the nearby 2,060 MW Indian Point nuclear units in 2020-2021 is expected to increase the use of the plants, worsening health impacts, Strategen reports. Four-hour duration battery energy storage could reduce NOx emissions “62% to 66%” without compromising reliability, Strategen says.

Storage vs. gas

Battery energy storage could be “more cost effective than new natural gas peakers” if market rules and policies provided remuneration for all its benefits, the consulting firm’s report argues.

Those who don’t see peak energy demand as a particular issue to be addressed now, still see storage as something worth exploring, though perhaps with less urgency than others might think is warranted.

Energy storage can help with peak demand and system resiliency, DesRoches, from the Mayor’s office, agreed. The office is working with ConEd and state agencies to eliminate barriers to storage created by NY Fire Department safety concerns, she added.

ConEd Resource Planning Manager Nehrozoglu said there are several ways NYC can meet peak demand but storage is not one right now. “New compensation mechanisms” are needed for battery storage to be competitive, he argued.

“NYC is transmission constrained because existing transmission capacity is insufficient, but we can build new transmission,” Nehrozoglu said. Using new transmission to import hydropower, land-based wind and offshore wind would achieve state and city climate goals more cost-effectively than storage, he added.

New compensation needed

Strategen agrees new compensation mechanisms for storage are needed. One is longer-term revenue certainty than is available through the NYISO’s six-month capacity auction. Including storage into the state’s value of DER (VDER) proceeding and monetizing the value of emissions-free peak capacity are others.

NYC energy sector stakeholders, including ConEd, the Mayor’s office and the NYISO, endorse concepts like these. Storage advocates argue state policy has ignored them.

Nehrozoglu said storage is under-developed in NY mainly because it is not economically competitive. “We are not saying there is not a need for storage. We are saying there is not a compensation mechanism that makes it viable.”

ConEd is studying the potential of storage and awaiting new NYISO capacity market rules for the resource. “Certain attributes of storage aren’t recognized and valued the way they probably will be in the future,” Nehrozoglu said. Deep decarbonization will necessitate storage to protect reliability, “but that will be between 2030 and 2050.”

A ConEd internal study showed storage improves system efficiency “by putting resources where they are needed during peak hours,” Nehrozoglu acknowledged. “But both studies showed it is hard to move the needle on capacity factor.”

In the interim, new high voltage direct current transmission and utility-scale renewables are the more cost-effective and achievable options, Nehrozoglu said.

NY-BEST Executive Director William Acker said new transmission and offshore wind are valuable but take a long time to develop and come with cost-effectiveness questions. “A combination of DER and in-zone storage are flexible assets that can meet local capacity requirements sooner,” he said.

A storage roadmap offering comprehensive solutions is expected soon from the New York State Energy Research and Development Authority (NYSERDA). The agency was unable to provide input for Utility Dive.

In addition, remuneration for storage’s full range of services is eventually expected through NY’s slowly unfolding Reforming the Energy Vision VDER proceeding. When that will happen is entirely uncertain.

Boosting storage

AES Energy Storage VP Praveen Kathpal told Utility Dive the Strategen analysis shows that NYC may have sufficient resources to meet peak demand now “but the recipe is brewing for a capacity crisis.” With the right new market rules and state policies, storage can help head off that crisis, he argued.

Strategen’s Burgess noted that storage could compete more effectively if it had access to the same system notifications as demand response providers. Dewey reported the NYISO’s notifications are available to all providers that reduce customer load. Limitations apply to all providers in energy markets, he added.

Kathpal, Burgess and NY-BEST’s Acker said a key mechanism to drive new Zone J peak demand capacity is longer-term contracts.

Long-term contracts have been “critical” to building generation assets,” Strategen reports. “Revenue certainty” that is “beyond six months” is key to energy storage deployment in NYC because it is “essential” to obtaining financing.

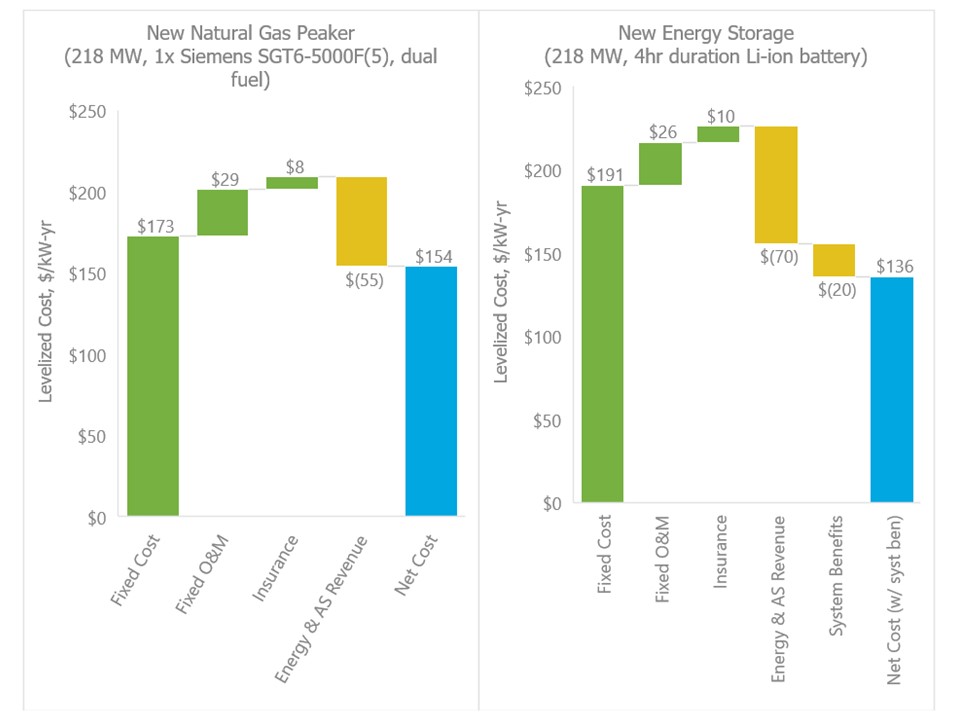

Burgess cited Strategen numbers, based on NYISO assumptions and data, which show the net cost of new entry (CONE) for a new natural gas peaker plant is $154/kW-year. For a new energy storage installation, it is $156/kW-year without including storage’s full benefits to the system. With those benefits, the storage CONE is $136/kW-year.

But “the NYISO capacity market’s longest option is six months,” Burgess said. “What investor will spend billions of dollars on a facility that only has six months revenue visibility?”

Dewey said three NYISO studies on a forward capacity market with longer-term contracts “determined it was not necessary.” The most recent NYISO study, based on 2015 data, concluded the existing capacity market “has worked reasonably well.” A forward market’s potential benefits could be obtained through “the current spot market” or “less expensive mechanisms,” it added.

AES’s Kathpal said other mechanisms proposed by Strategen could also drive investment. Policies that require some amount of capacity procurement or some share of peak load be served by zero-emissions resources could also offer predictable revenue streams, he said.

DesRoches said the Mayor’s office expects several NYISO initiatives to integrate more DER and “make the system more responsive to peak demand needs.” She also expects a NYSERDA-sponsored effort to overcome the NYC Fire Department’s safety concerns.

A 100% renewable future?

Stratagen reports that if only 5% of the annual capacity market payments to aging natural gas turbines went to new peak demand generation, it could support 450 MW of new capacity over five years. And it would have only a 1% customer bill impact.

Pace Energy and Climate Center Executive Director Karl Rabago and University of Albany Research Professor Richard Perez constructed a thought-exercise using data from Marc Perez. It demonstrates how, with reduced capacity costs, storage could potentially make clean energy cost-effective for NYC.

NYC is particularly challenging because it does not have a high direct solar insolation and it has a significant load. But its solar resource is adequate enough that, with five steps, the city could derive 100% of its energy from renewables.

First, build large-scale solar. Its cost is now very competitive. Next, add storage. Its costs are coming down fast, but solar plus storage now costs about $0.75/kWh, the researchers calculate.

Third, use demand-side technologies to shape the load. Smart technologies can “change the way demand occurs so that more of the load corresponds with solar output,” Rabago told Utility Dive.

Transmission is the “connection” part of the solution because geographic diversity further increases supply and further removes variability, he added.

The last step is using the low cost of solar and other renewables to overbuild. That is unaffordable with today’s high capacity costs, Rabago said. But, in this thought exercise, “if we get the remuneration right and the cost of solar falls, it can bring the cost to $0.08/kWh in New York City, where the average retail price of electricity is $0.15/kWh or more.”

Source: https://www.utilitydive.com/news/uptown-funk-where-will-nyc-get-its-peak-demand-capacity/507830/